- Taiwan

- /

- Semiconductors

- /

- TWSE:6415

3 Promising Growth Stocks With Insider Ownership Up To 20%

Reviewed by Simply Wall St

As global markets respond to cooling inflation and strong earnings reports, major indices have shown positive momentum, with U.S. stocks rebounding significantly after recent sell-offs. In this climate of cautious optimism, growth companies with substantial insider ownership can be particularly appealing as they often signal confidence from those closest to the business, providing a potential layer of stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

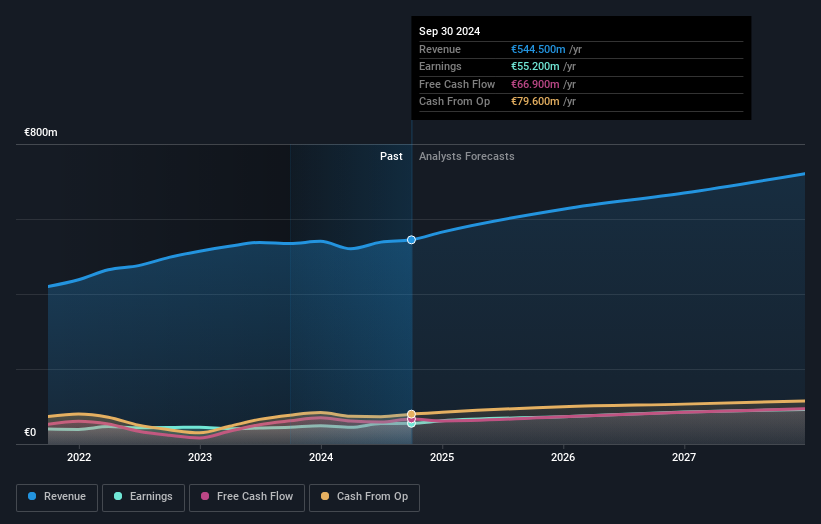

Vaisala Oyj (HLSE:VAIAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vaisala Oyj operates in the weather and environmental, as well as industrial measurement sectors, serving both weather-related and industrial markets, with a market cap of €1.92 billion.

Operations: The company's revenue is derived from two main segments: Industrial Measurements, contributing €219.40 million, and Weather and Environment, accounting for €325 million.

Insider Ownership: 19.7%

Vaisala Oyj is poised for growth with forecasted earnings expansion of 16.4% annually, outpacing the Finnish market's 14.7%. Despite slower revenue growth at 7.3%, it surpasses the Finnish average of 2.6%. Recent strategic appointments, such as Lorenzo Gulli as EVP for Strategy and M&A, highlight a focus on leveraging mergers and acquisitions to drive growth. The company remains fairly valued with no significant insider trading activity reported in recent months, supporting confidence in its trajectory.

- Click to explore a detailed breakdown of our findings in Vaisala Oyj's earnings growth report.

- The analysis detailed in our Vaisala Oyj valuation report hints at an inflated share price compared to its estimated value.

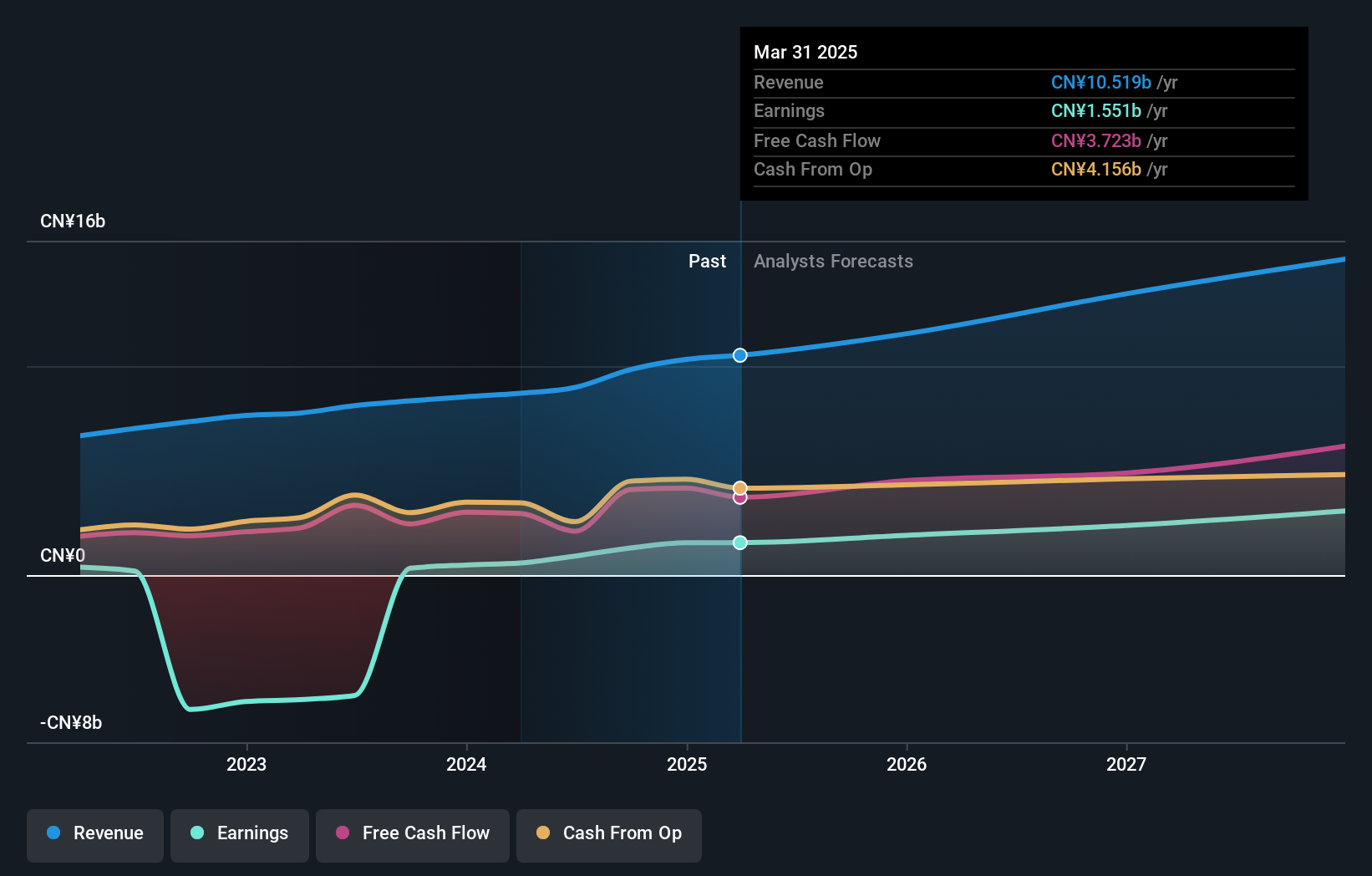

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of approximately HK$45.11 billion.

Operations: Kingsoft's revenue is primarily derived from its online games and others segment, which generated CN¥4.93 billion, and its office software and services segment, which brought in CN¥4.91 billion.

Insider Ownership: 20%

Kingsoft is positioned for growth with earnings expected to increase significantly at 23.7% annually, surpassing the Hong Kong market's 11.2%. Despite slower revenue growth of 13.8%, it remains above the market average of 7.6%. Recent Q3 results showed a substantial rise in net income to CNY 413.45 million from CNY 28.49 million a year ago, reflecting strong performance momentum. The stock trades below its estimated fair value, indicating potential investment appeal despite low forecasted return on equity.

- Delve into the full analysis future growth report here for a deeper understanding of Kingsoft.

- Our comprehensive valuation report raises the possibility that Kingsoft is priced higher than what may be justified by its financials.

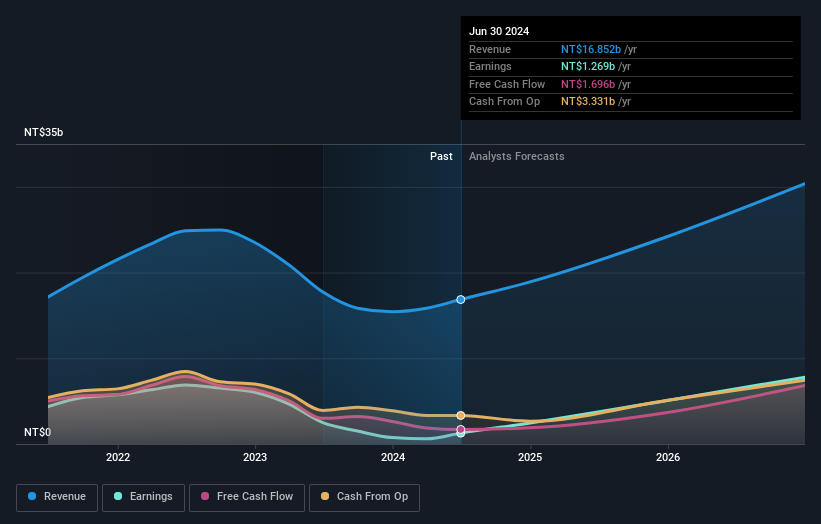

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Silergy Corp. designs, manufactures, and sells various integrated circuit products and related technical services in China and internationally, with a market cap of NT$154.70 billion.

Operations: The company generates revenue of NT$17.63 billion from its semiconductors segment.

Insider Ownership: 14.3%

Silergy's earnings are projected to grow significantly at 40.6% annually, outpacing the TW market's 17.3%. Revenue growth is slower at 19.9%, yet still above the market average of 11.3%. Recent Q3 results highlight a robust increase in net income to TWD 752.64 million from TWD 494.37 million last year, with basic EPS rising to TWD 1.96 from TWD 1.29, showcasing strong financial performance amidst high share price volatility and recent executive changes.

- Navigate through the intricacies of Silergy with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Silergy shares in the market.

Key Takeaways

- Get an in-depth perspective on all 1471 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6415

Silergy

Designs, manufactures, and sales of various integrated circuit products and related technical services in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives