- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1761

Would Shareholders Who Purchased BabyTree Group's (HKG:1761) Stock Year Be Happy With The Share price Today?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by BabyTree Group (HKG:1761) shareholders over the last year, as the share price declined 19%. That's disappointing when you consider the market returned 6.3%. BabyTree Group may have better days ahead, of course; we've only looked at a one year period. The silver lining is that the stock is up 1.4% in about a week.

Check out our latest analysis for BabyTree Group

Given that BabyTree Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

BabyTree Group's revenue didn't grow at all in the last year. In fact, it fell 65%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 19% over the year. We would want to see improvements in the core business, and diminishing losses, before getting too excited about this one.

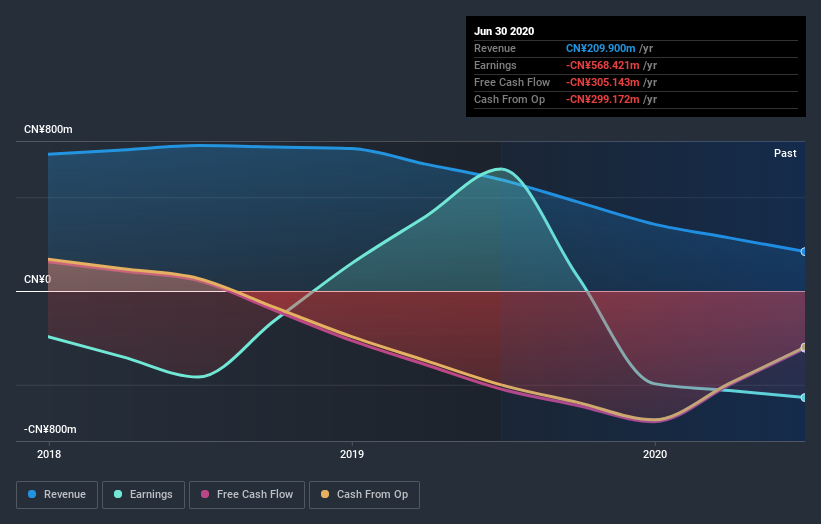

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on BabyTree Group's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 6.3% in the last year, BabyTree Group shareholders might be miffed that they lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 9.2%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with BabyTree Group , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade BabyTree Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BabyTree Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1761

BabyTree Group

BabyTree Group, an investment holding company, engages in the advertising, e-commerce, and content monetization businesses in the People’s Republic of China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives