Discovering Value: 3 Penny Stocks With At Least US$700M Market Cap

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stock indexes climbing toward record highs despite inflationary pressures and economic uncertainties. In this context, identifying stocks that offer both value and growth potential is crucial for investors looking to navigate these conditions effectively. Penny stocks, though often considered niche investments, can present unique opportunities when supported by strong financials—highlighting smaller or newer companies that may provide stability alongside the potential for significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR278.83M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Sino Biopharmaceutical (SEHK:1177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Biopharmaceutical Limited is a research and development-focused pharmaceutical conglomerate operating in the People's Republic of China, with a market cap of HK$60.92 billion.

Operations: The company generates revenue primarily from its Modernised Chinese Medicines and Chemical Medicines segment, which accounts for CN¥27.45 billion.

Market Cap: HK$60.92B

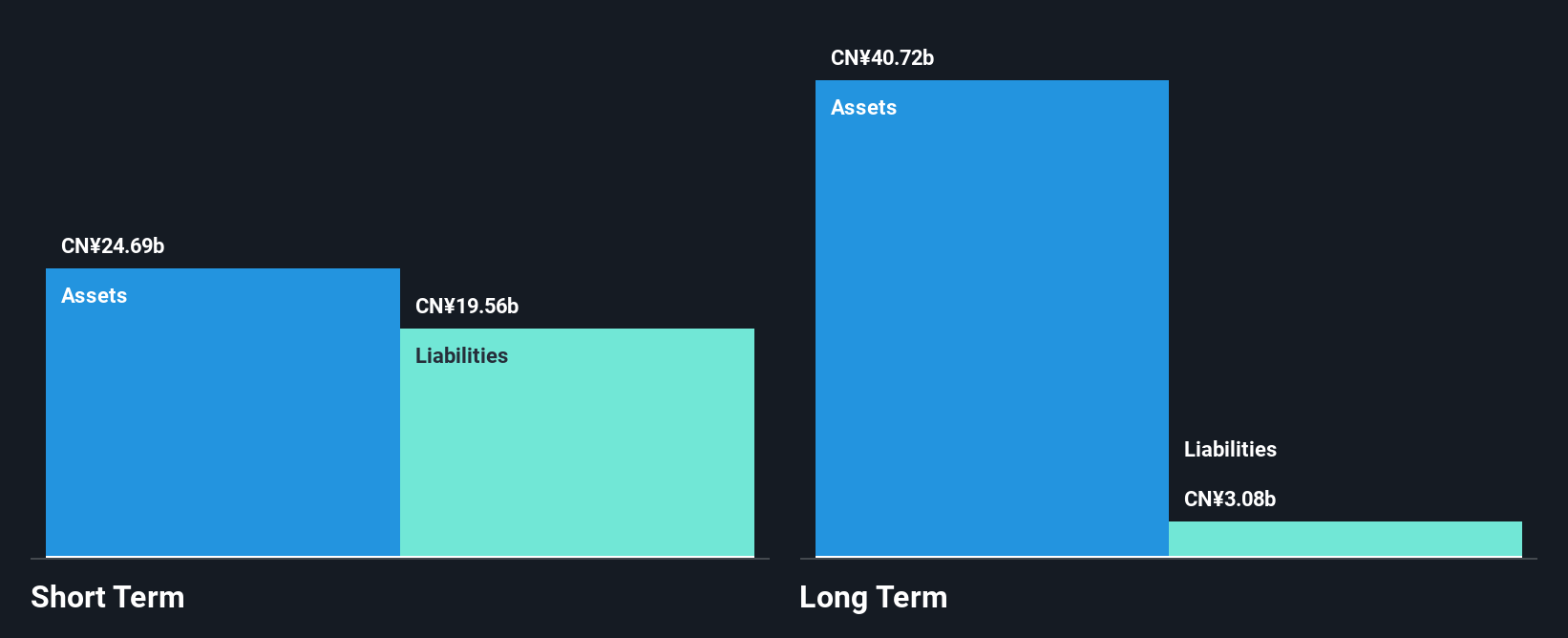

Sino Biopharmaceutical Limited has recently gained approval for its Tulobuterol Patches, marking a significant milestone in the treatment of obstructive airway diseases. The company is actively pursuing marketing applications for several innovative drugs, including Benmelstobart Injection and Anlotinib Hydrochloride Capsules, targeting various cancers. Financially, Sino Biopharmaceutical demonstrates robust short-term asset coverage of liabilities and maintains more cash than total debt. While earnings have declined over five years, recent profit growth is notable at 70.9%, outpacing the industry average. Share repurchases aim to enhance shareholder value amidst stable weekly volatility and experienced management oversight.

- Navigate through the intricacies of Sino Biopharmaceutical with our comprehensive balance sheet health report here.

- Gain insights into Sino Biopharmaceutical's outlook and expected performance with our report on the company's earnings estimates.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services in Mainland China, with a market cap of HK$80.95 billion.

Operations: The bank generates revenue of CN¥38.47 billion from its operations in Mainland China.

Market Cap: HK$80.95B

China Zheshang Bank presents a mixed picture for penny stock investors. With a market cap of HK$80.95 billion and revenue of CN¥38.47 billion, it is not pre-revenue, indicating operational stability. The bank's net profit margins have improved to 37%, and its earnings growth of 9.2% surpasses the industry average, suggesting potential value despite low return on equity at 7.9%. The management team is relatively inexperienced with an average tenure of 1.2 years, which could pose challenges in strategic execution. However, the bank's funding primarily from customer deposits minimizes risk exposure amidst stable weekly volatility.

- Get an in-depth perspective on China Zheshang Bank's performance by reading our balance sheet health report here.

- Explore China Zheshang Bank's analyst forecasts in our growth report.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company that specializes in the discovery, development, and commercialization of cancer-targeted therapies and immunotherapies both in China and internationally, with a market cap of HK$5.58 billion.

Operations: The company generates revenue of CN¥205.08 million from the sales of pharmaceutical products and the research and development of new drugs.

Market Cap: HK$5.58B

Lepu Biopharma, with a market cap of HK$5.58 billion and revenue of CN¥205.08 million, remains unprofitable but has reduced losses by 27.6% annually over the past five years. The company recently entered an exclusive licensing agreement with ArriVent BioPharma for MRG007, securing upfront payments totaling US$47 million and potential milestones up to US$1.16 billion, enhancing its financial outlook. Despite short-term liabilities exceeding assets, Lepu maintains a satisfactory net debt to equity ratio of 15.9% and has sufficient cash runway for over a year based on current free cash flow projections amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Lepu Biopharma stock in this financial health report.

- Understand Lepu Biopharma's earnings outlook by examining our growth report.

Make It Happen

- Discover the full array of 5,690 Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives