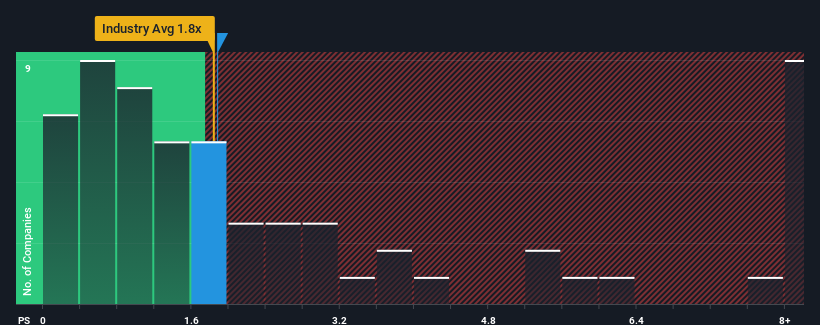

There wouldn't be many who think Cloud Music Inc.'s (HKG:9899) price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S for the Entertainment industry in Hong Kong is similar at about 1.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cloud Music

How Has Cloud Music Performed Recently?

Recent times have been pleasing for Cloud Music as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cloud Music will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Cloud Music's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow revenue by 288% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 15% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 27% each year, which is noticeably more attractive.

In light of this, it's curious that Cloud Music's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Cloud Music's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Cloud Music's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Cloud Music you should be aware of.

If you're unsure about the strength of Cloud Music's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NetEase Cloud Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9899

NetEase Cloud Music

An investment holding company, engages in the operation of online platforms to provide music and social entertainment services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives