Top 3 Stocks on SEHK Possibly Trading Below Estimated Value in July 2024

Reviewed by Simply Wall St

Amid a global landscape where major indices like the Dow Jones and Nasdaq are reaching new highs, the Hong Kong stock market presents unique opportunities. As investors seek value in July 2024, understanding which stocks are potentially undervalued becomes crucial in navigating through varying economic signals and market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$40.45 | HK$75.59 | 46.5% |

| China Resources Mixc Lifestyle Services (SEHK:1209) | HK$24.20 | HK$47.77 | 49.3% |

| China Cinda Asset Management (SEHK:1359) | HK$0.68 | HK$1.29 | 47.3% |

| West China Cement (SEHK:2233) | HK$1.16 | HK$2.15 | 46.1% |

| BYD (SEHK:1211) | HK$240.60 | HK$462.37 | 48% |

| Zhaojin Mining Industry (SEHK:1818) | HK$15.86 | HK$30.22 | 47.5% |

| Super Hi International Holding (SEHK:9658) | HK$14.14 | HK$25.95 | 45.5% |

| Vobile Group (SEHK:3738) | HK$1.23 | HK$2.31 | 46.8% |

| MicroPort Scientific (SEHK:853) | HK$5.31 | HK$9.66 | 45% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$11.00 | HK$21.99 | 50% |

Let's dive into some prime choices out of from the screener.

iDreamSky Technology Holdings (SEHK:1119)

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform, publishing games through mobile apps and websites in the People’s Republic of China, with a market cap of HK$3.92 billion.

Operations: The company generates revenue primarily from its Game and Information Services segment, amounting to CN¥1.92 billion.

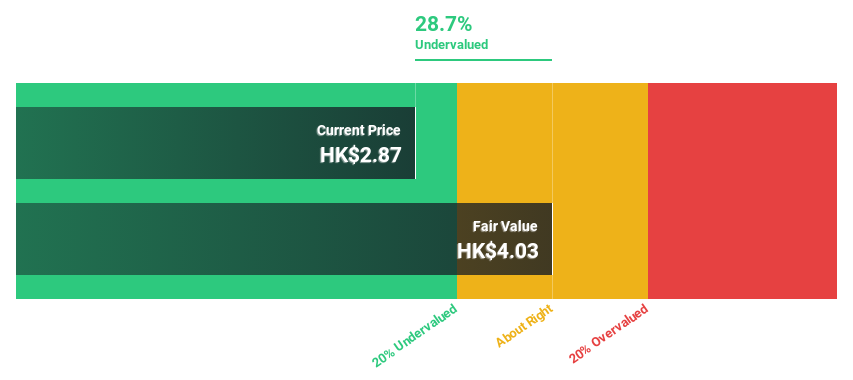

Estimated Discount To Fair Value: 36.4%

iDreamSky Technology Holdings is significantly undervalued based on cash flows, trading at HK$2.52 against a fair value estimate of HK$3.96. Its revenue growth is expected to outpace the Hong Kong market substantially, with a forecast increase of 29.8% per year compared to the market's 7.7%. Additionally, earnings are projected to surge, with profitability anticipated within three years and an impressive future return on equity of 24.8%. However, shareholder dilution has occurred over the past year.

- Our growth report here indicates iDreamSky Technology Holdings may be poised for an improving outlook.

- Dive into the specifics of iDreamSky Technology Holdings here with our thorough financial health report.

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, licensing, development, and commercialization of therapies and vaccines for unmet medical needs in Greater China and other Asia Pacific markets, with a market capitalization of approximately HK$6.40 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling CN¥125.93 million.

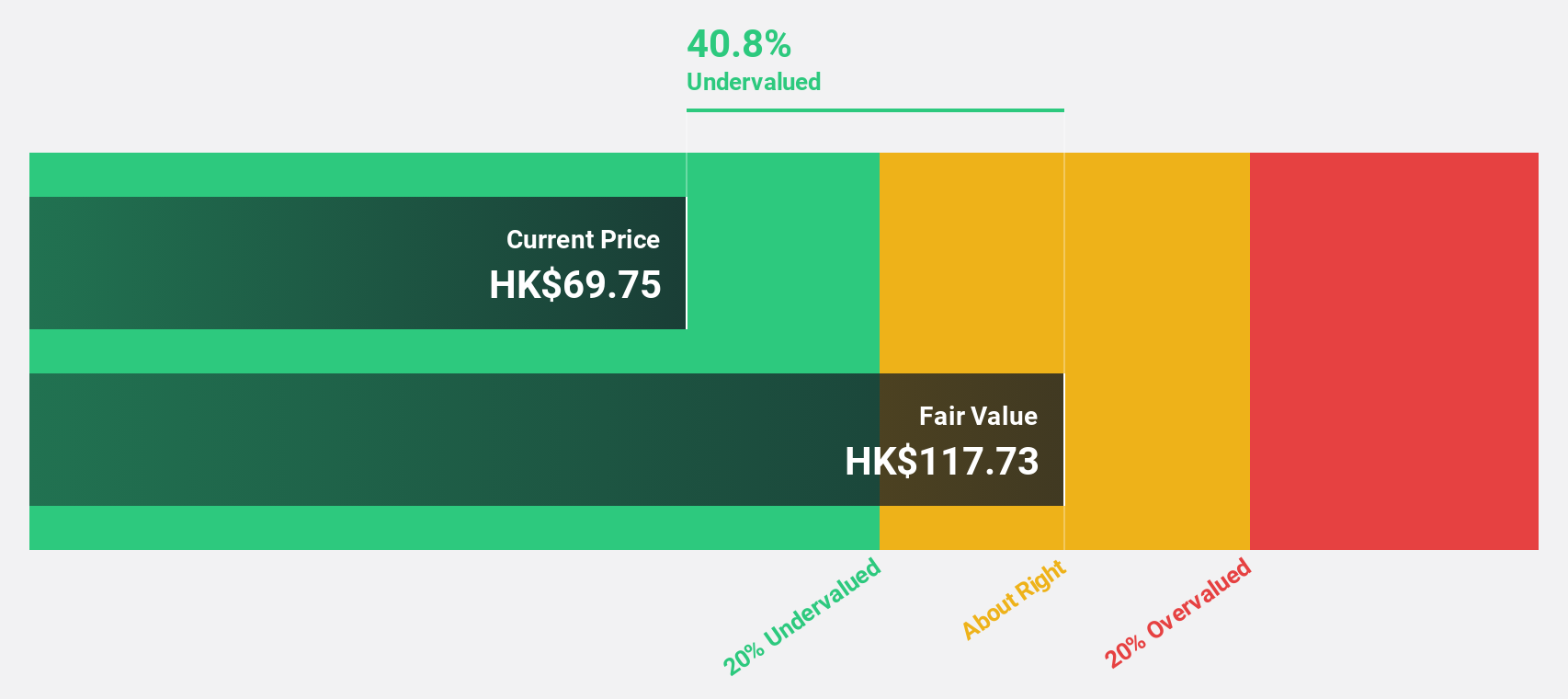

Estimated Discount To Fair Value: 17%

Everest Medicines is trading at HK$19.96, below the estimated fair value of HK$24.04, reflecting a potential undervaluation based on cash flows. It's expected to become profitable within three years with revenue growth forecasted at 38.6% annually, significantly outpacing the Hong Kong market average of 7.7%. However, its projected return on equity is low at 1.3%, and recent shareholder dilution may concern investors despite strong clinical trial results for its ulcerative colitis treatment, VELSIPITY®, showing effectiveness and safety.

- Upon reviewing our latest growth report, Everest Medicines' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Everest Medicines with our detailed financial health report.

IGG (SEHK:799)

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other global markets, with a market capitalization of approximately HK$3.09 billion.

Operations: The company's primary revenue of HK$5.27 billion is generated from the development and operation of online games.

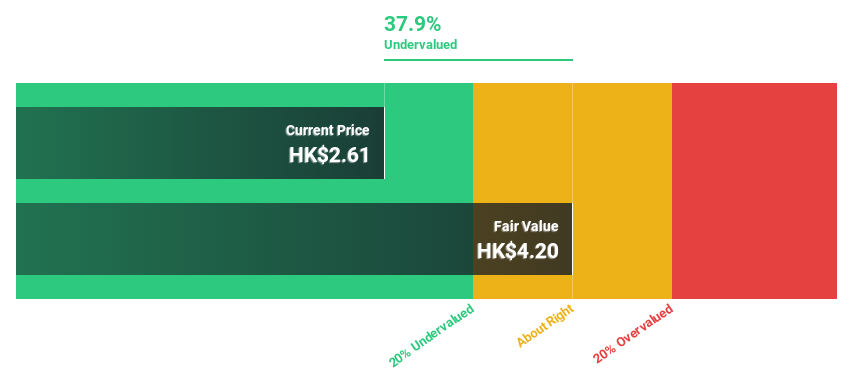

Estimated Discount To Fair Value: 31.8%

IGG Inc. is perceived as undervalued based on its cash flow analysis, trading at HK$2.73, significantly below the estimated fair value of HK$4.00. The company's earnings are expected to grow by 51.2% annually, outperforming the Hong Kong market's average growth rate of 11.4%. Despite this robust growth projection, IGG's revenue growth forecast of 4.2% annually trails behind the market expectation of 7.7%. Recent corporate governance enhancements and board changes could provide a stable foundation for future performance.

- Insights from our recent growth report point to a promising forecast for IGG's business outlook.

- Take a closer look at IGG's balance sheet health here in our report.

Turning Ideas Into Actions

- Embark on your investment journey to our 43 Undervalued SEHK Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives