Do These 3 Checks Before Buying Hong Kong Economic Times Holdings Limited (HKG:423) For Its Upcoming Dividend

Readers hoping to buy Hong Kong Economic Times Holdings Limited (HKG:423) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase Hong Kong Economic Times Holdings' shares before the 12th of August to receive the dividend, which will be paid on the 3rd of September.

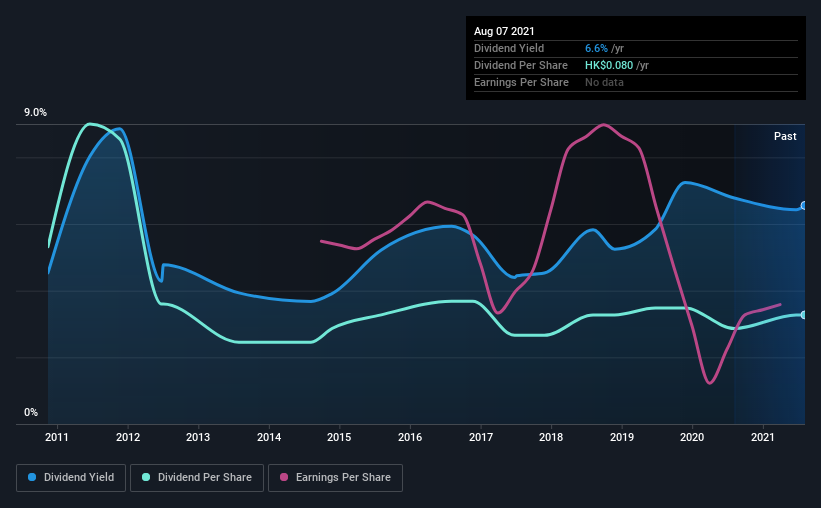

The company's next dividend payment will be HK$0.06 per share, and in the last 12 months, the company paid a total of HK$0.08 per share. Based on the last year's worth of payments, Hong Kong Economic Times Holdings has a trailing yield of 6.6% on the current stock price of HK$1.22. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Hong Kong Economic Times Holdings

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Hong Kong Economic Times Holdings distributed an unsustainably high 112% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. What's good is that dividends were well covered by free cash flow, with the company paying out 24% of its cash flow last year.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Hong Kong Economic Times Holdings fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Hong Kong Economic Times Holdings's earnings per share have fallen at approximately 12% a year over the previous five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Hong Kong Economic Times Holdings's dividend payments per share have declined at 4.7% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Is Hong Kong Economic Times Holdings worth buying for its dividend? It's never great to see earnings per share declining, especially when a company is paying out 112% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Hong Kong Economic Times Holdings.

With that being said, if you're still considering Hong Kong Economic Times Holdings as an investment, you'll find it beneficial to know what risks this stock is facing. For example, we've found 3 warning signs for Hong Kong Economic Times Holdings (1 makes us a bit uncomfortable!) that deserve your attention before investing in the shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Economic Times Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:423

Hong Kong Economic Times Holdings

An investment holding company, operates as a diversified multi-media company primarily in Hong Kong and Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives