- Hong Kong

- /

- Entertainment

- /

- SEHK:799

Asian Market Insights: Top Penny Stocks To Consider In November 2025

Reviewed by Simply Wall St

Amid global market fluctuations and AI-related concerns, the Asian markets have also experienced their share of volatility, with particular focus on technology valuations and economic stimulus measures. Despite these challenges, investors continue to explore opportunities in various sectors, including those offered by penny stocks. These smaller or newer companies can present significant potential when backed by solid financials, offering a chance to uncover hidden value in an ever-evolving market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB5.00 | THB3.1B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.34 | SGD13.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.85 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.445 | SGD166.71M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 962 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

NagaCorp (SEHK:3918)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NagaCorp Ltd. is an investment holding company that manages and operates a hotel and casino complex in the Kingdom of Cambodia, with a market capitalization of HK$22.11 billion.

Operations: The company's revenue is primarily derived from Casino Operations, contributing $591.45 million, with an additional $24.72 million generated from Hotel and Entertainment Operations.

Market Cap: HK$22.11B

NagaCorp Ltd., with a market capitalization of HK$22.11 billion, is trading at an attractive value relative to its peers, reflected by a price-to-earnings ratio of 11x, below the Hong Kong market average. The company has demonstrated robust earnings growth, with a significant 176.5% increase over the past year and stable weekly volatility at 7%. Its debt levels are well-managed, covered by operating cash flow at 431.3%, and it holds more cash than total debt. Recent unaudited results show strong revenue growth in gaming operations, indicating positive momentum in its core business activities.

- Navigate through the intricacies of NagaCorp with our comprehensive balance sheet health report here.

- Explore NagaCorp's analyst forecasts in our growth report.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other international markets with a market cap of HK$4.28 billion.

Operations: The company generates revenue of HK$5.72 billion from its development and operation of online games.

Market Cap: HK$4.28B

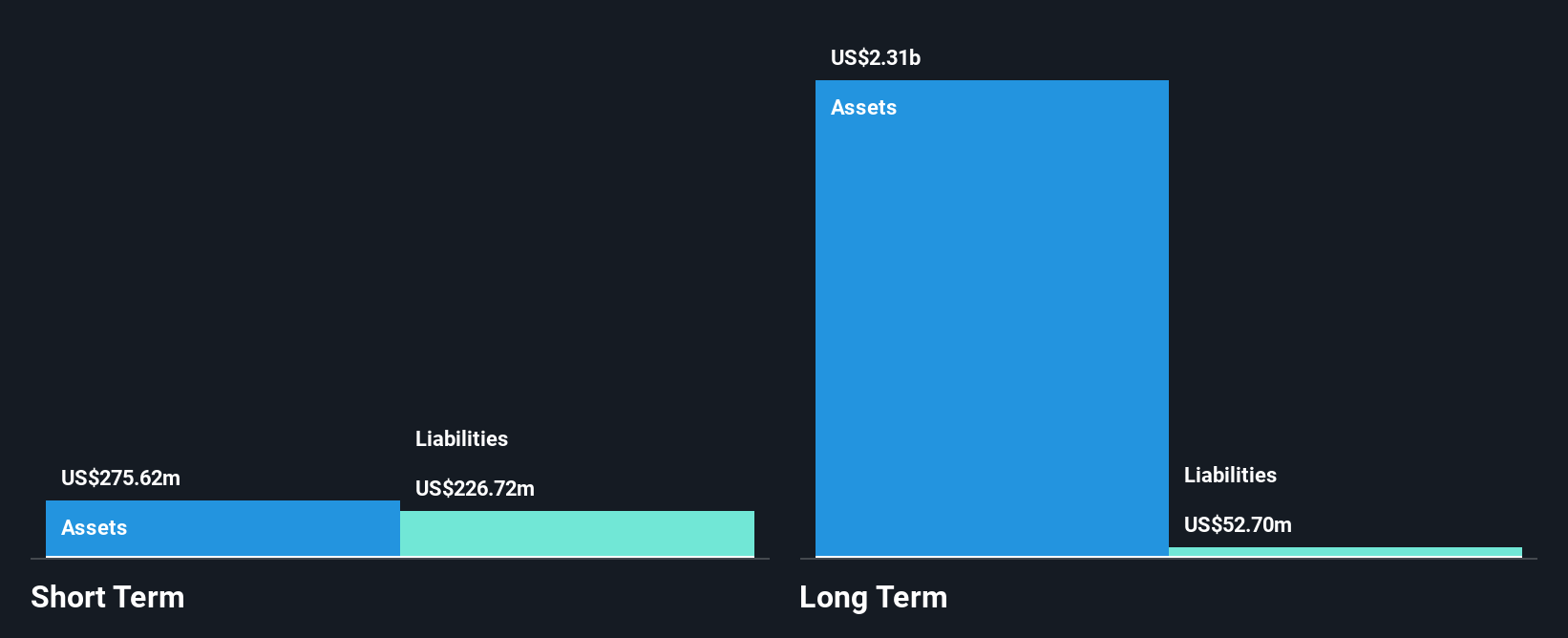

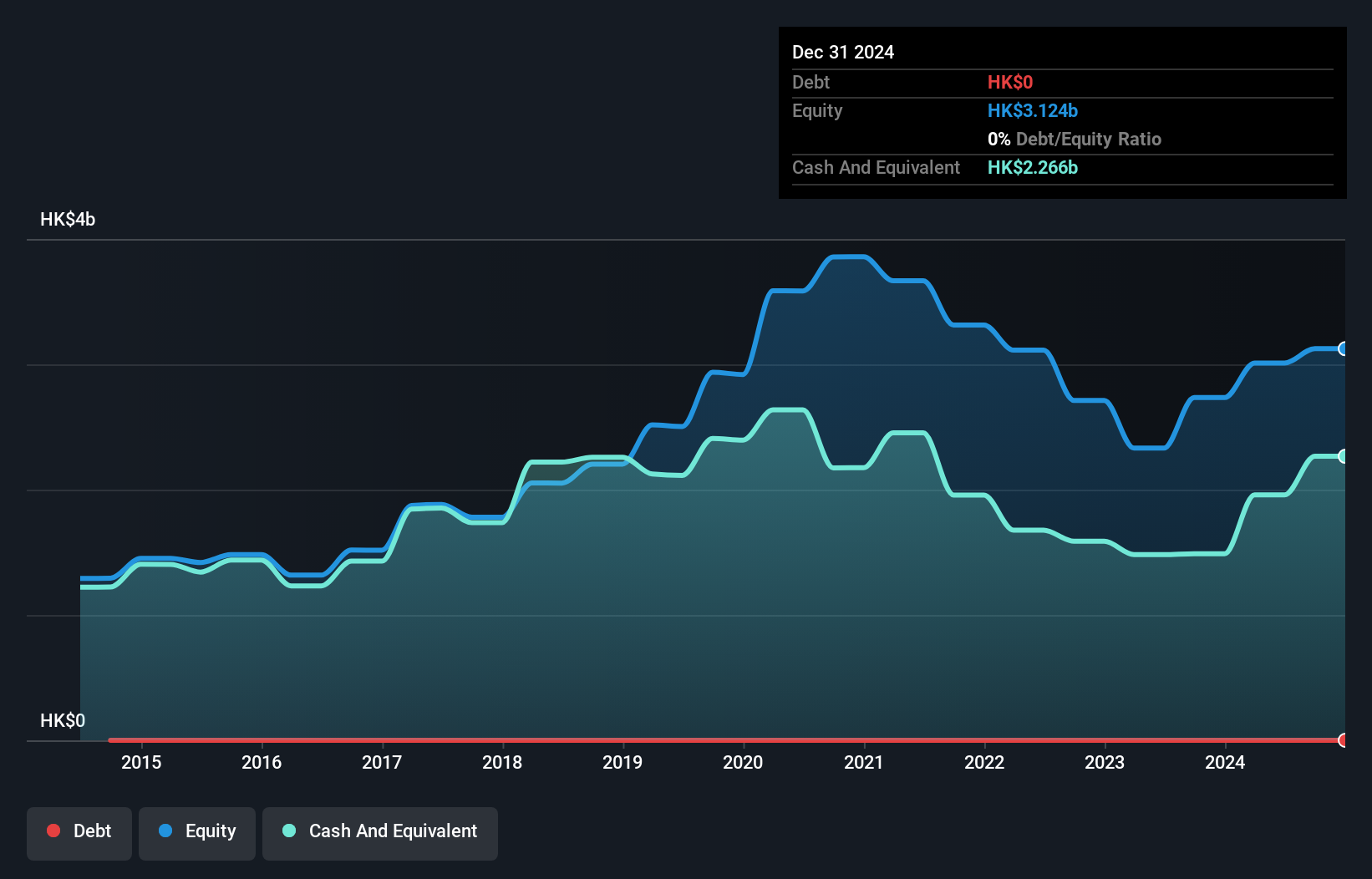

IGG Inc, with a market cap of HK$4.28 billion, offers value trading below the Hong Kong market's price-to-earnings ratio at 7.5x. Despite recent negative earnings growth and declining profit margins, IGG maintains strong financial health with short-term assets exceeding liabilities and no debt burden. The company completed a share buyback program worth HK$34 million and announced both interim and special dividends for H1 2025, although its dividend track record remains unstable. Earnings are projected to grow annually by 9.66%, supported by high-quality earnings despite past volatility in returns and profitability challenges over five years.

- Unlock comprehensive insights into our analysis of IGG stock in this financial health report.

- Gain insights into IGG's future direction by reviewing our growth report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers cloud services and on-premises software solutions in China, with a market cap of HK$5.86 billion.

Operations: The company generates revenue from Cloud Services amounting to CN¥1.11 billion and On-premise Software and Services totaling CN¥212.91 million.

Market Cap: HK$5.86B

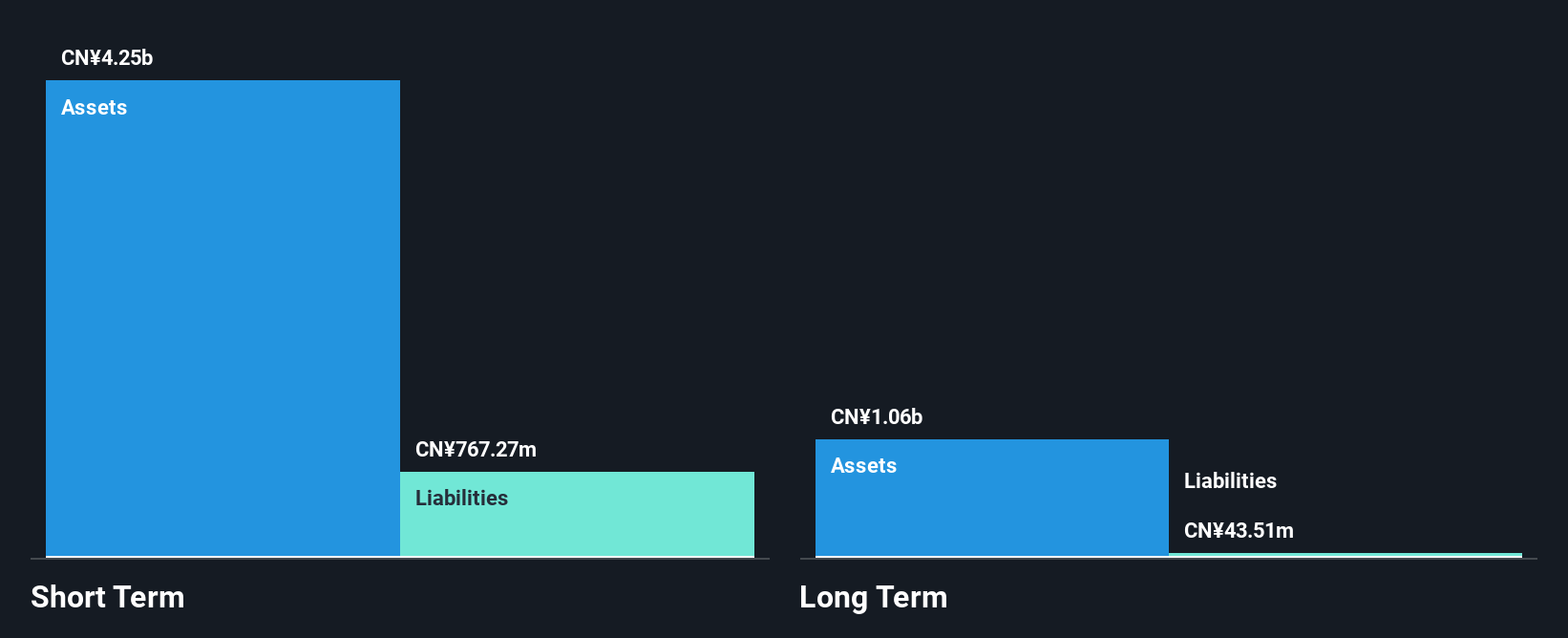

Ming Yuan Cloud Group Holdings, with a market cap of HK$5.86 billion, demonstrates strong financial positioning despite being unprofitable. The company has no debt and its short-term assets significantly exceed liabilities, providing a stable foundation. Recent earnings results show a turnaround with net income of CN¥13.75 million for H1 2025 compared to a loss the previous year. While earnings are forecast to grow substantially at 113.27% annually, volatility remains stable at 6%. The company completed significant share buybacks amounting to HKD 75.12 million in recent months, reflecting confidence in its future prospects despite an unstable dividend track record.

- Click here and access our complete financial health analysis report to understand the dynamics of Ming Yuan Cloud Group Holdings.

- Review our growth performance report to gain insights into Ming Yuan Cloud Group Holdings' future.

Turning Ideas Into Actions

- Take a closer look at our Asian Penny Stocks list of 962 companies by clicking here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:799

IGG

An investment holding company, develops and operates mobile and online games in Asia, North America, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success