- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

High Growth Tech Stocks to Watch in May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious economic outlooks, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week amid hopes for tariff de-escalation between major economies. With the Federal Reserve holding rates steady amidst rising uncertainties, investors are keenly observing sectors poised for growth, such as technology, where innovation and adaptability can offer compelling opportunities in an evolving market environment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| CD Projekt | 33.48% | 37.10% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Arabian Contracting Services | 20.05% | 27.78% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★☆

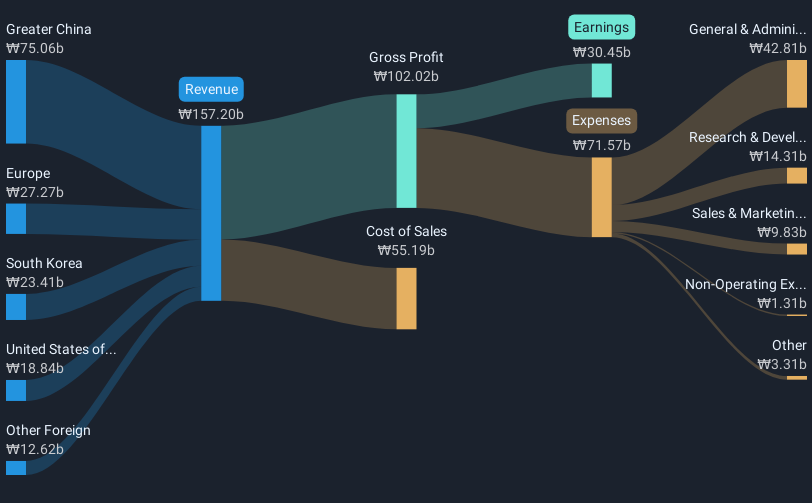

Overview: Park Systems Corp. is a company that specializes in the development, manufacture, and sale of atomic force microscopy systems globally, with a market capitalization of ₩1.61 trillion.

Operations: Park Systems generates revenue primarily from the sale of scientific and technical instruments, specifically atomic force microscopy systems, amounting to ₩175.06 billion. The company's gross profit margin is a notable aspect of its financial performance.

Park Systems, a leader in nanotechnology solutions, has demonstrated robust financial performance with a 74.3% surge in earnings over the past year, significantly outpacing the electronic industry's average of 16.6%. This growth is underpinned by an aggressive R&D strategy that allocates substantial resources to innovation—evident from its R&D expenses which are integral to its development trajectory. With revenues and earnings expected to grow annually by 15.8% and 21.5%, respectively, Park Systems is not only outperforming the broader KR market forecasts of 7.4% revenue growth and 20.9% earnings growth but is also setting a benchmark in technological advancements within its sector.

- Click here and access our complete health analysis report to understand the dynamics of Park Systems.

Gain insights into Park Systems' historical performance by reviewing our past performance report.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

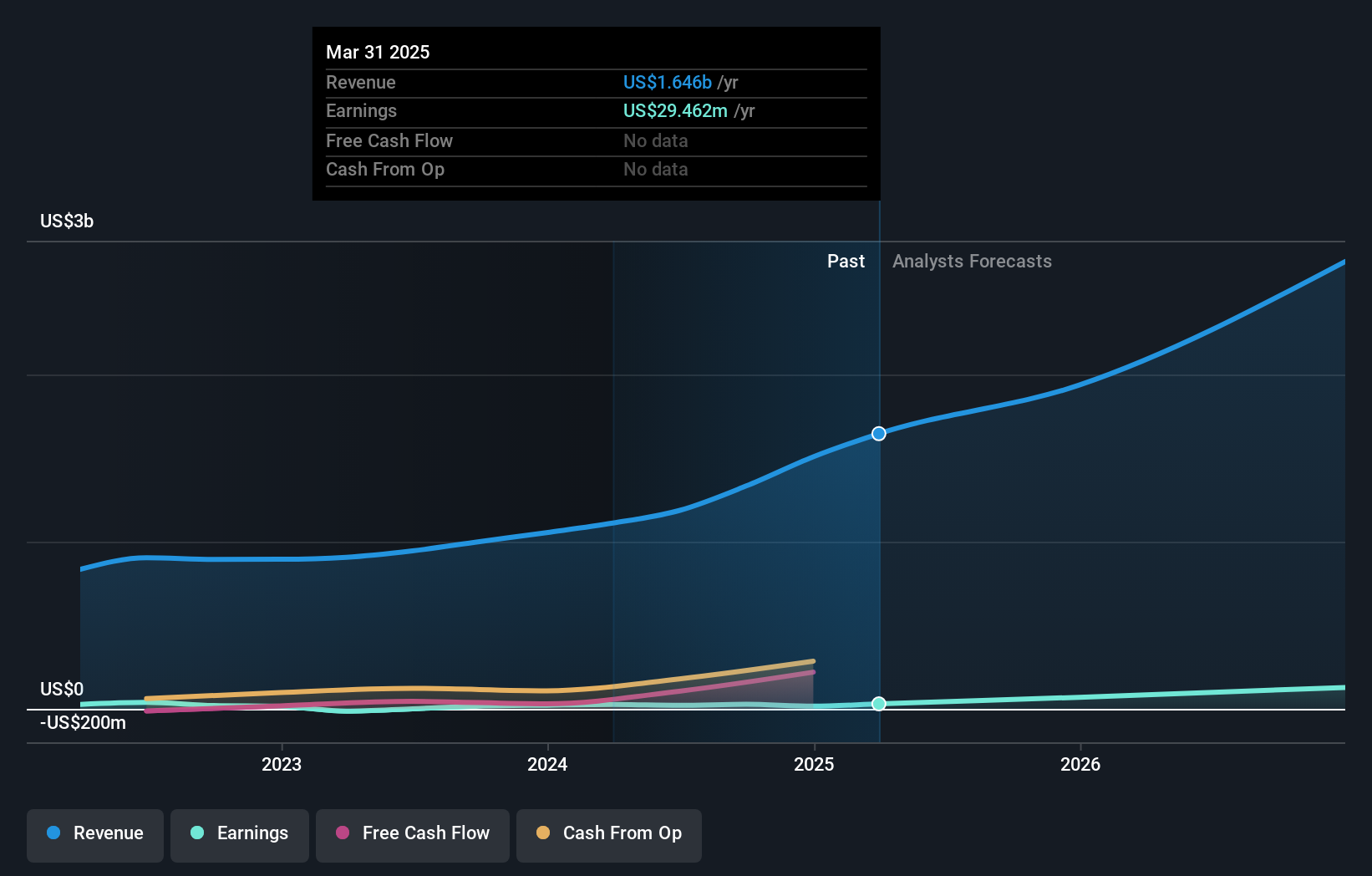

Overview: Mobvista Inc. operates globally, offering advertising and marketing technology services to support the mobile internet ecosystem, with a market cap of HK$9.28 billion.

Operations: Mobvista Inc. generates revenue primarily from its Advertising Technology Services, contributing significantly more than its Marketing Technology Business, with figures of $1.49 billion and $17.52 million respectively.

Despite a challenging year where Mobvista saw a dip in net income from USD 21.8 million to USD 15.74 million, the company's sales surged by over 43%, reaching USD 1.51 billion in 2024. This growth underscores its ability to expand revenue streams significantly above the market average, pegged at an annual increase of 27.6%. However, earnings per share did see a slight decrease, reflecting some operational challenges amidst this rapid expansion. The firm’s commitment to innovation is evident from its strategic board meetings focused on business development and addressing legal risks, positioning it well for future scalability within the high-growth tech sector.

- Dive into the specifics of Mobvista here with our thorough health report.

Examine Mobvista's past performance report to understand how it has performed in the past.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

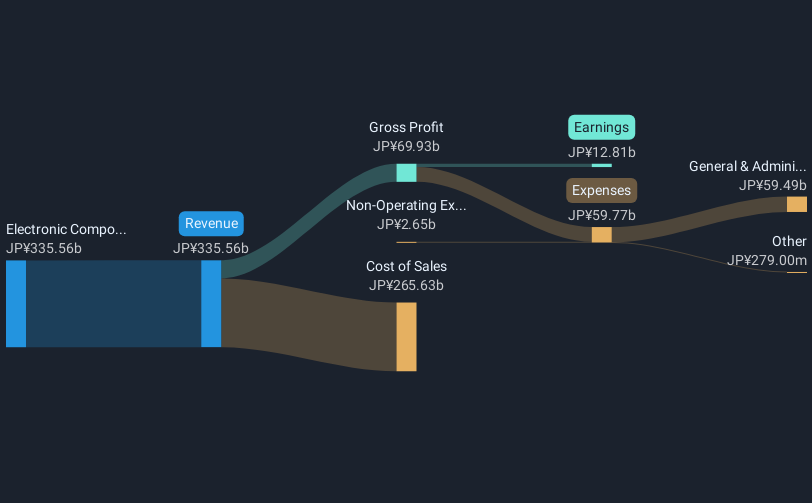

Overview: Taiyo Yuden Co., Ltd. is engaged in the development, manufacturing, and sales of electronic components across Japan, China, Hong Kong, and international markets with a market capitalization of ¥279.40 billion.

Operations: Taiyo Yuden focuses on the electronic components sector, generating revenue of ¥341.44 billion from this segment. The company's operations span multiple regions, including Japan and China.

Taiyo Yuden's recent advancements, particularly the commercialization of the LCQPB series inductors, underscore its strategic focus on automotive electronics—a sector poised for growth with increasing electronic vehicle production. These components are crucial for enhancing power circuit efficiency and noise reduction in vehicles, aligning with industry demands for higher performance and reliability. Despite a challenging financial year with a revised earnings guidance indicating a net profit drop to JPY 2,328 million from an earlier forecast, Taiyo Yuden maintains robust dividend payouts at JPY 45.00 per share and projects an operating profit rebound to JPY 16,000 million by next fiscal year. This resilience in maintaining shareholder returns amidst forecast adjustments reflects a prudent financial strategy while continuing to innovate within key market segments.

- Delve into the full analysis health report here for a deeper understanding of Taiyo Yuden.

Gain insights into Taiyo Yuden's past trends and performance with our Past report.

Taking Advantage

- Get an in-depth perspective on all 734 Global High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Taiyo Yuden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives