- Hong Kong

- /

- Entertainment

- /

- SEHK:8082

Sunny Side Up Culture Holdings Limited (HKG:8082) Stock's 31% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Sunny Side Up Culture Holdings Limited (HKG:8082) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 109% in the last twelve months.

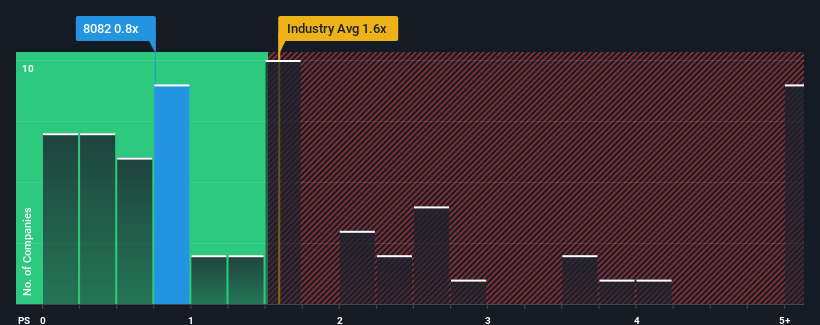

Following the heavy fall in price, given about half the companies operating in Hong Kong's Entertainment industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider Sunny Side Up Culture Holdings as an attractive investment with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Sunny Side Up Culture Holdings

What Does Sunny Side Up Culture Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Sunny Side Up Culture Holdings has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunny Side Up Culture Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Sunny Side Up Culture Holdings?

In order to justify its P/S ratio, Sunny Side Up Culture Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 20% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Sunny Side Up Culture Holdings' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Sunny Side Up Culture Holdings' P/S?

Sunny Side Up Culture Holdings' recently weak share price has pulled its P/S back below other Entertainment companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Sunny Side Up Culture Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 5 warning signs we've spotted with Sunny Side Up Culture Holdings (including 2 which are a bit unpleasant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Qing Hua Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8082

Qing Hua Holding Group

Offers media and entertainment, and cremation and funeral services in Hong Kong, Mainland China, Macau, Thailand, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.