- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

Here's Why Newborn Town (HKG:9911) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Newborn Town (HKG:9911). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Newborn Town with the means to add long-term value to shareholders.

How Fast Is Newborn Town Growing Its Earnings Per Share?

In the last three years Newborn Town's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Newborn Town's EPS has grown from CN¥0.48 to CN¥0.56 over twelve months. That's a 15% gain; respectable growth in the broader scheme of things.

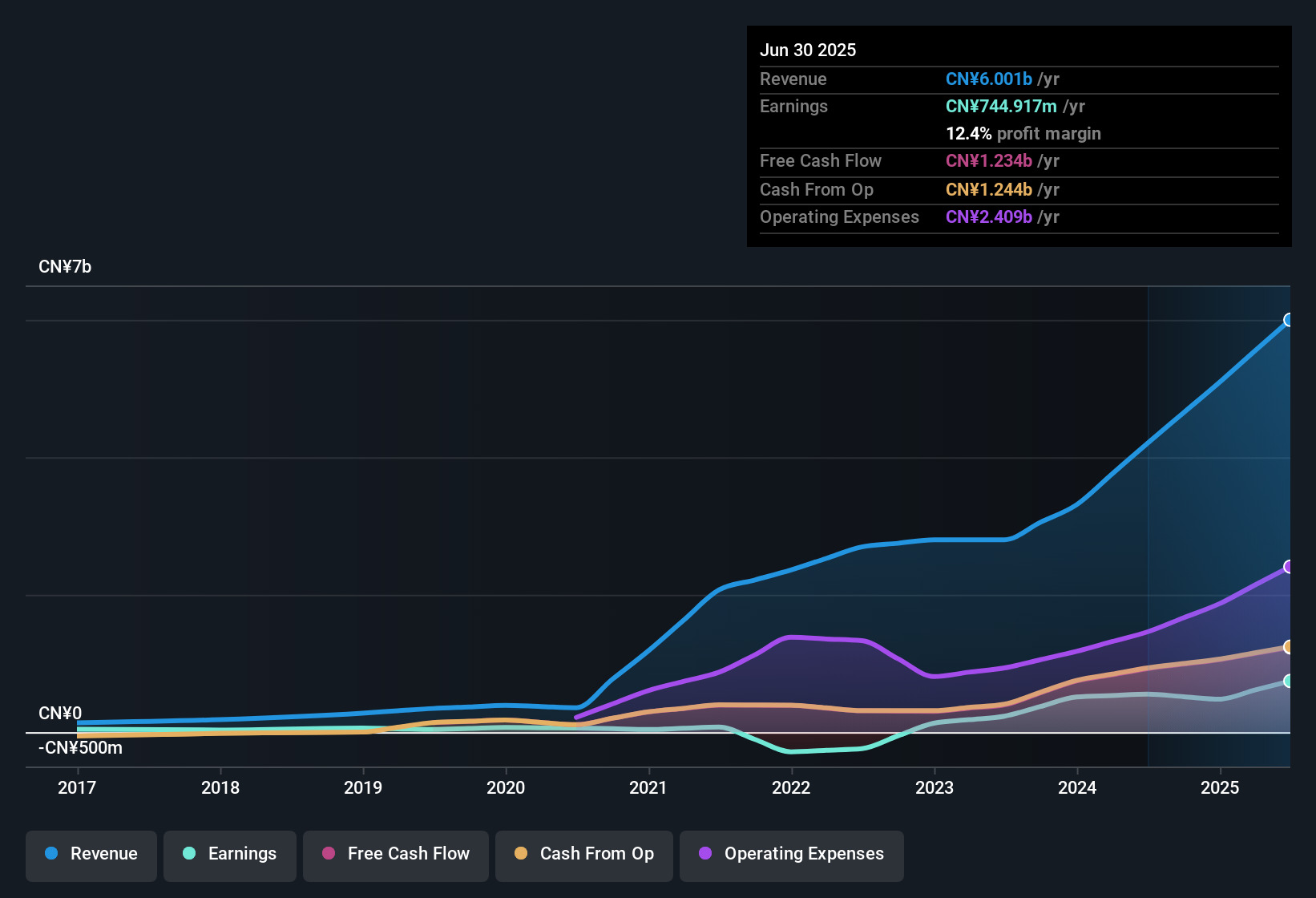

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Newborn Town has done well over the past year, growing revenue by 43% to CN¥6.0b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

View our latest analysis for Newborn Town

Fortunately, we've got access to analyst forecasts of Newborn Town's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Newborn Town Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Newborn Town shares worth a considerable sum. Notably, they have an enviable stake in the company, worth CN¥5.4b. Coming in at 33% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Should You Add Newborn Town To Your Watchlist?

One positive for Newborn Town is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. We don't want to rain on the parade too much, but we did also find 1 warning sign for Newborn Town that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in HK with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives