CANbridge Pharmaceuticals Inc.'s (HKG:1228) 26% Dip In Price Shows Sentiment Is Matching Earnings

To the annoyance of some shareholders, CANbridge Pharmaceuticals Inc. (HKG:1228) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 66% share price decline.

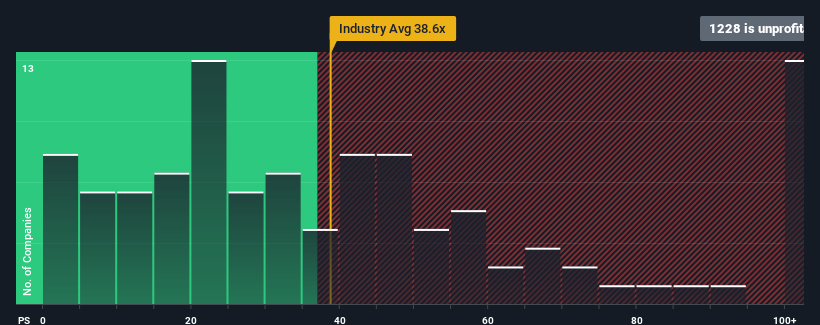

After such a large drop in price, CANbridge Pharmaceuticals may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -1.2x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for CANbridge Pharmaceuticals as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for CANbridge Pharmaceuticals

Does Growth Match The Low P/E?

CANbridge Pharmaceuticals' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 90% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 4.3% per year over the next three years. With the market predicted to deliver 20% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that CANbridge Pharmaceuticals is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Having almost fallen off a cliff, CANbridge Pharmaceuticals' share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CANbridge Pharmaceuticals maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for CANbridge Pharmaceuticals (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on CANbridge Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1228

CANbridge Pharmaceuticals

A biopharmaceutical company, engages in the research, development, and commercialization of therapies for rare diseases and oncology indications worldwide.

Low and slightly overvalued.

Market Insights

Community Narratives