As global markets react to the evolving policy landscape under the new Trump administration, with significant movements across sectors like financials and energy, investors are closely watching how these changes impact corporate earnings and market sentiment. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that can adapt to regulatory shifts and leverage technological advancements to maintain robust growth trajectories.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1297 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

SK bioscienceLtd (KOSE:A302440)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SK bioscience Co., Ltd. focuses on the research, development, production, and distribution of vaccines and biopharmaceuticals both in Korea and internationally, with a market cap of ₩3.89 trillion.

Operations: SK bioscience generates revenue primarily through the sale of vaccines and biopharmaceutical products. The company is involved in both domestic and international markets, focusing on research, development, production, and distribution activities within these sectors.

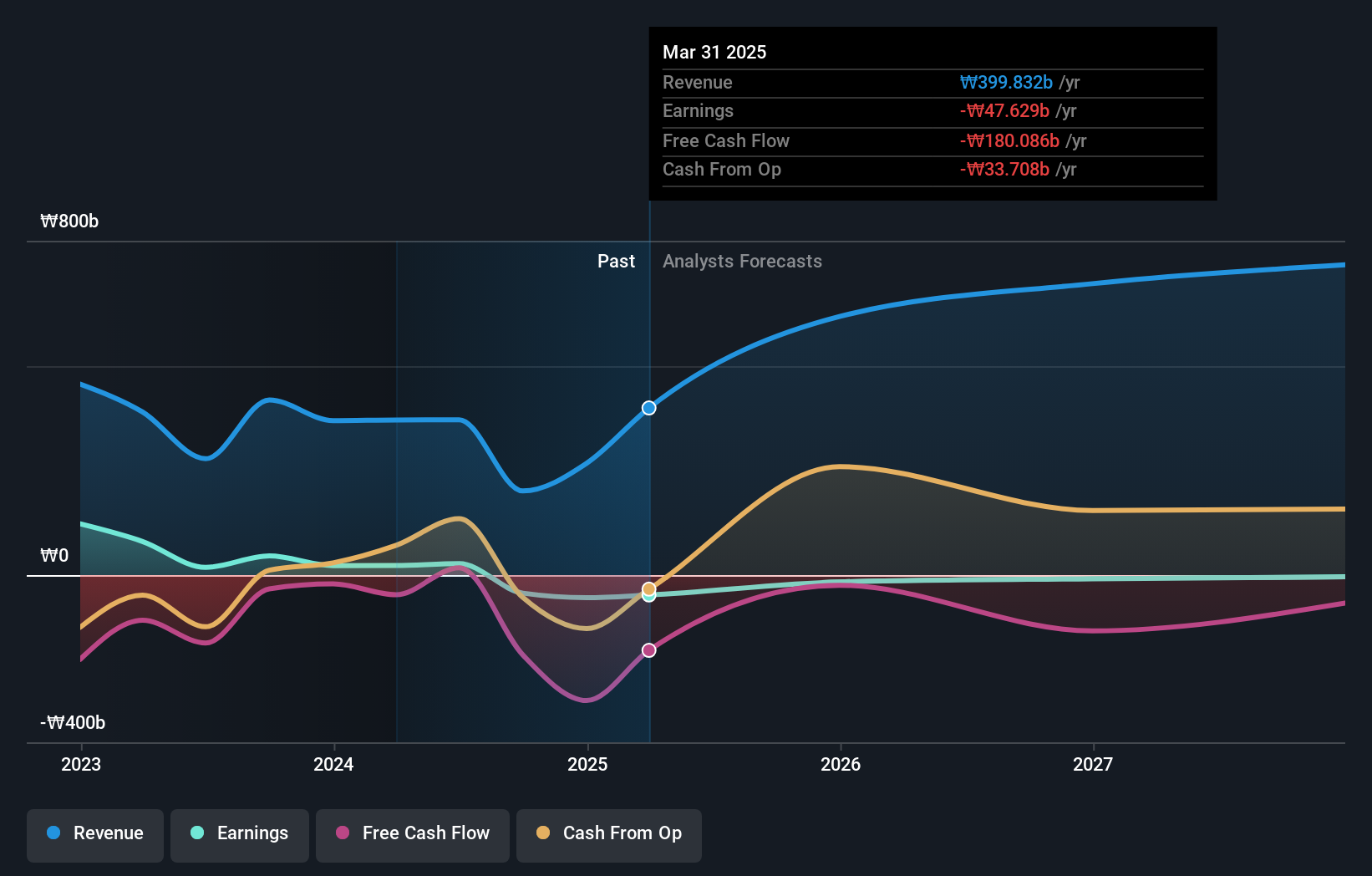

SK bioscience, amid challenging market conditions, is navigating with promising forecasts and strategic approvals. The company's revenue is expected to surge by 22.2% annually, outpacing the KR market's growth of 9.5%. This growth trajectory is bolstered by the recent approval in Indonesia for SKYCellflu, a significant advancement as it represents the world’s first quadrivalent cell-cultured influenza vaccine. Furthermore, earnings are projected to grow at an impressive rate of 70.9% per year. Despite current unprofitability and shareholder dilution over the past year, these developments could position SK bioscience favorably in high-demand markets, especially given its pioneering status in cell-cultured vaccine technology which offers faster production times and potentially more effective responses to pandemics compared to traditional methods.

- Unlock comprehensive insights into our analysis of SK bioscienceLtd stock in this health report.

Understand SK bioscienceLtd's track record by examining our Past report.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that creates products to enhance digitalization in the beauty industry through image, video, and design solutions in China and globally, with a market cap of approximately HK$14.88 billion.

Operations: The company generates revenue primarily from its Internet Business segment, which contributed CN¥3.06 billion. The focus is on developing solutions that facilitate the digital transformation of the beauty industry through innovative image, video, and design tools.

Meitu's recent financial performance reflects a robust uptick in sales, escalating from CNY 1.26 billion to CNY 1.62 billion year-over-year, alongside an increase in net income from CNY 227.63 million to CNY 303.43 million. This growth is underpinned by a significant R&D commitment, crucial for sustaining innovation and competitiveness in the fast-evolving tech landscape. Despite challenges such as a notable insider selling over the past quarter and a dip in profit margins from 24.8% to 14.9%, Meitu's projected revenue and earnings growth rates of 22.1% and 31.6% respectively outpace those of its Hong Kong market counterparts significantly, suggesting potential for future scalability and market penetration. The company's investment in R&D not only fuels its product enhancements but also strategically positions it within the technology sector where continuous innovation is key to retaining competitive edge and customer interest—a vital aspect given the industry’s swift pace of change. While current profitability metrics may present concerns, Meitu’s aggressive growth forecasts indicate a proactive approach toward capturing market share and refining its offerings, potentially leading to improved financial health over time.

- Click here and access our complete health analysis report to understand the dynamics of Meitu.

Examine Meitu's past performance report to understand how it has performed in the past.

Mobvista (SEHK:1860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mobvista Inc. provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market cap of HK$12.65 billion.

Operations: The company operates in the advertising and marketing technology sector, offering solutions that facilitate the growth of the mobile internet ecosystem on a global scale. Its business model focuses on leveraging advanced technology to deliver targeted advertising services to clients worldwide.

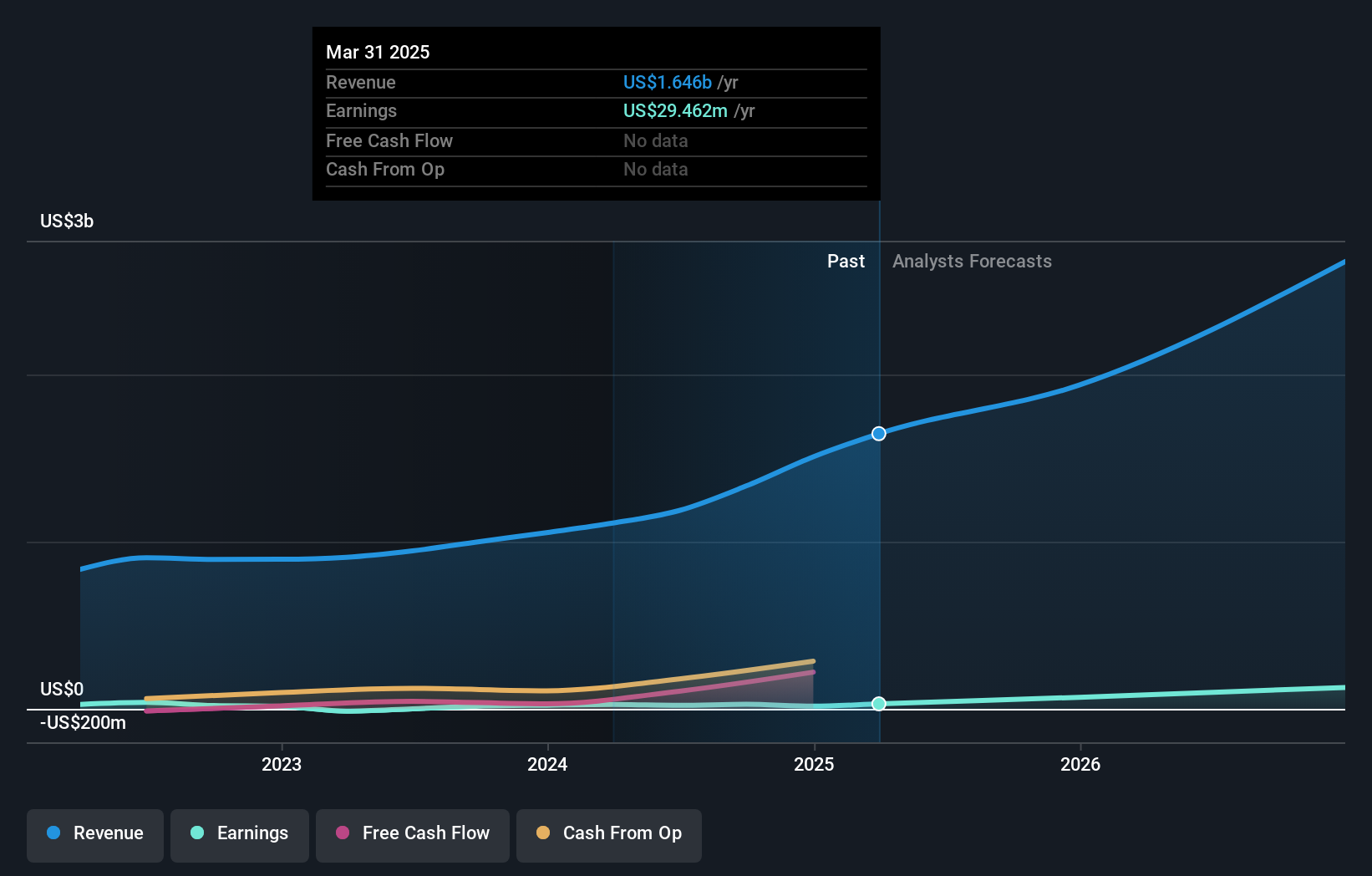

Mobvista's recent financial surge, with third-quarter sales jumping to USD 416.46 million from USD 269.37 million year-over-year, underscores its robust position in the tech sector. This growth is complemented by a net income increase to USD 9.9 million from USD 3.78 million, reflecting a strategic emphasis on scalable operations and market responsiveness. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining competitive advantage in a rapidly evolving industry landscape. With revenue growth expected at an impressive rate of 21.7% annually, outpacing the Hong Kong market average of 7.8%, and profit projections soaring by 67% per year, Mobvista is poised to capitalize on emerging tech trends while enhancing its product offerings and customer reach.

- Dive into the specifics of Mobvista here with our thorough health report.

Gain insights into Mobvista's historical performance by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 1297 High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1860

Mobvista

Engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

High growth potential with proven track record.