- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1762

Wanka Online Inc. (HKG:1762) Stocks Shoot Up 90% But Its P/S Still Looks Reasonable

Wanka Online Inc. (HKG:1762) shares have had a really impressive month, gaining 90% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

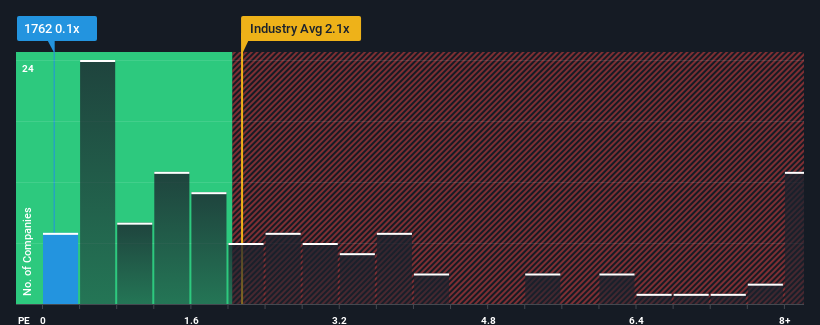

In spite of the firm bounce in price, there still wouldn't be many who think Wanka Online's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Hong Kong's Interactive Media and Services industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Wanka Online

What Does Wanka Online's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Wanka Online, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on Wanka Online will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wanka Online will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Wanka Online?

The only time you'd be comfortable seeing a P/S like Wanka Online's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.5% shows it's about the same on an annualised basis.

In light of this, it's understandable that Wanka Online's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From Wanka Online's P/S?

Its shares have lifted substantially and now Wanka Online's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that Wanka Online maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Wanka Online you should be aware of, and 1 of them is a bit concerning.

If these risks are making you reconsider your opinion on Wanka Online, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wanka Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1762

Wanka Online

Provides android-based content distribution services in Mainland China.

Adequate balance sheet with acceptable track record.