- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:3700

Discovering Hidden Potential In These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, with major indexes like the S&P 500 reaching new highs, small-cap stocks have not kept pace with their larger counterparts. In this environment of shifting tariffs and AI-driven optimism, uncovering stocks with hidden potential becomes crucial for investors looking to capitalize on underappreciated opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Toyo Kanetsu K.K | 32.74% | 2.71% | 17.49% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

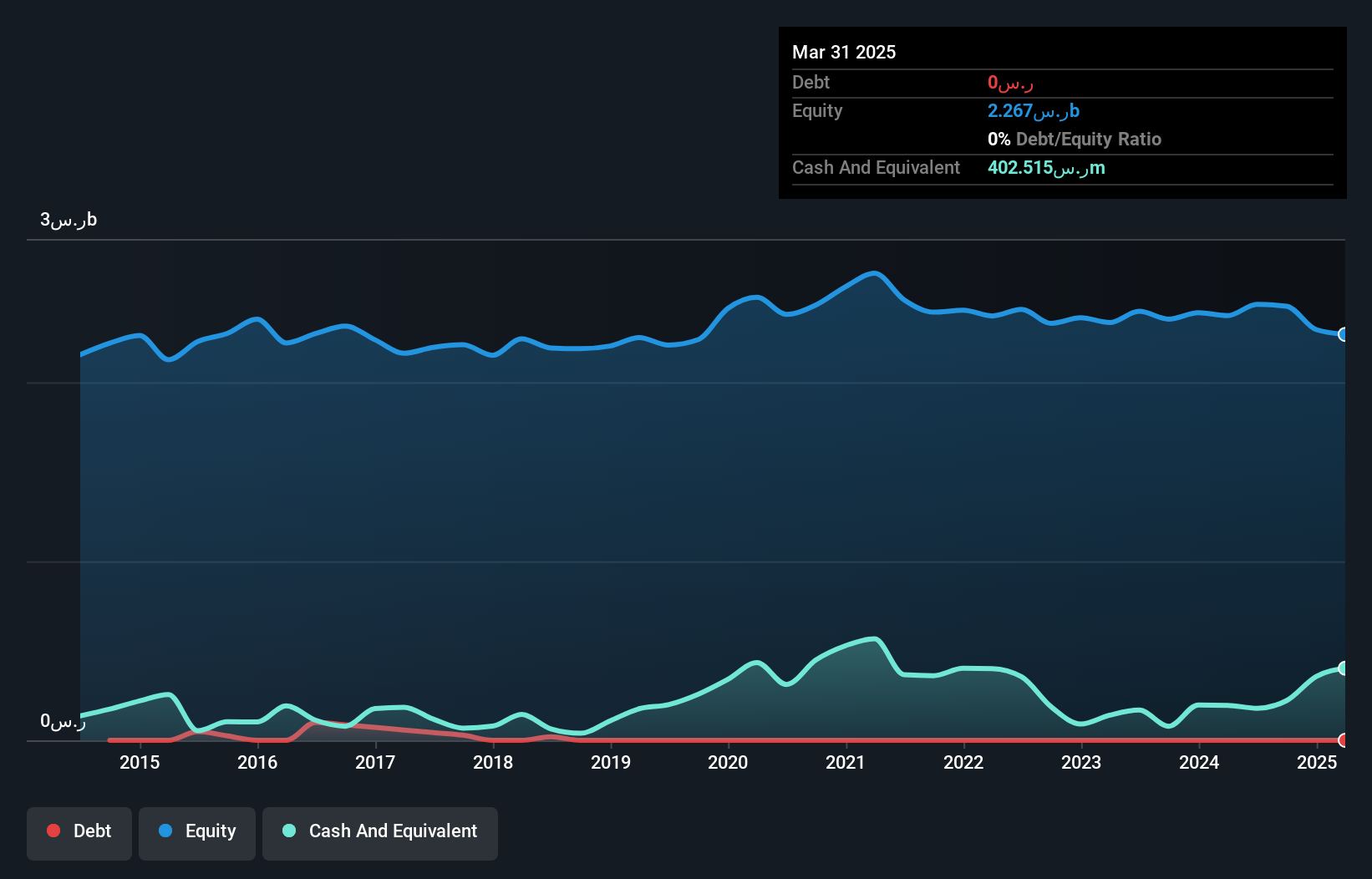

Eastern Province Cement (SASE:3080)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastern Province Cement Company engages in the production and sale of clinker and cement within Saudi Arabia and internationally, with a market capitalization of SAR3.06 billion.

Operations: Eastern Province Cement generates revenue primarily from its cement segment, contributing SAR818.25 million, followed by the precast concrete segment at SAR342.82 million. The company's cost structure and profitability are influenced by these segments, with a focus on optimizing production efficiency to enhance financial performance.

Eastern Province Cement, a smaller player in the industry, showcases promising figures with its recent earnings announcement. Sales for the third quarter reached SAR 279.72 million, up from SAR 242.91 million last year, while net income slightly increased to SAR 41.15 million from SAR 40.89 million. Over nine months, sales jumped to SAR 864.61 million compared to the previous year's SAR 695.62 million, indicating robust demand or improved market position likely driving growth. The company is trading at a good value relative to peers and remains debt-free with high-quality earnings that suggest solid operational management and potential for continued performance enhancement.

- Click here and access our complete health analysis report to understand the dynamics of Eastern Province Cement.

Gain insights into Eastern Province Cement's past trends and performance with our Past report.

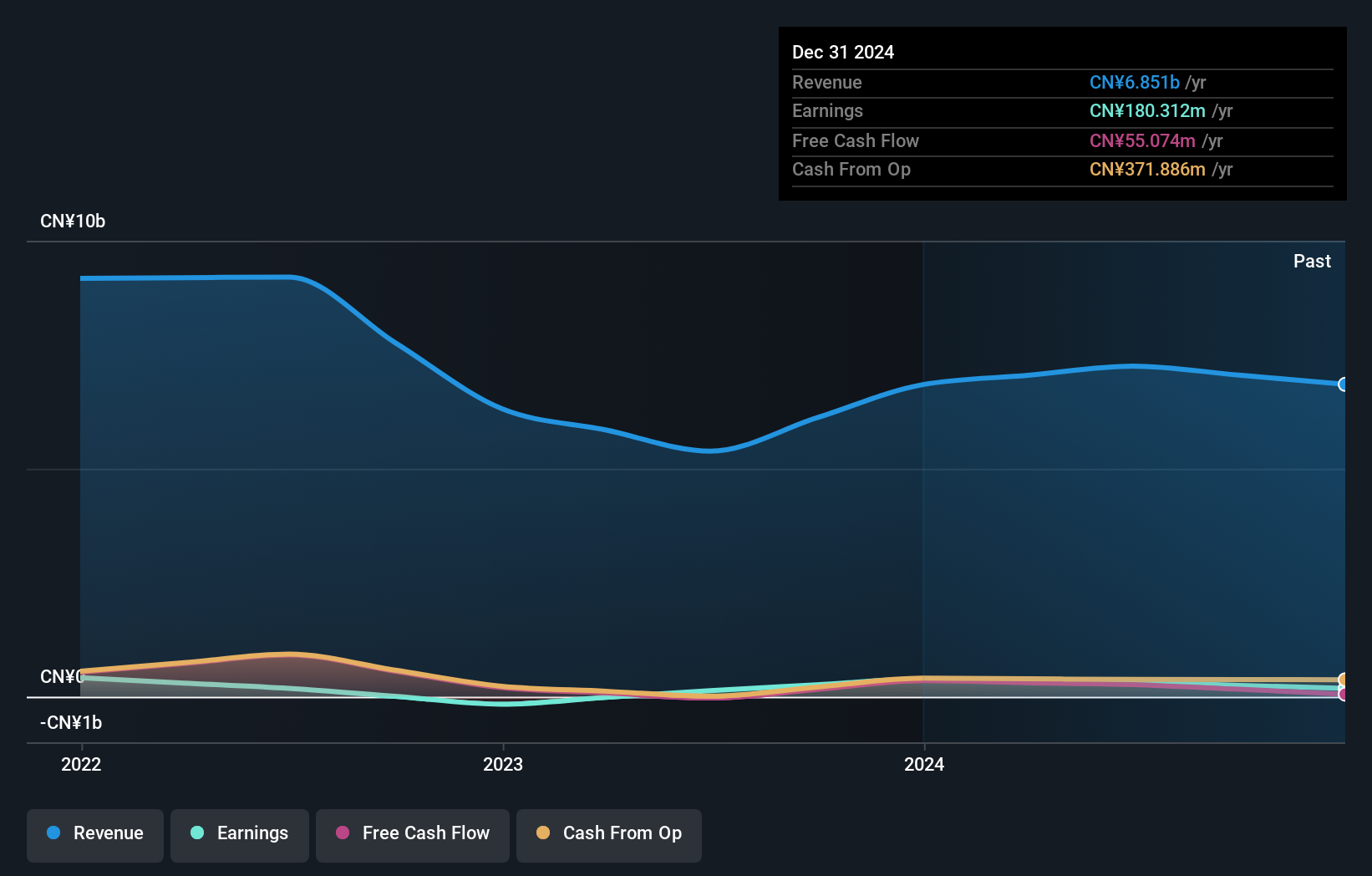

Inkeverse Group (SEHK:3700)

Simply Wall St Value Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China, with a market capitalization of approximately HK$3.18 billion.

Operations: The primary revenue stream for Inkeverse Group comes from its live streaming business, generating CN¥7.25 billion.

Inkeverse Group, a small player in the interactive media space, has shown impressive earnings growth of 136.1% over the past year, outpacing the industry average of 6.5%. With no debt on its books for five years and a price-to-earnings ratio at 9.3x, it appears undervalued compared to Hong Kong's market average of 10x. Despite this financial strength, its share price has been highly volatile recently. Recent board changes include appointing Ms. Zheng Congnan as an independent director; her tech expertise from Silicon Valley could steer innovation and enhance operational efficiency moving forward.

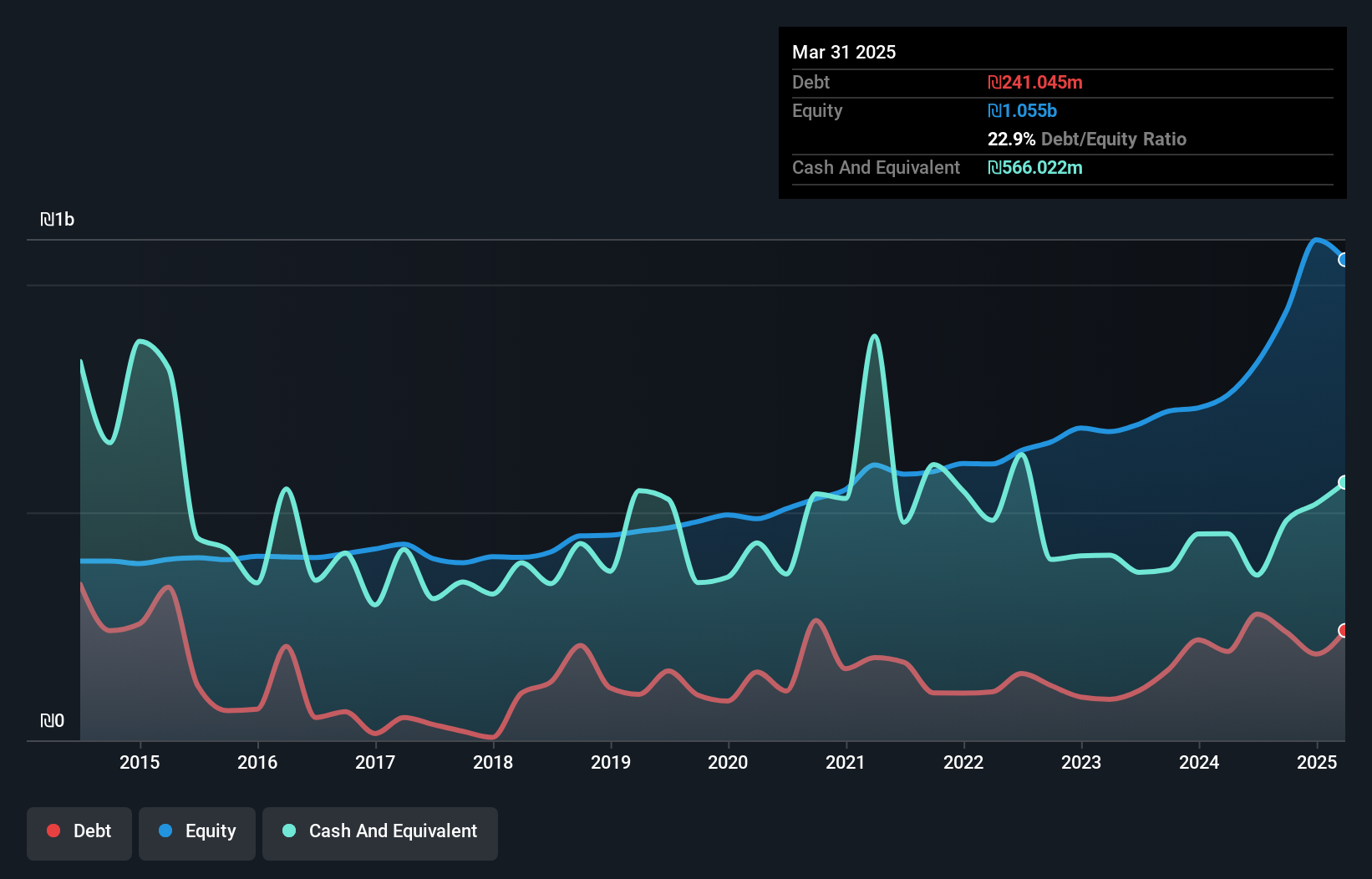

I.B.I. Investment House (TASE:IBI)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.B.I. Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market capitalization of ₪2.54 billion, focusing on diverse financial services and investment solutions.

Operations: I.B.I. Investment House generates revenue primarily from trading, depository, and execution services (₪307.77 million), alternative investment management (₪152.92 million), and equity management and operation services (₪142.95 million). The company also derives income from pension and financial agencies (₪89.46 million) and investments for its own account (₪16.16 million).

I.B.I. Investment House, a compact player in the financial sector, is trading at a decent value, 7.2% below its estimated fair market price. Despite recent negative earnings growth of -2.2%, contrasting with the industry average of 12.8%, it boasts high-quality past earnings and strong debt coverage with EBIT covering interest payments 33 times over. The company recently reported third-quarter revenue of ILS 245 million, up from ILS 201 million last year, although net income dipped to ILS 31 million from ILS 41 million previously. A private placement raised additional funds at an attractive share price of ILS 0.142 each in December.

Seize The Opportunity

- Click this link to deep-dive into the 4666 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3700

Inkeverse Group

An investment holding company, operates mobile live streaming platforms in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)