CSPC Pharmaceutical Group And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, and anticipation of a Federal Reserve decision, investors are keenly observing how these shifts influence various sectors. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for growth at lower price points. Despite being considered somewhat outdated as a term, these stocks can still provide value when they exhibit strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$139.45M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$45.15B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,811 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CSPC Pharmaceutical Group (SEHK:1093)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CSPC Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical products across China, other Asian regions, North America, Europe, and internationally with a market cap of HK$55.63 billion.

Operations: The company's revenue is primarily derived from Finished Drugs at CN¥24.97 billion, followed by Functional Food and Others at CN¥2.02 billion, Bulk Products - Vitamin C at CN¥1.91 billion, and Bulk Products - Antibiotics at CN¥1.82 billion.

Market Cap: HK$55.63B

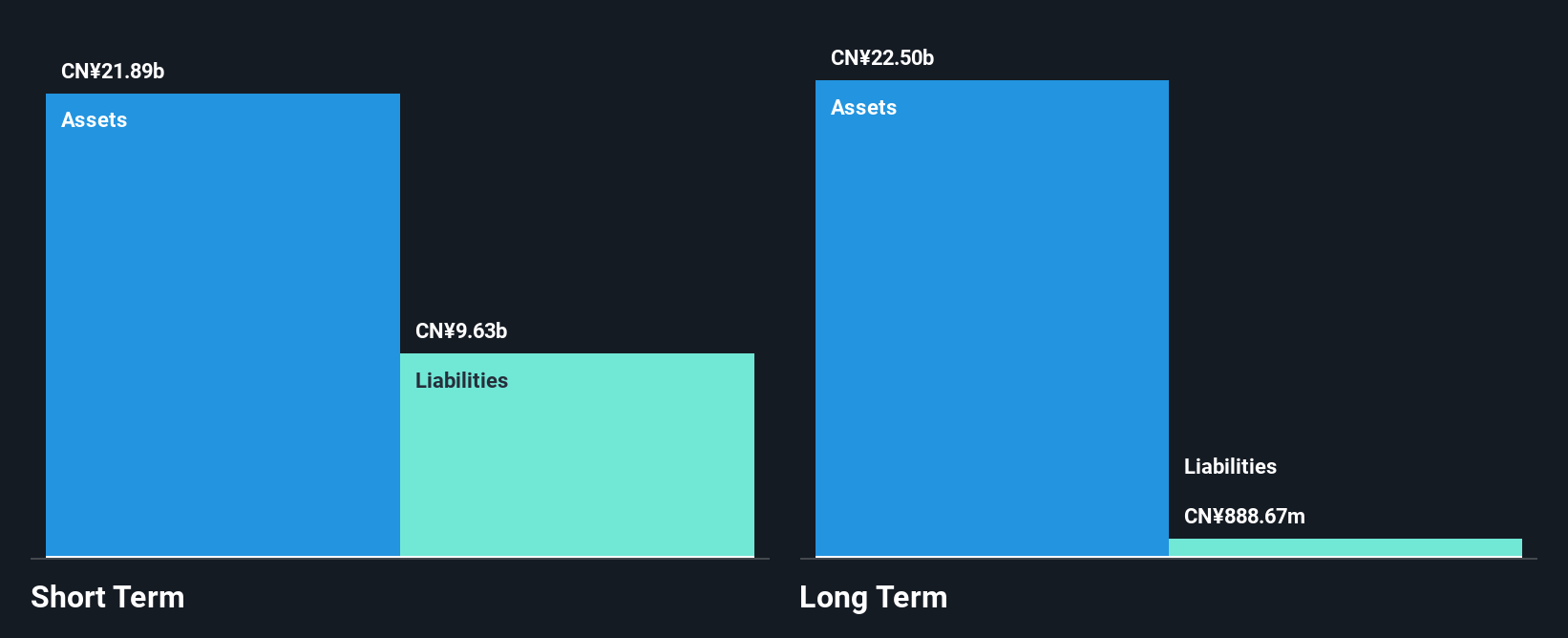

CSPC Pharmaceutical Group, with a market cap of HK$55.63 billion, has demonstrated financial stability through high-quality earnings and strong asset coverage of liabilities. Despite a low return on equity at 14.3% and recent negative earnings growth, the company maintains robust cash flow covering its debt significantly. Recent product approvals for innovative treatments like SYS6005 and SYS6043 highlight CSPC's commitment to advancing cancer therapies, while strategic partnerships such as the exclusive license agreement with BeiGene promise substantial milestone payments potentially enhancing future revenue streams. However, management inexperience could pose challenges in navigating complex market dynamics effectively.

- Get an in-depth perspective on CSPC Pharmaceutical Group's performance by reading our balance sheet health report here.

- Evaluate CSPC Pharmaceutical Group's prospects by accessing our earnings growth report.

Gilston Group (SEHK:2011)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gilston Group Limited, an investment holding company, specializes in designing, manufacturing, and selling finished zippers and other garment accessories for original equipment manufacturers of apparel brands and labels, with a market capitalization of approximately HK$695.14 million.

Operations: The company generates revenue primarily from its Manufacture and Sales of Zippers segment, which contributed HK$225.41 million.

Market Cap: HK$695.14M

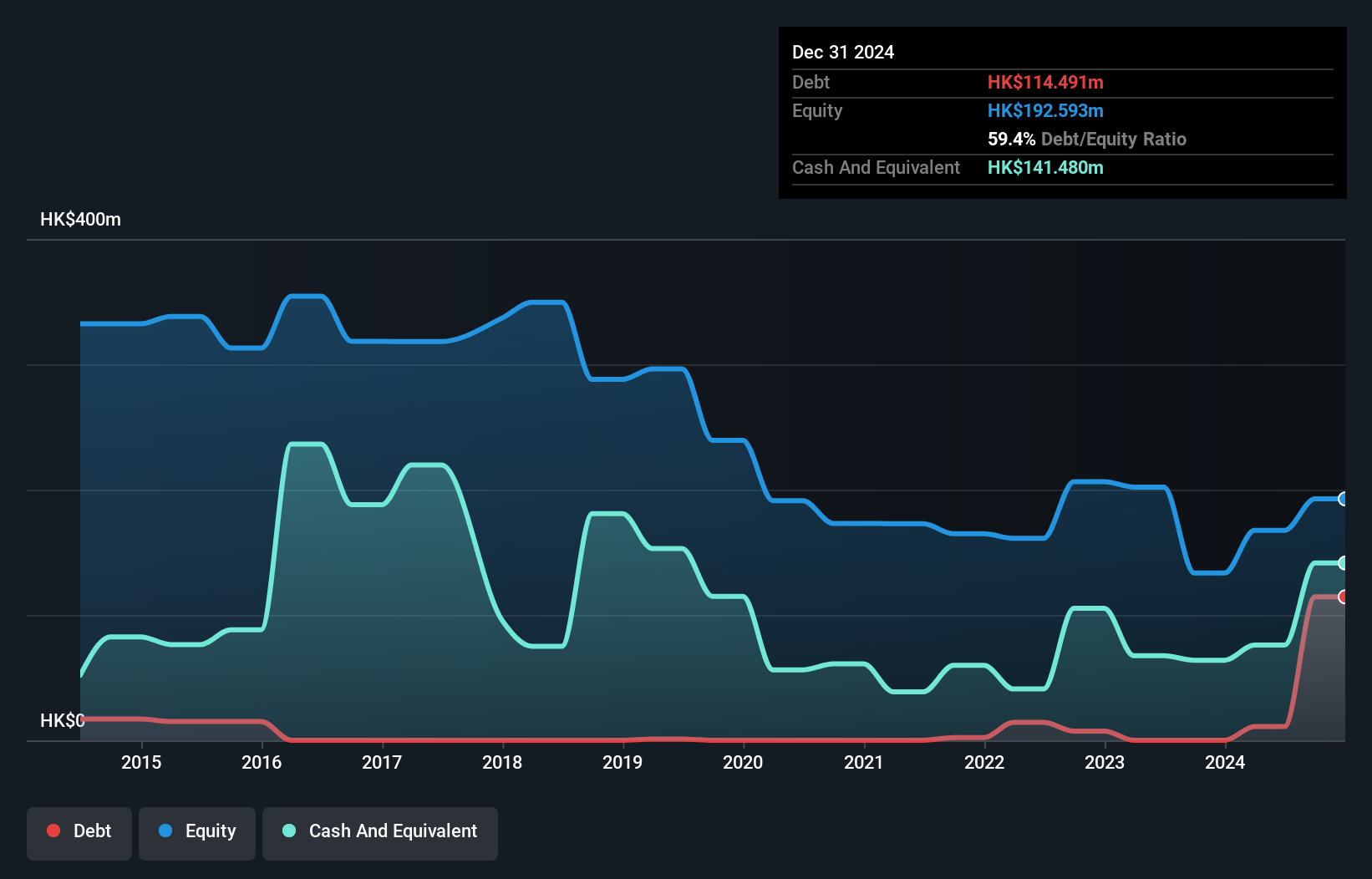

Gilston Group Limited, with a market cap of HK$695.14 million, focuses on manufacturing zippers and garment accessories. Despite being unprofitable, it has reduced losses over the past five years by 6.4% annually and maintains a solid financial position with short-term assets exceeding both short- and long-term liabilities. The company recently appointed SFAI Hong Kong as its new auditor to enhance independence after BDO's resignation. Shareholders experienced dilution last year as shares outstanding grew by 3%, while the debt-to-equity ratio increased but remains manageable due to more cash than total debt on hand.

- Dive into the specifics of Gilston Group here with our thorough balance sheet health report.

- Evaluate Gilston Group's historical performance by accessing our past performance report.

Vibrant Group (SGX:BIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vibrant Group Limited is an investment holding company involved in integrated logistics, real estate, and financial services globally, with a market capitalization of SGD36.15 million.

Operations: Vibrant Group Limited does not have any reported revenue segments.

Market Cap: SGD36.15M

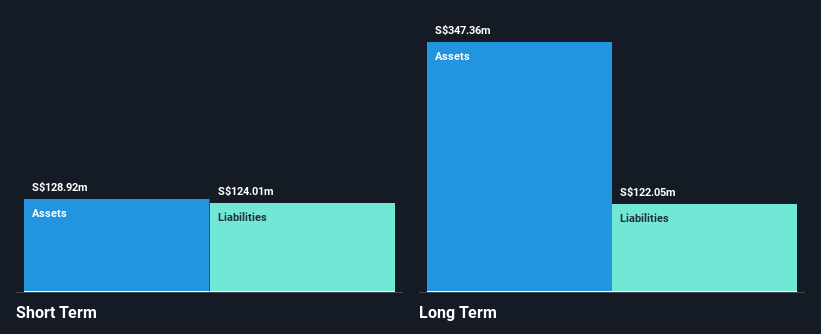

Vibrant Group Limited, with a market cap of SGD36.15 million, recently reported half-year sales of SGD78.69 million and turned profitable with a net income of SGD3.31 million, compared to a loss the previous year. The company's seasoned management and board bring stability, although its interest coverage is below ideal levels at 2.8 times EBIT. Operating cash flow covers debt well at 27.9%, but the debt-to-equity ratio has risen over five years to 44.7%. Despite high volatility in share price and low return on equity at 3.9%, short-term assets cover liabilities effectively, supporting financial resilience amidst market fluctuations.

- Jump into the full analysis health report here for a deeper understanding of Vibrant Group.

- Examine Vibrant Group's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Jump into our full catalog of 5,811 Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2011

Gilston Group

An investment holding company, designs, manufactures, and sells in finished zippers and other garment accessories for the original equipment manufacturers of apparel brands and labels.

Adequate balance sheet with weak fundamentals.