Kontafarma China Holdings Limited's (HKG:1312) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

Kontafarma China Holdings Limited (HKG:1312) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.9% in the last twelve months.

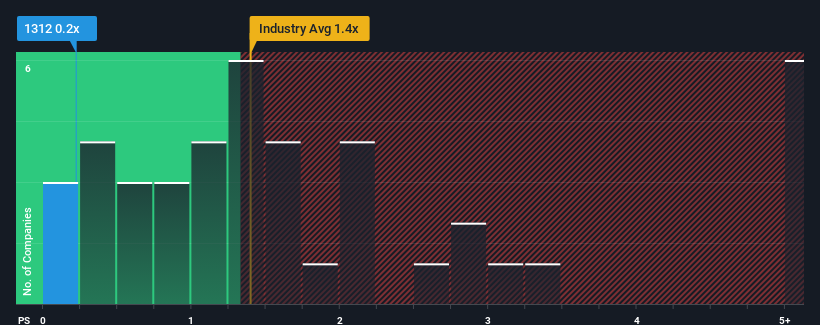

Even after such a large jump in price, given about half the companies operating in Hong Kong's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Kontafarma China Holdings as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Kontafarma China Holdings

What Does Kontafarma China Holdings' P/S Mean For Shareholders?

For example, consider that Kontafarma China Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kontafarma China Holdings will help you shine a light on its historical performance.How Is Kontafarma China Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Kontafarma China Holdings' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.2%. As a result, revenue from three years ago have also fallen 11% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.2% shows it's an unpleasant look.

With this information, we are not surprised that Kontafarma China Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Kontafarma China Holdings' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Kontafarma China Holdings confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Kontafarma China Holdings (1 doesn't sit too well with us) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kontafarma China Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1312

Kontafarma China Holdings

An investment holding company, engages in the manufacture and sale of prescription drugs in Mainland China, Singapore, Taiwan, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives