In the current global market landscape, U.S. indexes are approaching record highs with broad-based gains, and smaller-cap indexes have been outperforming their larger counterparts, reflecting a positive sentiment bolstered by strong labor market data and rising home sales. As investors navigate this environment of cautious optimism amid geopolitical uncertainties and economic indicators, identifying potential opportunities in lesser-known small-cap stocks can be a strategic move for those seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Mobvista (SEHK:1860)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services essential for the development of the mobile internet ecosystem globally, with a market cap of HK$14.39 billion.

Operations: Mobvista generates revenue primarily from its advertising and marketing technology services. The company's net profit margin has shown notable changes over recent periods, reflecting the impact of its cost structure on profitability.

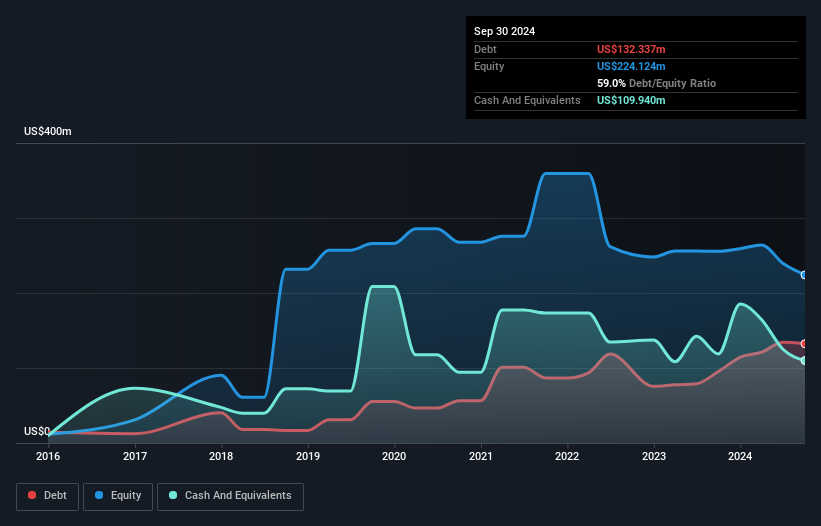

Mobvista, a dynamic player in the tech space, reported impressive sales growth for Q3 2024, reaching US$416.46 million compared to US$269.37 million last year. This surge contributed to net income rising to US$9.9 million from US$3.78 million previously, reflecting robust operational performance despite market volatility over the past three months. The company is trading at a notable discount of 39.6% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in this sector. Additionally, Mobvista's earnings have grown by 64%, outpacing industry averages and indicating strong momentum going forward.

- Click here to discover the nuances of Mobvista with our detailed analytical health report.

Gain insights into Mobvista's historical performance by reviewing our past performance report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.16 billion, operates through its subsidiaries in the production, distribution, and sale of electricity under the naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from three segments: Customer-Oriented Energy Solutions (€1.15 billion), Renewable Generation Infrastructure (€1.09 billion), and System Relevant Infrastructure (€403.50 million).

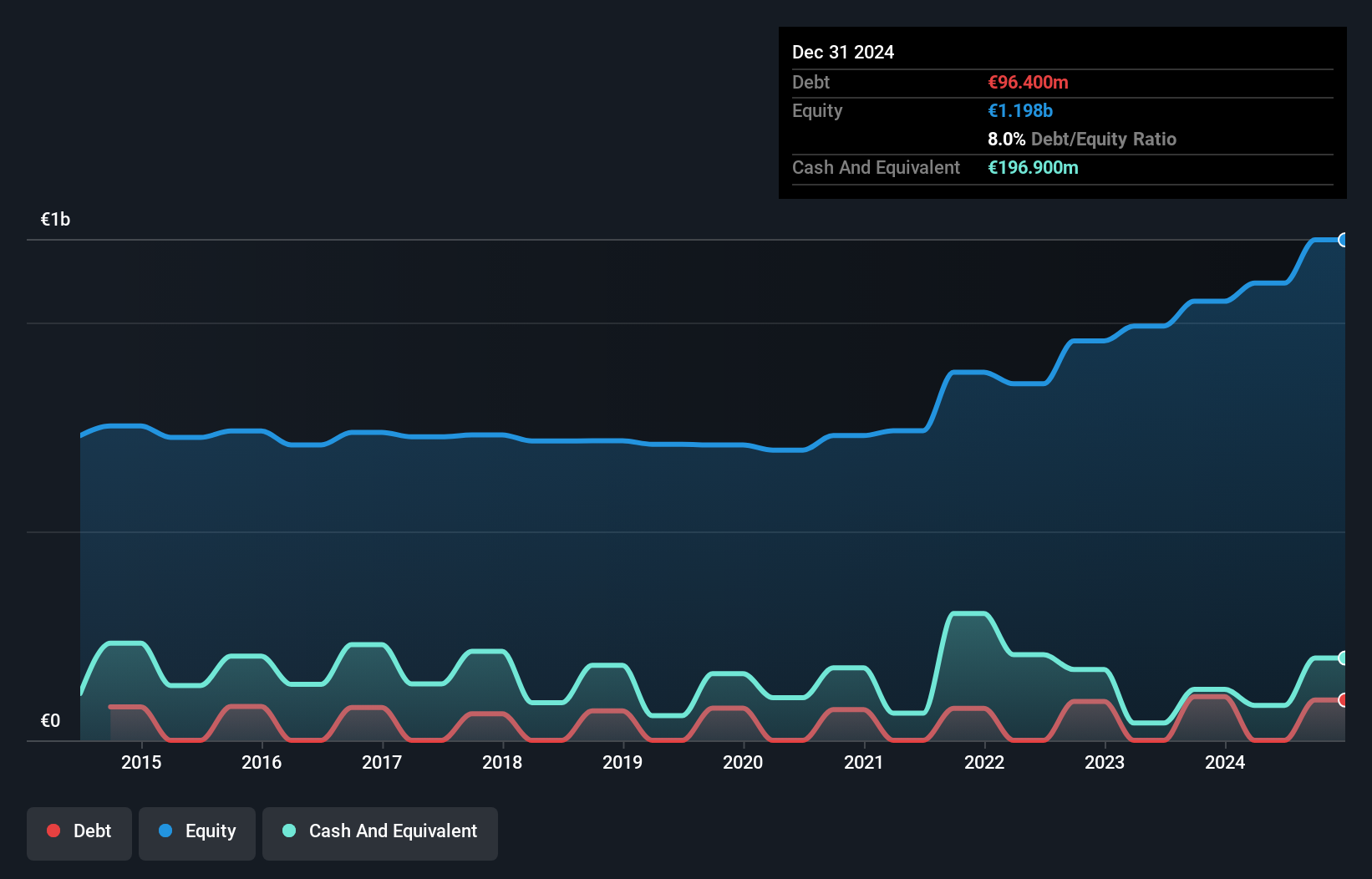

Naturenergie Holding, a nimble player in the energy sector, showcases impressive earnings growth of 40.5% over the past year, outpacing the Electric Utilities industry's -14.7%. With no debt on its books for five years and a solid price-to-earnings ratio of 10.8x compared to the Swiss market's 19.9x, it trades at an attractive valuation relative to peers. The company is profitable with high-quality earnings and positive free cash flow, suggesting financial stability despite recent negative levered free cash flow figures like US$341 million as of June 2023. Earnings are expected to grow by 3.28% annually, indicating potential for steady expansion ahead.

- Get an in-depth perspective on naturenergie holding's performance by reading our health report here.

Assess naturenergie holding's past performance with our detailed historical performance reports.

Senshu Ikeda Holdings (TSE:8714)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senshu Ikeda Holdings, Inc. offers banking products and services to small and medium-sized enterprises and individuals in Japan and internationally, with a market cap of ¥1.09 billion.

Operations: The company's revenue primarily stems from its banking products and services offered to small and medium-sized enterprises, as well as individuals. It has a market capitalization of ¥108.53 billion.

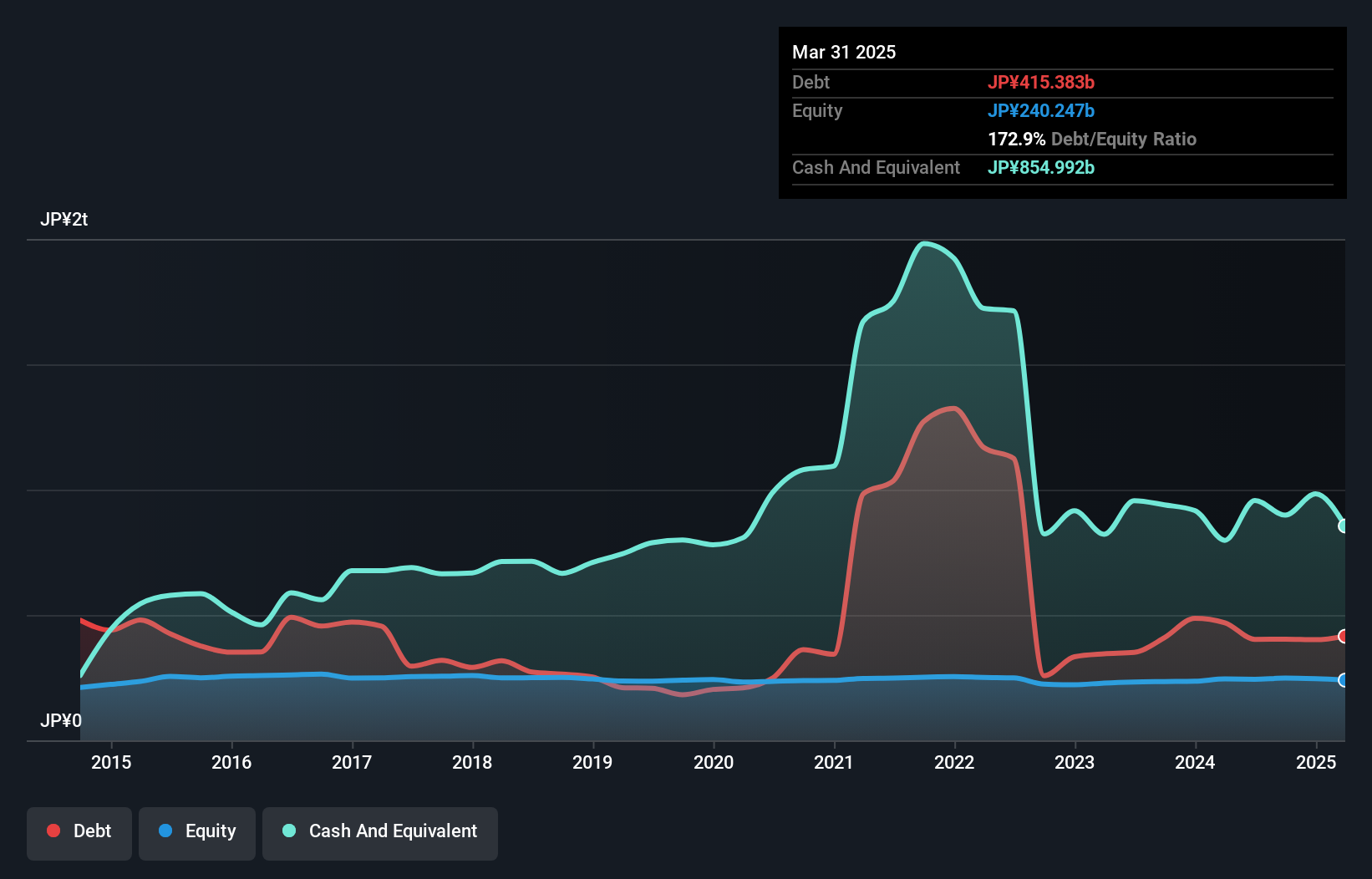

Senshu Ikeda Holdings, a financial institution with assets totaling ¥6,338.7 billion and equity of ¥248.1 billion, stands out for its robust growth in earnings by 42% over the past year, surpassing the industry average of 22.6%. The company primarily relies on low-risk funding sources, with customer deposits making up 92% of liabilities. Despite trading at 11.7% below its estimated fair value and having an appropriate bad loan ratio of 1.1%, it has insufficient allowance for bad loans at only 19%. Recent guidance anticipates a profit attributable to owners of ¥12.9 billion for fiscal year ending March 2025, reflecting strong potential amidst cautious risk management practices.

Taking Advantage

- Embark on your investment journey to our 4638 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1860

Mobvista

Engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives