- Hong Kong

- /

- Entertainment

- /

- SEHK:9890

ZX Inc. (HKG:9890) Might Not Be As Mispriced As It Looks After Plunging 26%

ZX Inc. (HKG:9890) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

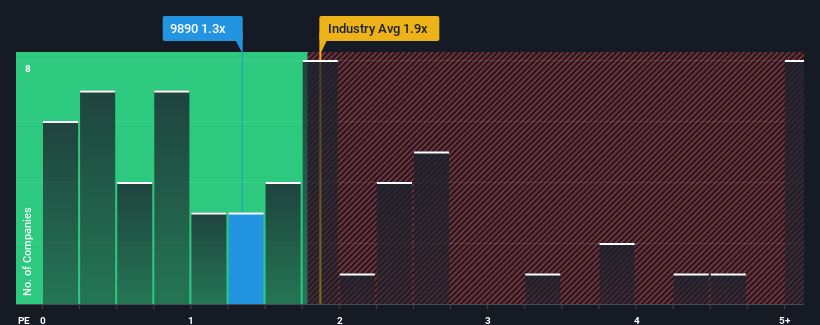

Even after such a large drop in price, given about half the companies operating in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") above 1.9x, you may still consider ZX as an attractive investment with its 1.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ZX

What Does ZX's Recent Performance Look Like?

For instance, ZX's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on ZX will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ZX will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For ZX?

The only time you'd be truly comfortable seeing a P/S as low as ZX's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. Still, the latest three year period has seen an excellent 127% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 20%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that ZX's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On ZX's P/S

The southerly movements of ZX's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of ZX revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for ZX (4 can't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tanwan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9890

Tanwan

Operates as a publisher of online game products in Mainland China, Hong Kong, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives