- Hong Kong

- /

- Entertainment

- /

- SEHK:2309

Birmingham Sports Holdings (HKG:2309) Share Prices Have Dropped 12% In The Last Three Years

Investors are understandably disappointed when a stock they own declines in value. But when the market is down, you're bound to have some losers. While the Birmingham Sports Holdings Limited (HKG:2309) share price is down 12% in the last three years, the total return to shareholders (which includes dividends) was -1.5%. And that total return actually beats the market decline of 4.6%. More recently, the share price has dropped a further 8.8% in a month.

View our latest analysis for Birmingham Sports Holdings

Birmingham Sports Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Birmingham Sports Holdings grew revenue at 8.5% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 4% per year, for three years. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

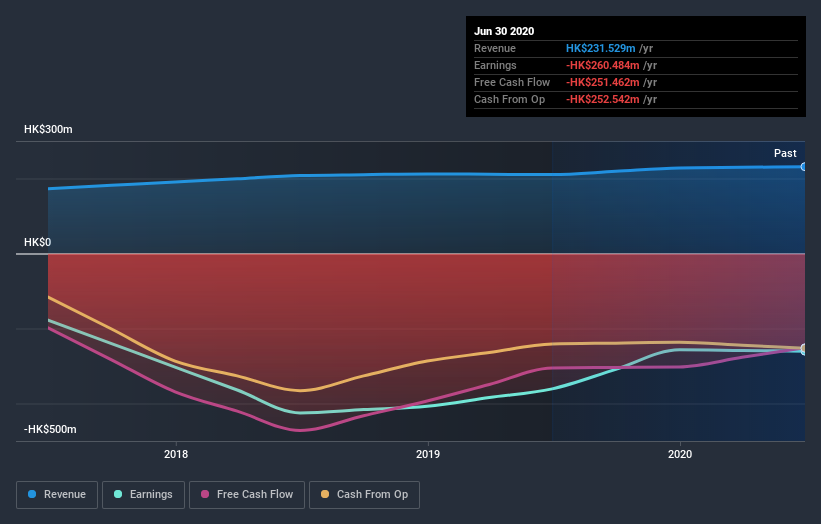

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Birmingham Sports Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Birmingham Sports Holdings' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Birmingham Sports Holdings' TSR, at -1.5% is higher than its share price return of -12%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

The last twelve months weren't great for Birmingham Sports Holdings shares, which cost holders 2.7%, while the market was up about 25%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 0.5% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Birmingham Sports Holdings (2 are potentially serious!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Birmingham Sports Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ZO Future Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2309

ZO Future Group

An investment holding company, operates a professional football club in Hong Kong, the United Kingdom, the People's Republic of China, Cambodia, and Japan.

Very low with worrying balance sheet.

Market Insights

Community Narratives