Shareholders in Culturecom Holdings (HKG:343) have lost 49%, as stock drops 11% this past week

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Culturecom Holdings Limited (HKG:343) share price slid 49% over twelve months. That contrasts poorly with the market decline of 9.9%. On the bright side, the stock is actually up 2.6% in the last three years. More recently, the share price has dropped a further 24% in a month.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Culturecom Holdings

Given that Culturecom Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Culturecom Holdings saw its revenue fall by 33%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 49% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

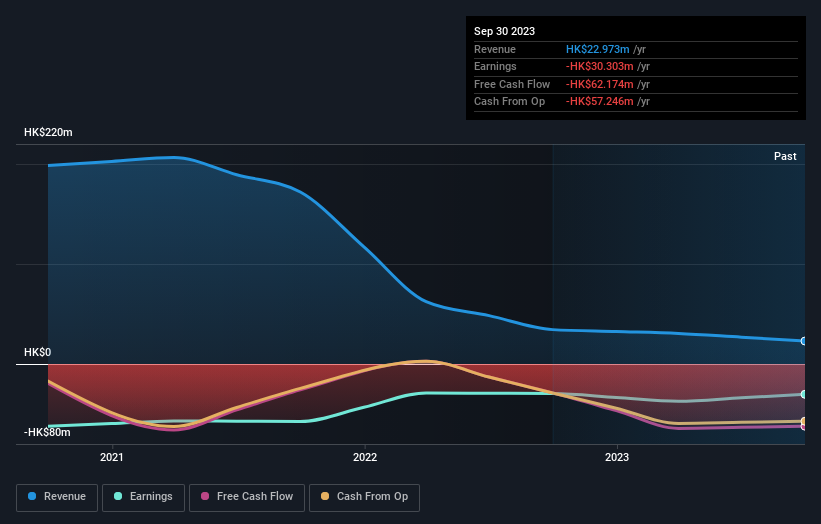

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Culturecom Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 9.9% in the twelve months, Culturecom Holdings shareholders did even worse, losing 49%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Culturecom Holdings (including 1 which shouldn't be ignored) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:343

Culturecom Holdings

An investment holding company, operates as a comic book publishers and media content provider in Hong Kong and the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026