- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

Kingsoft (SEHK:3888) Eyes Growth with AI Innovations and New Gaming Genres Despite Profitability Challenges

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Kingsoft stock here.

Innovative Factors Supporting Kingsoft

Kingsoft Corporation has shown remarkable growth in its financial metrics, with total revenue reaching RMB 2.92 billion, marking a 42% year-on-year increase. This performance is largely attributed to its thriving gaming division, notably the success of JX3 Online and JX3 Ultimate. The company's operating profit also saw a substantial rise, achieving a 204% year-on-year increase, as noted by CEO Tao Zou. Furthermore, Kingsoft's strategic focus on AI-driven innovations, such as the WPS AI Co-writing feature, has significantly boosted user engagement, contributing to a 17.2% increase in the office subscription business revenue.

Strategic Gaps That Could Affect Kingsoft

Despite its strong financial health, Kingsoft faces challenges with a Return on Equity of 8.6%, which is below the desired threshold. The company has also reported losses from associates amounting to RMB 428 million, highlighting potential issues in strategic investments. Additionally, the significant rise in R&D and personnel costs, increasing by 28% year-on-year, may strain profitability if not balanced by revenue growth. These factors, coupled with a low dividend yield of 0.43%, suggest areas where Kingsoft could improve its financial strategy.

Potential Strategies for Leveraging Growth and Competitive Advantage

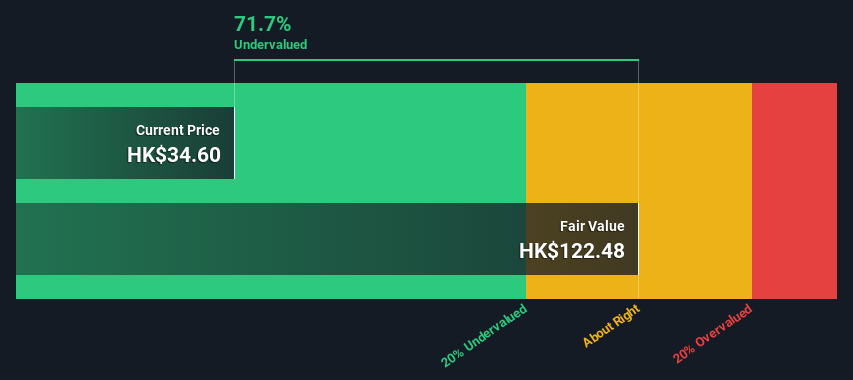

Kingsoft is actively expanding its gaming portfolio, with new genres like the sci-fi mecha game Mecha BREAK, which has garnered strong player response. This diversification could open new market segments and drive future growth. The company's international expansion, particularly in mobile and PC platforms, presents a significant opportunity to leverage AI capabilities and enhance global market presence. Trading at 74.9% below its estimated fair value, Kingsoft may be undervalued, suggesting potential for market positioning improvements.

Market Volatility Affecting Kingsoft's Position

Economic and regulatory risks remain a concern, as potential changes in government policies could impact operations. The competitive environment in gaming and office software sectors is intense, requiring continuous innovation to maintain a competitive edge. Substantial insider selling over the past three months may indicate a lack of confidence among insiders, while a high Price-To-Earnings Ratio compared to peers could raise investor concerns about overvaluation. These factors highlight the need for Kingsoft to navigate market dynamics carefully.

Conclusion

Kingsoft Corporation's impressive growth, driven by its successful gaming division and AI-driven innovations, underscores its potential for sustained revenue increases. However, the company must address its below-threshold Return on Equity and rising costs to maintain profitability. Strategic diversification into new gaming genres and international expansion offer promising growth avenues, especially as the company trades significantly below its estimated fair value, suggesting room for market positioning improvements. Nonetheless, Kingsoft must carefully navigate economic and regulatory risks, and address insider confidence issues to capitalize on its growth potential and reassure investors about its future performance.

Make It Happen

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with solid track record.