- Hong Kong

- /

- Entertainment

- /

- SEHK:136

3 Asian Growth Stocks With Insider Ownership Up To 28%

Reviewed by Simply Wall St

As Asian markets experience a notable rise, with technology-focused shares in China and Japan's proactive fiscal policies boosting investor confidence, the region presents intriguing opportunities for growth-oriented investors. In this context, companies with high insider ownership often attract attention due to their potential alignment of interests between management and shareholders, making them appealing candidates for those seeking to capitalize on Asia's evolving economic landscape.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19% | 84.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.7% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and internationally, with a market cap of HK$45.43 billion.

Operations: The company generates revenue through its content production business, which accounts for CN¥648.86 million, and its online streaming and online gaming businesses, which contribute CN¥3.44 billion.

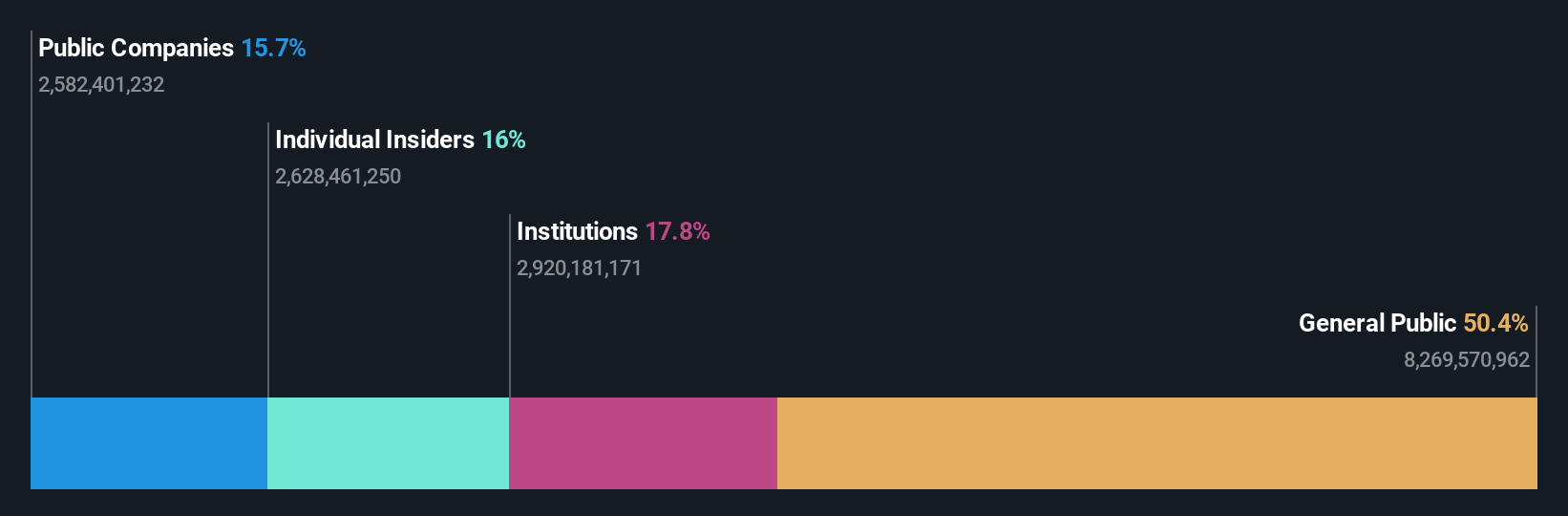

Insider Ownership: 16%

China Ruyi Holdings has shown substantial growth, with earnings rising significantly from a net loss to CNY 1,235.1 million for the half year ending June 2025. Despite recent shareholder dilution via a HKD 3.9 billion equity offering, the company is trading below fair value estimates and is expected to outpace market profit growth at 25.5% annually. However, its return on equity forecast remains low at 11.9%, and insider activity lacks recent significant buying or selling trends.

- Delve into the full analysis future growth report here for a deeper understanding of China Ruyi Holdings.

- Our valuation report here indicates China Ruyi Holdings may be undervalued.

MIXUE Group (SEHK:2097)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MIXUE Group operates in the production and sale of fruit drinks, tea drinks, ice cream, and coffee products both in Mainland China and internationally, with a market cap of HK$156.02 billion.

Operations: The company's revenue is primarily derived from franchise and related services (CN¥707.31 million), sales of goods (CN¥27.37 billion), and sales of equipment (CN¥949.98 million).

Insider Ownership: 28.8%

MIXUE Group's revenue is projected to grow at 13.9% annually, surpassing the Hong Kong market average of 8.6%, while earnings are expected to increase by 14.58% per year, outpacing the market's 12.3%. The company was recently added to the S&P Global BMI Index, highlighting its growing prominence. Despite no recent significant insider trading activity, MIXUE’s forecasted return on equity remains robust at 24%, indicating strong potential for sustained growth.

- Click here and access our complete growth analysis report to understand the dynamics of MIXUE Group.

- Our valuation report unveils the possibility MIXUE Group's shares may be trading at a premium.

Shenzhen Dobot (SEHK:2432)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dobot Corp Ltd is an investment holding company that designs, develops, manufactures, commercializes, and sells robots across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$21.82 billion.

Operations: The company's revenue primarily comes from its Industrial Automation & Controls segment, generating CN¥406.30 million.

Insider Ownership: 19.6%

Shenzhen Dobot's revenue is forecast to grow at 32.1% annually, significantly outpacing the Hong Kong market average of 8.6%. Despite reporting a net loss of CNY 40.87 million for the first half of 2025, this represents an improvement from the previous year's loss. The company is expected to become profitable within three years, with earnings projected to grow by 86.92% annually. Recent amendments to its Articles of Association could impact future governance and operations.

- Dive into the specifics of Shenzhen Dobot here with our thorough growth forecast report.

- According our valuation report, there's an indication that Shenzhen Dobot's share price might be on the expensive side.

Turning Ideas Into Actions

- Click this link to deep-dive into the 619 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Solid track record and good value.

Market Insights

Community Narratives