Asian Market Insights: Promising Penny Stocks For October 2025

Reviewed by Simply Wall St

As of late October 2025, Asian markets have shown resilience amid global economic fluctuations, with notable strength in technology-focused shares and proactive fiscal policies boosting investor sentiment. Penny stocks, a term often associated with smaller or newer companies, continue to offer intriguing opportunities for growth at accessible price points. When these stocks are supported by solid financial health and robust fundamentals, they can present compelling investment prospects despite the inherent risks of this market segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.74 | THB1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.04 | SGD421.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.30 | THB8.69B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, focuses on the research, design, development, manufacturing, and sale of automotive steering systems and accessories in China and has a market cap of HK$10.10 billion.

Operations: Zhejiang Shibao has not reported any specific revenue segments.

Market Cap: HK$10.1B

Zhejiang Shibao has shown robust earnings growth, with a 25.8% increase over the past year, outpacing the Auto Components industry average. The company demonstrates financial stability with short-term assets exceeding both long-term and short-term liabilities and more cash than debt. Recent earnings reports highlight improved sales and net income, while maintaining high-quality earnings. However, its return on equity remains low at 10%, which could be a concern for investors seeking higher returns. The board's decision to streamline governance by eliminating the supervisory committee reflects an effort to enhance operational efficiency.

- Get an in-depth perspective on Zhejiang Shibao's performance by reading our balance sheet health report here.

- Learn about Zhejiang Shibao's future growth trajectory here.

BAIOO Family Interactive (SEHK:2100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BAIOO Family Interactive Limited is an investment holding company that offers internet content and services in China and internationally, with a market cap of HK$1.58 billion.

Operations: The company generates revenue primarily from its Online Entertainment Business, which accounts for CN¥573.95 million.

Market Cap: HK$1.58B

BAIOO Family Interactive has experienced a turnaround, reporting CN¥302.71 million in sales and CN¥5.66 million net income for the first half of 2025, reversing a previous loss. The company benefits from robust content updates and new game launches, enhancing user engagement and revenue growth. With seasoned leadership averaging over nine years of tenure, BAIOO maintains financial stability with assets surpassing liabilities and operates debt-free. Despite past earnings declines, recent profitability improvements suggest potential for sustained recovery in its niche gaming market segments through strategic IP management and cultural integration initiatives.

- Navigate through the intricacies of BAIOO Family Interactive with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into BAIOO Family Interactive's track record.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers cloud services and on-premises software in China, with a market cap of HK$6.05 billion.

Operations: The company generates revenue from Cloud Services amounting to CN¥1.11 billion and On-premise Software and Services totaling CN¥212.91 million.

Market Cap: HK$6.05B

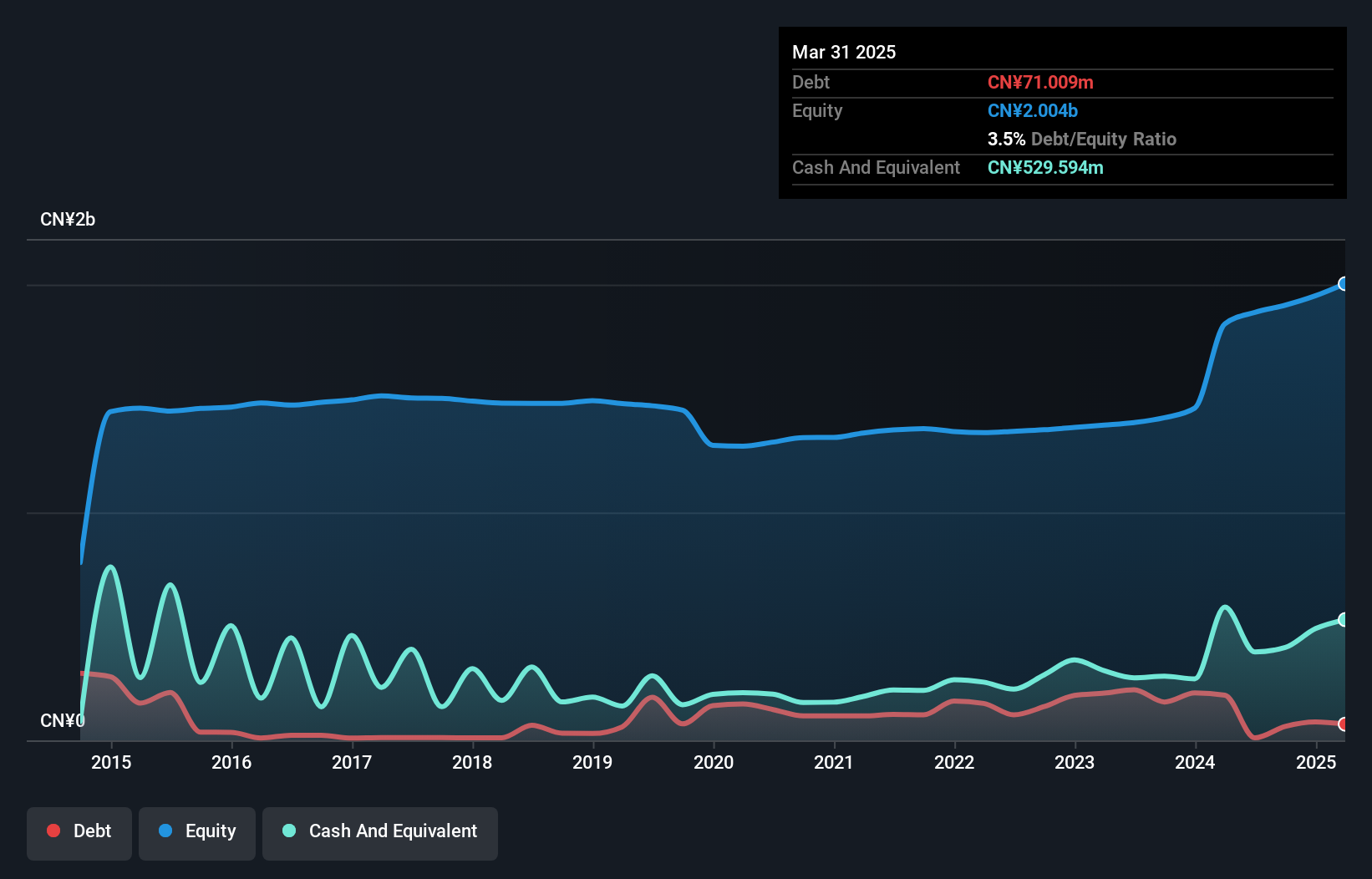

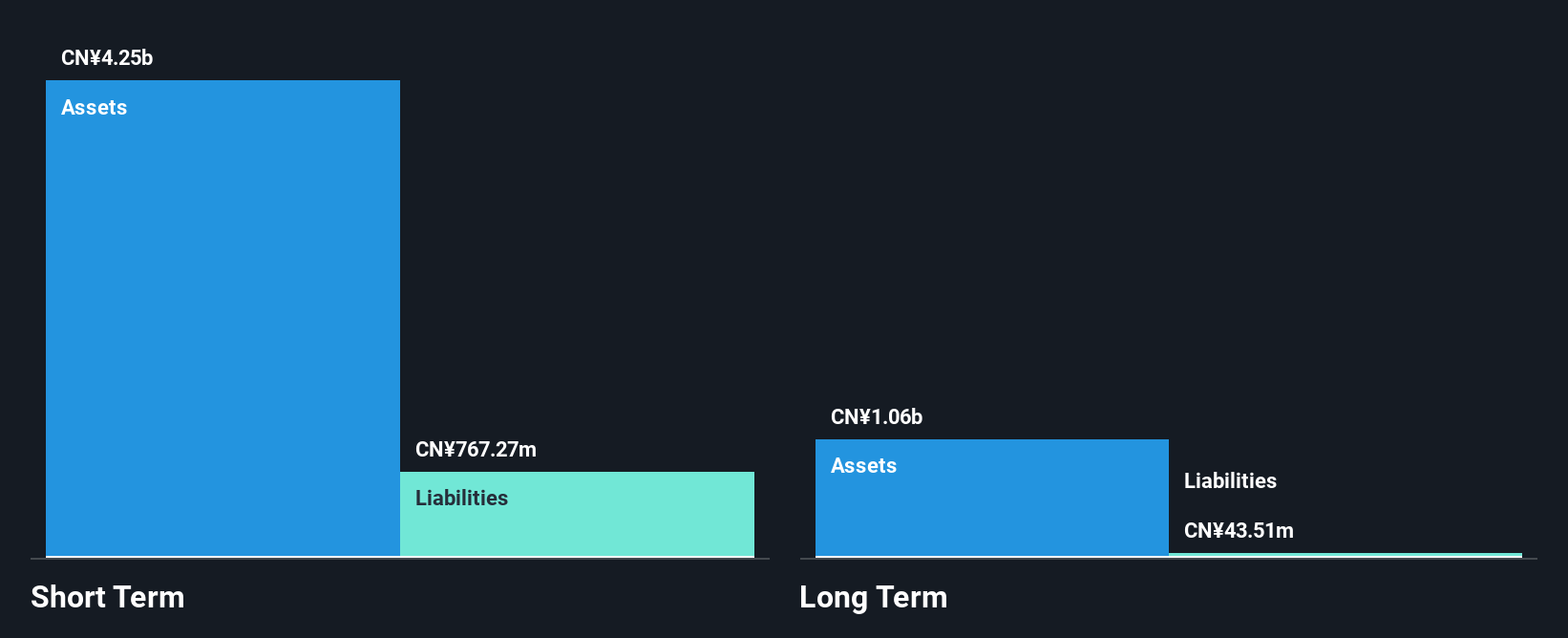

Ming Yuan Cloud Group Holdings has shown a significant financial turnaround, reporting net income of CN¥13.75 million for the first half of 2025, compared to a loss in the same period last year. This improvement stems from strategic product and customer optimization, enhanced operational efficiency via AI technology, and favorable foreign exchange gains. The company remains debt-free with substantial short-term assets exceeding liabilities and maintains positive free cash flow with a runway exceeding three years. Recent share buybacks further reflect management's confidence in its financial health amidst ongoing profitability challenges in the software sector.

- Take a closer look at Ming Yuan Cloud Group Holdings' potential here in our financial health report.

- Gain insights into Ming Yuan Cloud Group Holdings' future direction by reviewing our growth report.

Key Takeaways

- Jump into our full catalog of 955 Asian Penny Stocks here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides cloud services and on-premises software and services in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives