- Hong Kong

- /

- Entertainment

- /

- SEHK:8082

Sunny Side Up Culture Holdings Limited (HKG:8082) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Sunny Side Up Culture Holdings Limited (HKG:8082) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

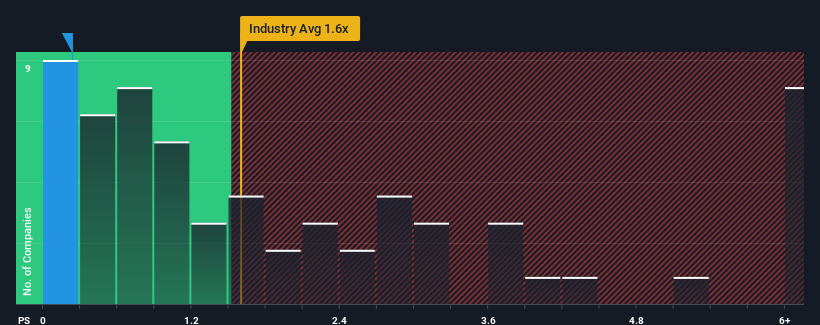

After such a large drop in price, Sunny Side Up Culture Holdings may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Entertainment industry in Hong Kong have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sunny Side Up Culture Holdings

What Does Sunny Side Up Culture Holdings' Recent Performance Look Like?

Recent times have been quite advantageous for Sunny Side Up Culture Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunny Side Up Culture Holdings' earnings, revenue and cash flow.How Is Sunny Side Up Culture Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sunny Side Up Culture Holdings' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to grow revenue by 295% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 47% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Sunny Side Up Culture Holdings' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Sunny Side Up Culture Holdings' P/S Mean For Investors?

Sunny Side Up Culture Holdings' recently weak share price has pulled its P/S back below other Entertainment companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Sunny Side Up Culture Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Sunny Side Up Culture Holdings that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8082

Sunny Side Up Culture Holdings

Operates in the media and entertainment, and cremation and funeral services business activities in Hong Kong, Mainland China, Macau, and internationally.

Excellent balance sheet and good value.