With EPS Growth And More, CSPC Pharmaceutical Group (HKG:1093) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like CSPC Pharmaceutical Group (HKG:1093), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for CSPC Pharmaceutical Group

How Fast Is CSPC Pharmaceutical Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, CSPC Pharmaceutical Group's EPS has grown 27% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

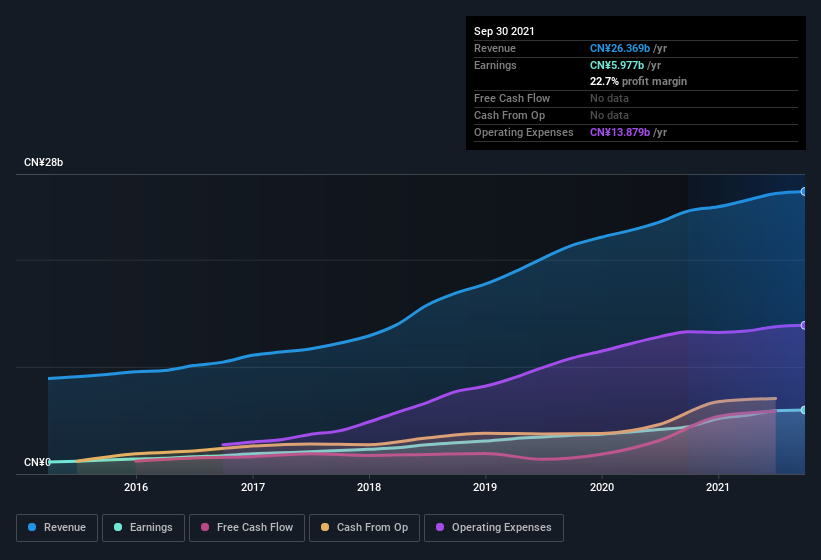

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note CSPC Pharmaceutical Group's EBIT margins were flat over the last year, revenue grew by a solid 7.4% to CN¥26b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of CSPC Pharmaceutical Group's forecast profits?

Are CSPC Pharmaceutical Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One gleaming positive for CSPC Pharmaceutical Group, in the last year, is that a certain insider has buying shares with ample enthusiasm. In one fell swoop, Executive Chairman & CEO Dongchen Cai, spent HK$48m, at a price of HK$8.05 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

On top of the insider buying, it's good to see that CSPC Pharmaceutical Group insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth CN¥26b. Coming in at 23% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Should You Add CSPC Pharmaceutical Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about CSPC Pharmaceutical Group's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. Now, you could try to make up your mind on CSPC Pharmaceutical Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But CSPC Pharmaceutical Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade CSPC Pharmaceutical Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical products in the People’s Republic of China, other Asian regions, North America, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives