- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:439

3 Promising Penny Stocks With Market Caps Over US$100M

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed performances, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs while others like the Russell 2000 face declines, investors are exploring diverse opportunities. Penny stocks, a term that may seem outdated but still relevant, represent smaller or newer companies that can surprise with their potential. Despite their reputation for volatility, some penny stocks offer financial resilience and growth prospects that appeal to those looking beyond established market giants.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.21B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Logory Logistics Technology Co., Ltd. offers digital freight transportation services and solutions in China, with a market cap of HK$1.07 billion.

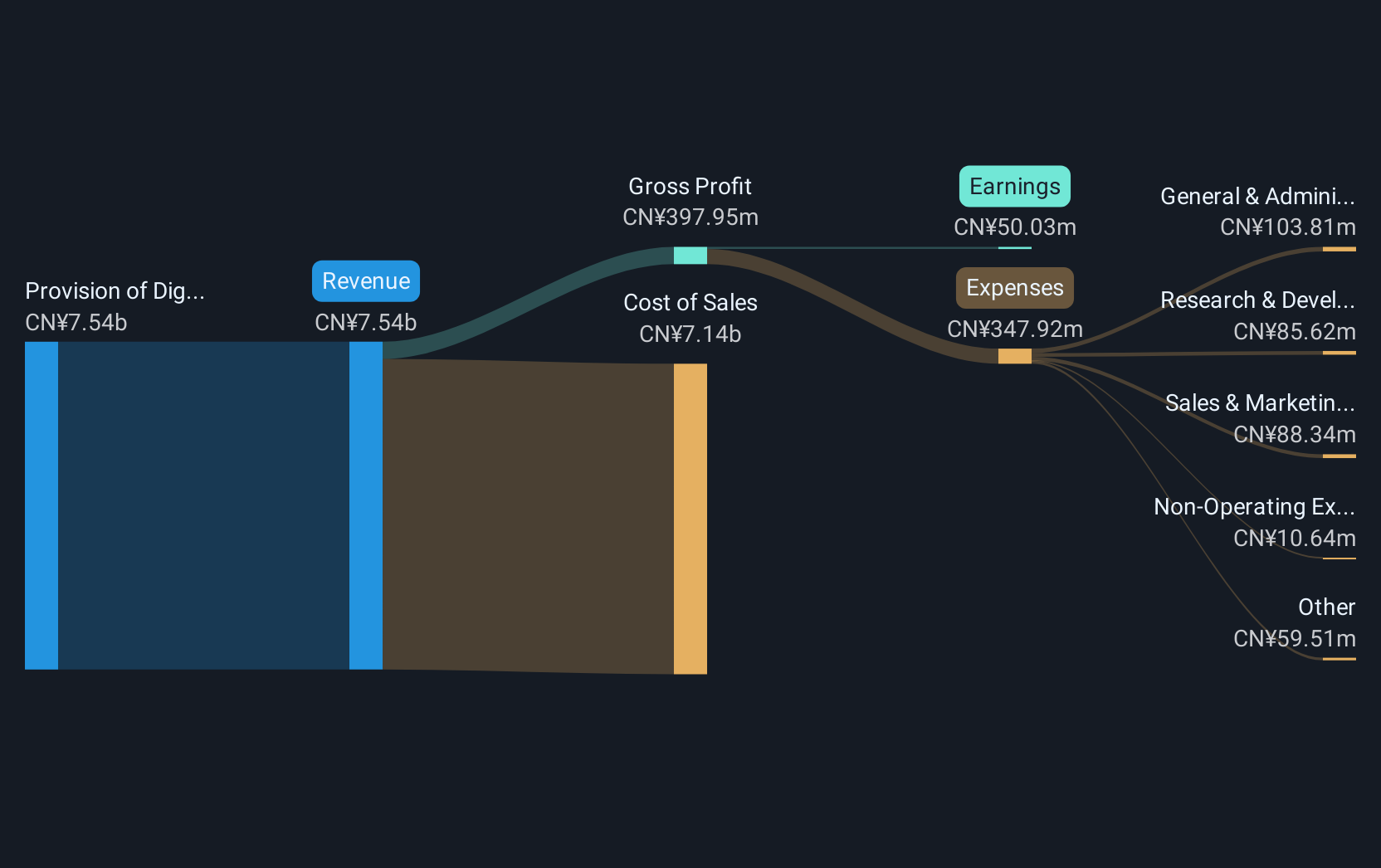

Operations: The company generates CN¥6.26 billion from its digital freight businesses and related services.

Market Cap: HK$1.07B

Logory Logistics Technology has recently turned profitable, marking a significant shift in its financial trajectory. With CN¥6.26 billion in revenue from digital freight services, the company shows potential for growth within its sector. Its management and board are experienced, with an average tenure of 3.3 years, providing stability and strategic direction. The company's cash reserves exceed total debt, indicating prudent financial management despite negative operating cash flow and low return on equity at 2.7%. Short-term assets cover both short- and long-term liabilities comfortably, while interest payments are well-covered by EBIT at 9.6x coverage. However, share price volatility remains high.

- Dive into the specifics of Logory Logistics Technology here with our thorough balance sheet health report.

- Gain insights into Logory Logistics Technology's past trends and performance with our report on the company's historical track record.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development, as well as financial services across Hong Kong, the People's Republic of China, the United Kingdom, and Australia, with a market cap of HK$4.92 billion.

Operations: The company's revenue is primarily derived from consumer finance (HK$3.17 billion), property development (HK$1.10 billion), investment and finance (HK$944.4 million), property investment (HK$911.5 million), property management (HK$348.3 million), elderly care services (HK$180.2 million), and includes a segment adjustment of HK$1.19 billion, with corporate and other operations contributing HK$420.9 million.

Market Cap: HK$4.92B

Allied Group Limited, despite being unprofitable with a negative return on equity of 0.26%, maintains a robust balance sheet where short-term assets (HK$46.6 billion) surpass both short- and long-term liabilities, indicating strong liquidity. The company's seasoned management and board, with tenures averaging 13 and 21.8 years respectively, provide stability amid financial challenges. Although the firm’s debt level is satisfactory with a net debt to equity ratio of 8.1%, operating cash flow covers only 10% of its debt obligations, suggesting room for improvement in cash flow management as losses have grown by an average of 28.2% annually over five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Allied Group.

- Review our historical performance report to gain insights into Allied Group's track record.

KuangChi Science (SEHK:439)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KuangChi Science Limited is an investment holding company focused on developing artificial intelligence technology and related products in China, Hong Kong, and internationally, with a market cap of HK$1.11 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, which generated HK$81.71 million.

Market Cap: HK$1.11B

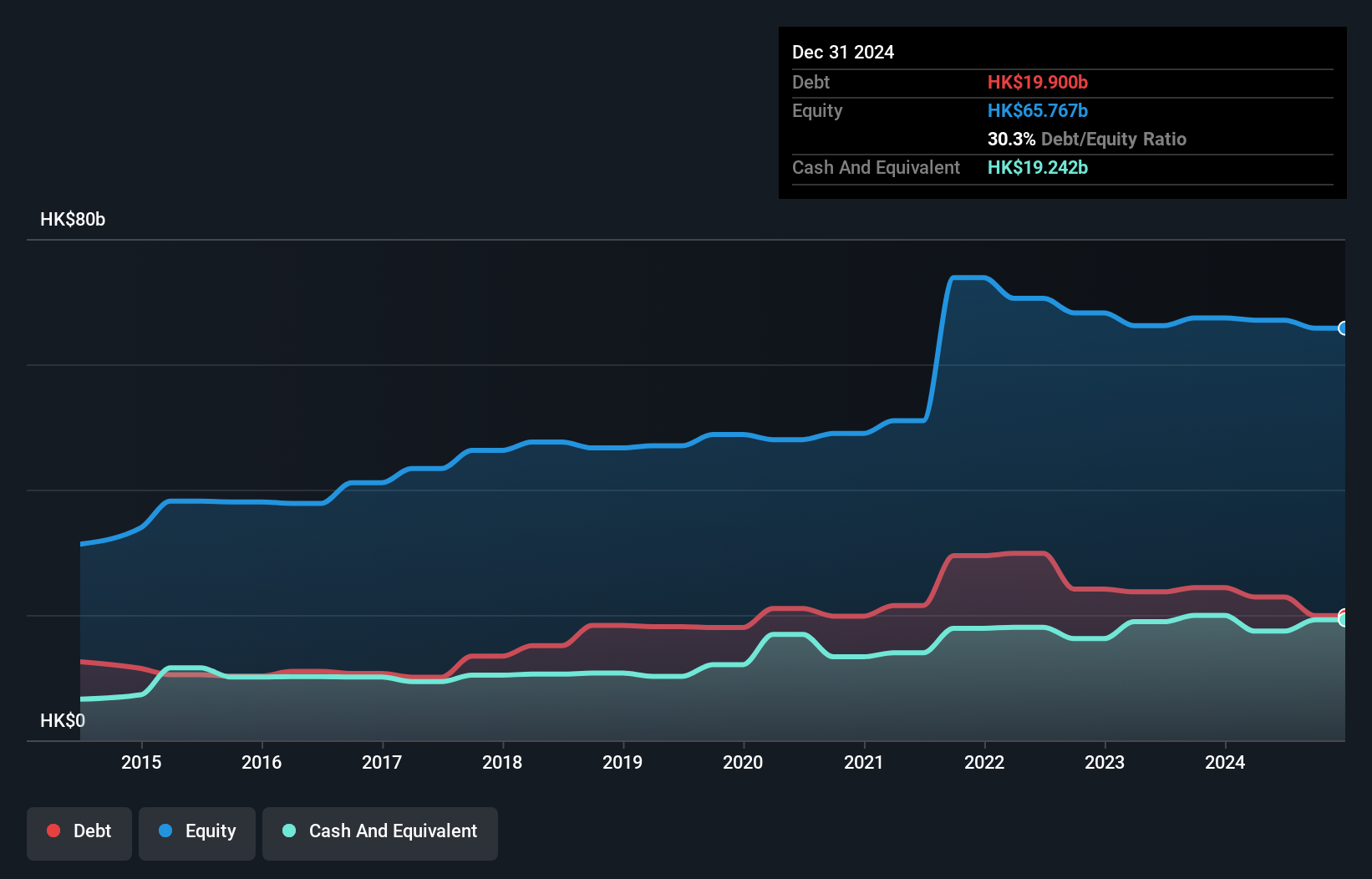

KuangChi Science Limited, with a market cap of HK$1.11 billion, primarily generates revenue from its Aerospace & Defense segment, reporting HK$81.71 million. Despite being unprofitable and having a negative return on equity of -0.22%, the company has made strides in reducing losses by 58.4% annually over the past five years and has not diluted shareholders recently. The firm benefits from an experienced board with an average tenure of 7.8 years and maintains strong liquidity as short-term assets exceed both short- and long-term liabilities, although it faces challenges due to high share price volatility and limited cash runway if growth continues at historical rates.

- Unlock comprehensive insights into our analysis of KuangChi Science stock in this financial health report.

- Learn about KuangChi Science's historical performance here.

Next Steps

- Access the full spectrum of 5,707 Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KuangChi Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:439

KuangChi Science

An investment holding company, engages in the development of artificial intelligence (AI) technology and related products in the People’s Republic of China, Hong Kong, and internationally.

Excellent balance sheet very low.