Shareholders have faith in loss-making Icon Culture Global (HKG:8500) as stock climbs 16% in past week, taking one-year gain to 2.2%

Icon Culture Global Company Limited (HKG:8500) shareholders should be happy to see the share price up 16% in the last week. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 33% in one year, under-performing the market.

While the last year has been tough for Icon Culture Global shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Icon Culture Global

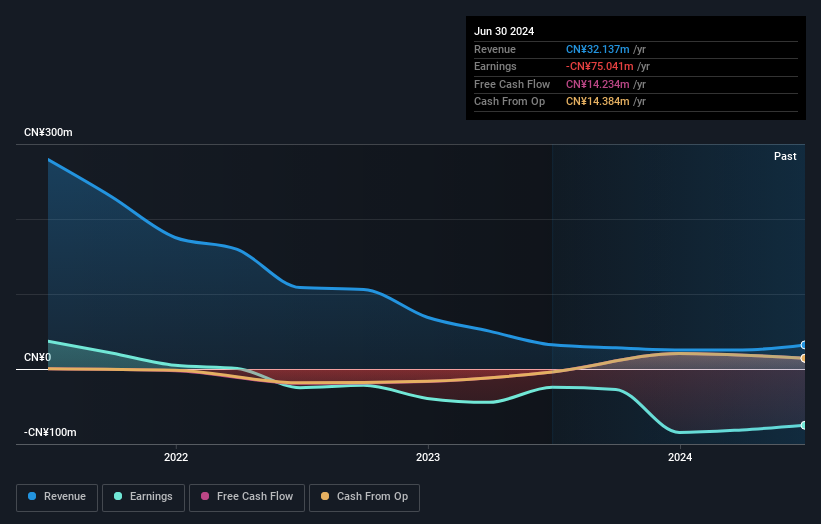

Because Icon Culture Global made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In just one year Icon Culture Global saw its revenue fall by 0.3%. That's not what investors generally want to see. Shareholders have seen the share price drop 33% in that time. What would you expect when revenue is falling, and it doesn't make a profit? We think most holders must believe revenue growth will improve, or else costs will decline.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Icon Culture Global's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Icon Culture Global's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Icon Culture Global hasn't been paying dividends, but its TSR of 2.2% exceeds its share price return of -33%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Icon Culture Global produced a TSR of 2.2% over the last year. While you don't go broke making a profit, this return was actually lower than the average market return of about 23%. At least the longer term returns (running at about 17% a year, are better. Even the best companies don't see strong share price performance every year. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Icon Culture Global (including 2 which shouldn't be ignored) .

Icon Culture Global is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8500

Icon Culture Global

An investment holding company, engages in the provision of integrated multimedia advertising and marketing solution services in the People’s Republic of China.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives