- Hong Kong

- /

- Entertainment

- /

- SEHK:8280

China Digital Video Holdings Limited's (HKG:8280) 38% Dip In Price Shows Sentiment Is Matching Revenues

The China Digital Video Holdings Limited (HKG:8280) share price has softened a substantial 38% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

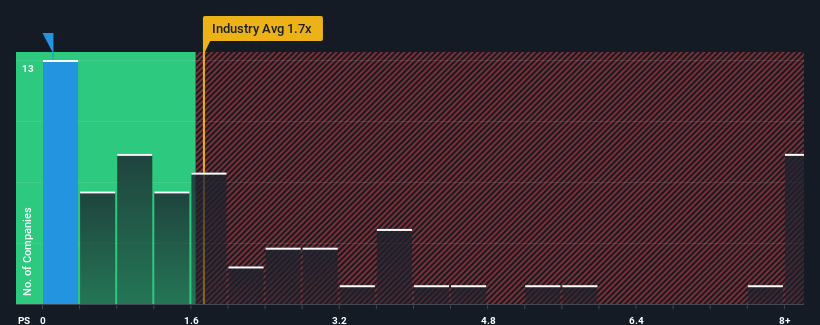

Since its price has dipped substantially, China Digital Video Holdings may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for China Digital Video Holdings

What Does China Digital Video Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for China Digital Video Holdings, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on China Digital Video Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Digital Video Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, China Digital Video Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.3%. However, this wasn't enough as the latest three year period has seen an unpleasant 36% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 45% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that China Digital Video Holdings is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

The southerly movements of China Digital Video Holdings' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that China Digital Video Holdings maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for China Digital Video Holdings that we have uncovered.

If these risks are making you reconsider your opinion on China Digital Video Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade China Digital Video Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8280

China Digital Video Holdings

An investment holding company, engages in the research, development, and sale of video-related and broadcasting equipment and software to TV broadcasters, new media operators, and other digital video content providers in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives