There Is A Reason Xinhua Winshare Publishing and Media Co., Ltd.'s (HKG:811) Price Is Undemanding

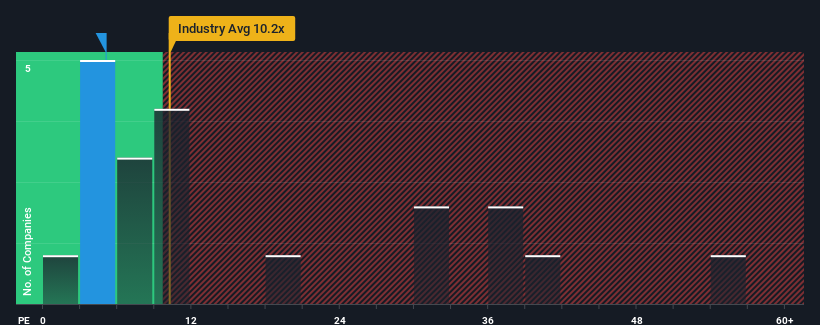

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 9x, you may consider Xinhua Winshare Publishing and Media Co., Ltd. (HKG:811) as an attractive investment with its 5.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The earnings growth achieved at Xinhua Winshare Publishing and Media over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Xinhua Winshare Publishing and Media

How Is Xinhua Winshare Publishing and Media's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Xinhua Winshare Publishing and Media's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. Pleasingly, EPS has also lifted 38% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Xinhua Winshare Publishing and Media is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Xinhua Winshare Publishing and Media's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Xinhua Winshare Publishing and Media maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Xinhua Winshare Publishing and Media that you should be aware of.

You might be able to find a better investment than Xinhua Winshare Publishing and Media. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:811

Xinhua Winshare Publishing and Media

Xinhua Winshare Publishing and Media Co., Ltd.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.