Capital Allocation Trends At Asiaray Media Group (HKG:1993) Aren't Ideal

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at Asiaray Media Group (HKG:1993) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Asiaray Media Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.02 = HK$71m ÷ (HK$5.3b - HK$1.7b) (Based on the trailing twelve months to December 2020).

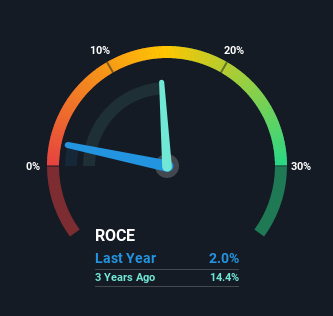

So, Asiaray Media Group has an ROCE of 2.0%. In absolute terms, that's a low return and it also under-performs the Media industry average of 5.1%.

See our latest analysis for Asiaray Media Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Asiaray Media Group, check out these free graphs here.

What Does the ROCE Trend For Asiaray Media Group Tell Us?

The trend of ROCE doesn't look fantastic because it's fallen from 4.3% five years ago, while the business's capital employed increased by 400%. Usually this isn't ideal, but given Asiaray Media Group conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Asiaray Media Group's earnings and if they change as a result from the capital raise.

On a related note, Asiaray Media Group has decreased its current liabilities to 33% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line On Asiaray Media Group's ROCE

From the above analysis, we find it rather worrisome that returns on capital and sales for Asiaray Media Group have fallen, meanwhile the business is employing more capital than it was five years ago. Long term shareholders who've owned the stock over the last five years have experienced a 49% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

Asiaray Media Group does have some risks, we noticed 3 warning signs (and 1 which is potentially serious) we think you should know about.

While Asiaray Media Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1993

Asiaray Media Group

An investment holding company, operates as an out-of-home media company in the People’s Republic of China, Hong Kong, Macau, and Southeast Asia.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026