- Hong Kong

- /

- Entertainment

- /

- SEHK:2100

Should BAIOO Family Interactive (HKG:2100) Be Disappointed With Their 93% Profit?

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, BAIOO Family Interactive Limited (HKG:2100) shareholders have seen the share price rise 93% over three years, well in excess of the market return (2.7%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 75% in the last year , including dividends .

See our latest analysis for BAIOO Family Interactive

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, BAIOO Family Interactive failed to grow earnings per share, which fell 6.8% (annualized). So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The revenue drop of 11% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between BAIOO Family Interactive's share price and its historic fundamental data. Further research may be required!

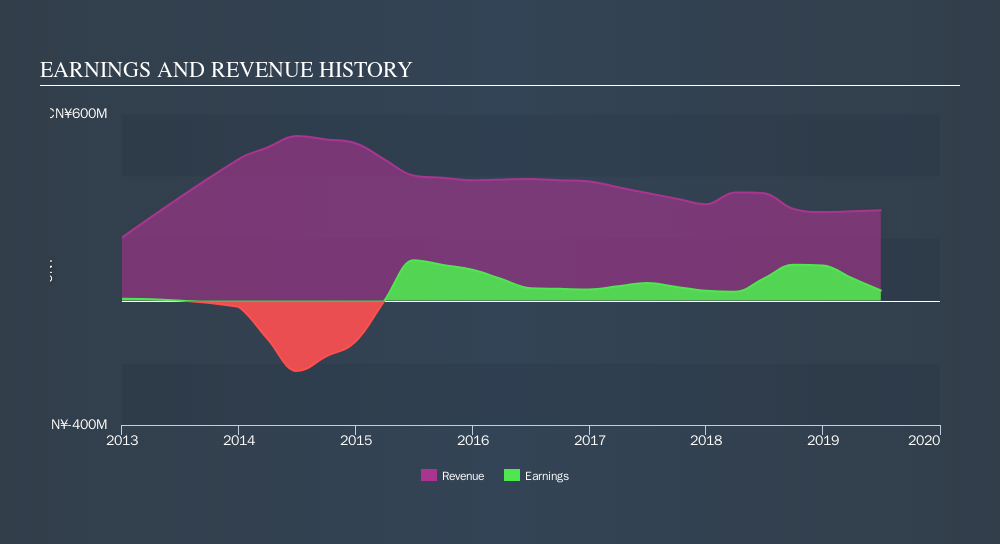

The image below shows how revenue has tracked over time.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for BAIOO Family Interactive the TSR over the last 3 years was 116%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that BAIOO Family Interactive shareholders have received a total shareholder return of 75% over the last year. And that does include the dividend. That certainly beats the loss of about 3.9% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before deciding if you like the current share price, check how BAIOO Family Interactive scores on these 3 valuation metrics.

We will like BAIOO Family Interactive better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:2100

BAIOO Family Interactive

An investment holding company, provides internet content and services in the People’s Republic of China and internationally.

Flawless balance sheet minimal.

Similar Companies

Market Insights

Community Narratives