- Hong Kong

- /

- Entertainment

- /

- SEHK:777

Here's Why NetDragon Websoft Holdings Limited's (HKG:777) CEO May Not Expect A Pay Rise This Year

Key Insights

- NetDragon Websoft Holdings' Annual General Meeting to take place on 5th of June

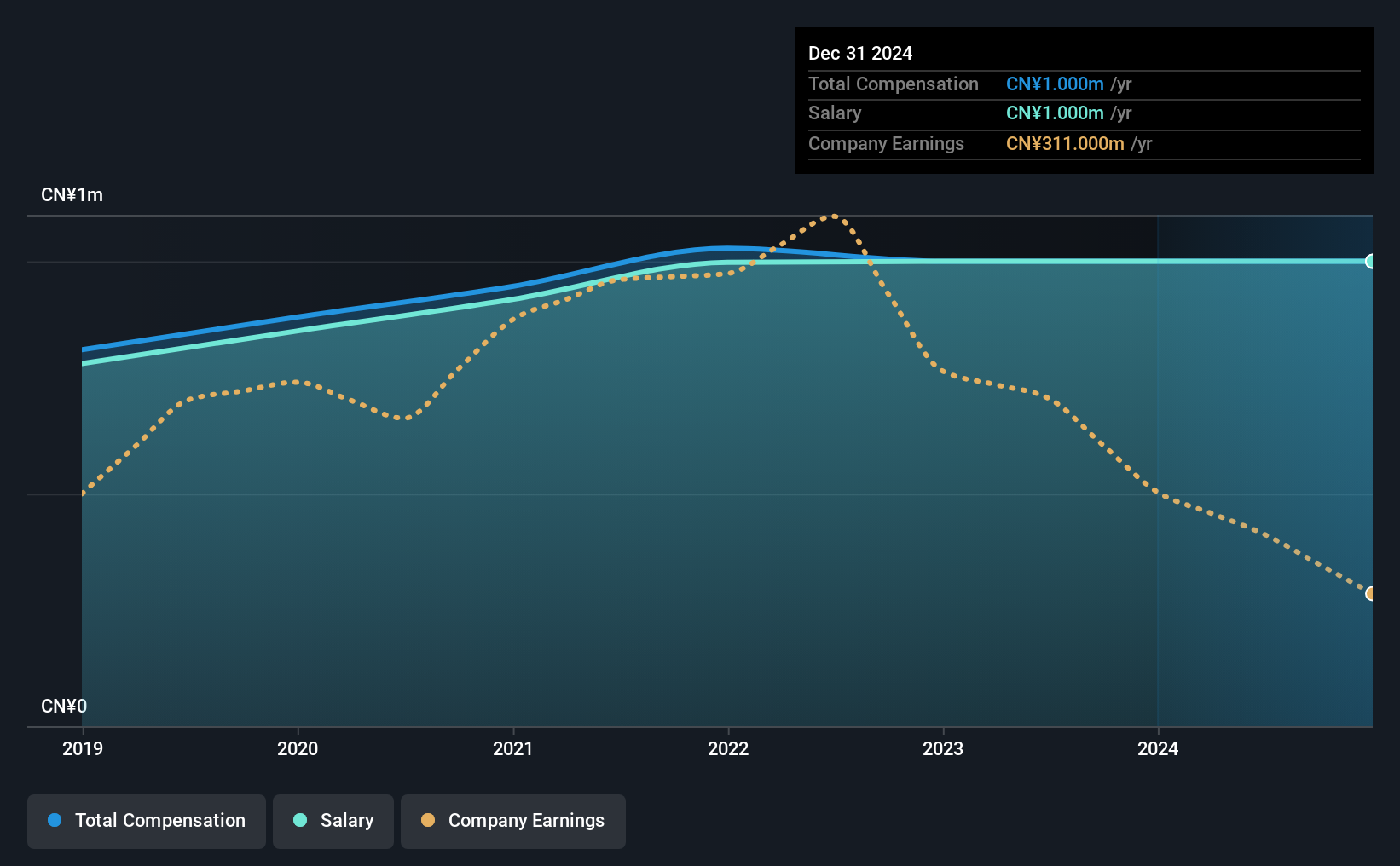

- Total pay for CEO Luyuan Liu includes CN¥1.00m salary

- The total compensation is 33% less than the average for the industry

- NetDragon Websoft Holdings' three-year loss to shareholders was 17% while its EPS was down 33% over the past three years

Performance at NetDragon Websoft Holdings Limited (HKG:777) has not been particularly rosy recently and shareholders will likely be holding CEO Luyuan Liu and the board accountable for this. The next AGM coming up on 5th of June will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. The data we gathered below shows that CEO compensation looks acceptable for now.

See our latest analysis for NetDragon Websoft Holdings

How Does Total Compensation For Luyuan Liu Compare With Other Companies In The Industry?

At the time of writing, our data shows that NetDragon Websoft Holdings Limited has a market capitalization of HK$5.2b, and reported total annual CEO compensation of CN¥1.0m for the year to December 2024. There was no change in the compensation compared to last year. Notably, the salary of CN¥1.0m is the entirety of the CEO compensation.

On examining similar-sized companies in the Hong Kong Entertainment industry with market capitalizations between HK$3.1b and HK$13b, we discovered that the median CEO total compensation of that group was CN¥1.5m. This suggests that Luyuan Liu is paid below the industry median. What's more, Luyuan Liu holds HK$212m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥1.0m | CN¥1.0m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥1.0m | CN¥1.0m | 100% |

On an industry level, around 85% of total compensation represents salary and 15% is other remuneration. Speaking on a company level, NetDragon Websoft Holdings prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at NetDragon Websoft Holdings Limited's Growth Numbers

Over the last three years, NetDragon Websoft Holdings Limited has shrunk its earnings per share by 33% per year. It saw its revenue drop 15% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has NetDragon Websoft Holdings Limited Been A Good Investment?

Given the total shareholder loss of 17% over three years, many shareholders in NetDragon Websoft Holdings Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

NetDragon Websoft Holdings rewards its CEO solely through a salary, ignoring non-salary benefits completely. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for NetDragon Websoft Holdings that investors should be aware of in a dynamic business environment.

Important note: NetDragon Websoft Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if NetDragon Websoft Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:777

NetDragon Websoft Holdings

Provides online and mobile games the People’s Republic of China, the United States, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.