- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

3 Growth Companies With Insider Ownership Up To 32%

Reviewed by Simply Wall St

In the current global market environment, where cautious Federal Reserve commentary and political uncertainties have led to volatility in major indices, investors are increasingly looking for stable opportunities amidst broader economic fluctuations. One key factor that can signal potential resilience and alignment of interests is high insider ownership in growth companies, as it often indicates confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

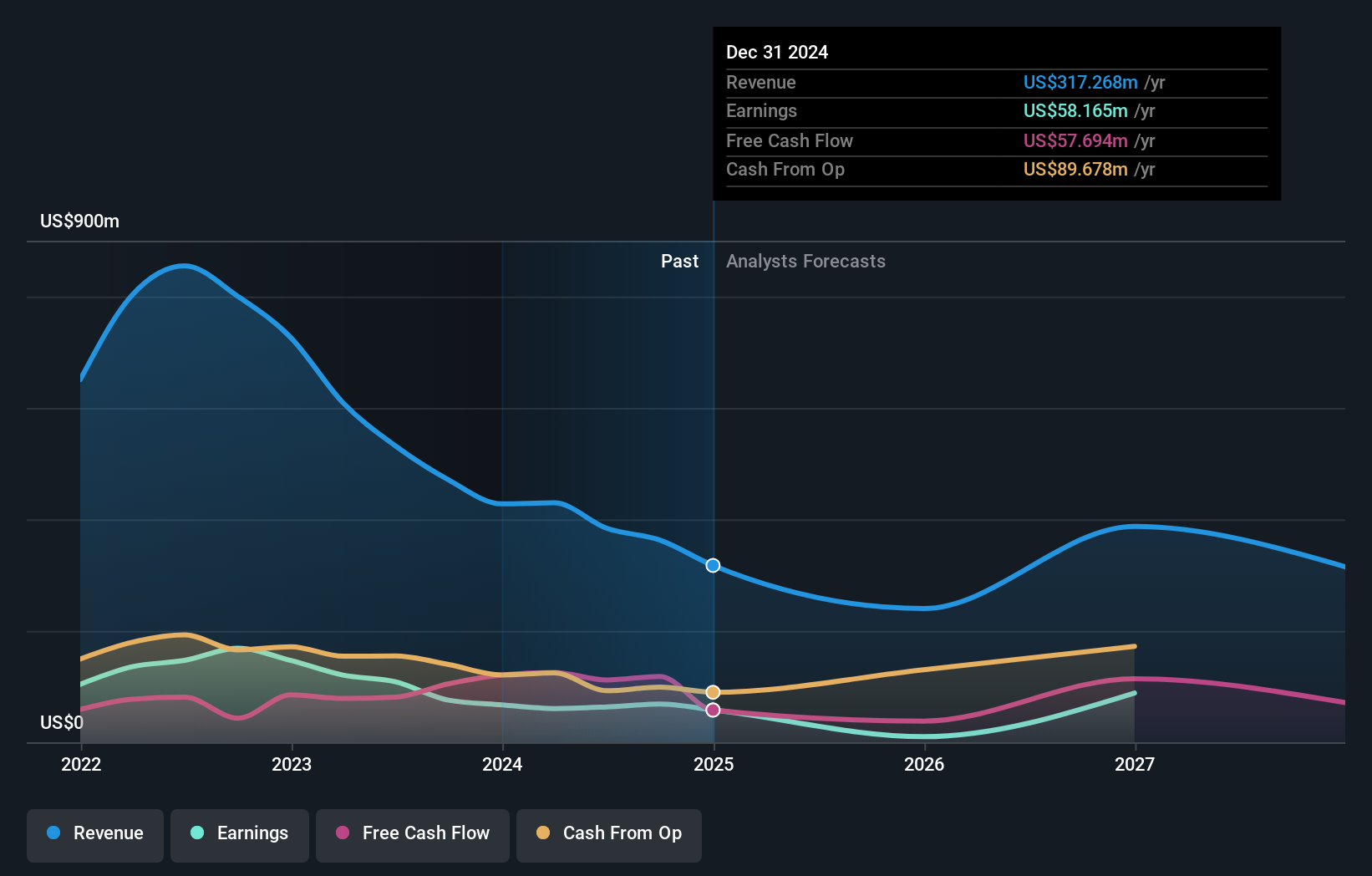

Belships (OB:BELCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Belships ASA is a global owner and operator of dry bulk ships, with a market cap of NOK5.12 billion.

Operations: The company generates revenue from its dry bulk shipping operations, with $173.65 million from Belships and $189.14 million from its operating business segment.

Insider Ownership: 13.6%

Belships ASA is currently the subject of a NOK 5.2 billion acquisition offer by ENTRUST GLOBAL LTD., with significant insider ownership influencing the transaction. The board has recommended acceptance, highlighting fair valuation amid volatile share prices. Although earnings are forecast to grow faster than the Norwegian market at 13% annually, revenue growth remains modest at 2.3%. Recent earnings showed improved net income despite declining revenue, and dividends have fluctuated recently.

- Get an in-depth perspective on Belships' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Belships' share price might be on the cheaper side.

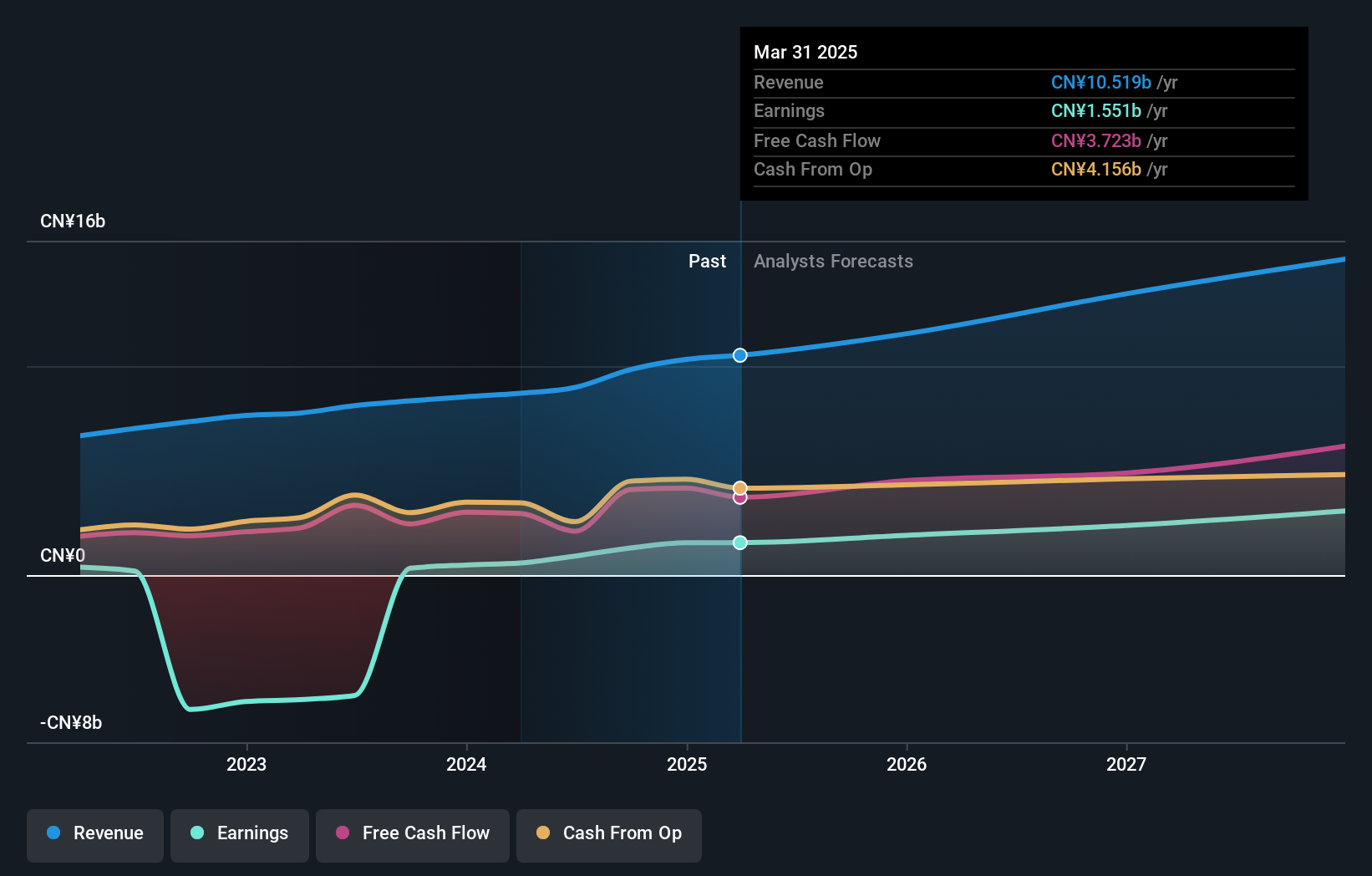

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of approximately HK$45.11 billion.

Operations: The company's revenue is primarily derived from its online games and others segment, generating CN¥4.93 billion, and its office software and services segment, contributing CN¥4.91 billion.

Insider Ownership: 20%

Kingsoft Corporation Limited's recent earnings report showed a substantial increase in net income, reaching CNY 413.45 million, up from CNY 28.49 million the previous year. Despite significant insider selling recently, the company's earnings are projected to grow at 21.3% annually, outpacing the Hong Kong market's average growth rate. However, revenue growth is expected to be slower than desired at 12.9% per year and return on equity remains low at an estimated 8.8%.

- Take a closer look at Kingsoft's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Kingsoft's current price could be inflated.

Guangdong Yussen Energy Technology (SZSE:002986)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Yussen Energy Technology Co., Ltd. operates in the energy technology sector and has a market cap of CN¥5.05 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Guangdong Yussen Energy Technology Co., Ltd.

Insider Ownership: 32.2%

Guangdong Yussen Energy Technology is poised for significant growth, with earnings forecasted to rise 36.9% annually, surpassing the Chinese market average. Despite recent profit margin contraction from 7.7% to 4.4%, the company trades at a favorable price-to-earnings ratio of 15.1x compared to the market's 36.6x, suggesting good relative value. Recent revenue figures show an increase to CNY 5.69 billion, but net income declined year-over-year, indicating potential challenges ahead.

- Click here to discover the nuances of Guangdong Yussen Energy Technology with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Guangdong Yussen Energy Technology shares in the market.

Next Steps

- Navigate through the entire inventory of 1515 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with solid track record.