- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

High Growth Tech Stocks in Asia to Watch

Reviewed by Simply Wall St

As global markets face challenges with U.S. inflation easing but trade policy uncertainties weighing on sentiment, Asian tech stocks continue to capture attention amid economic shifts and stimulus hopes in China. In this environment, identifying high growth potential involves focusing on companies that demonstrate resilience and adaptability to changing market dynamics, particularly those positioned to benefit from technological advancements and increased consumption trends in the region.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Zhongji Innolight | 28.47% | 28.82% | ★★★★★★ |

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that creates products to enhance image, video, and design production with beauty-related solutions for digitalization in China and globally, with a market cap of HK$28.58 billion.

Operations: The company generates revenue primarily through its Internet Business segment, which reported earnings of CN¥3.06 billion. It focuses on developing digital solutions that facilitate image, video, and design production across China and international markets.

Meitu, a tech firm in Asia, has demonstrated robust financial growth with a significant increase in annual revenue and earnings. In 2024, the company's sales surged to CNY 3.34 billion from CNY 2.70 billion the previous year, while net income more than doubled to CNY 805.18 million. This performance is underscored by an aggressive R&D investment strategy that bolsters its competitive edge in mobile technology and image processing software sectors—industries poised for substantial expansion as digital media consumption escalates globally. Moreover, Meitu's recent decision to increase its dividend payout reflects confidence in sustained profitability and cash flow generation, aligning with shareholder interests amidst volatile market conditions.

- Dive into the specifics of Meitu here with our thorough health report.

Review our historical performance report to gain insights into Meitu's's past performance.

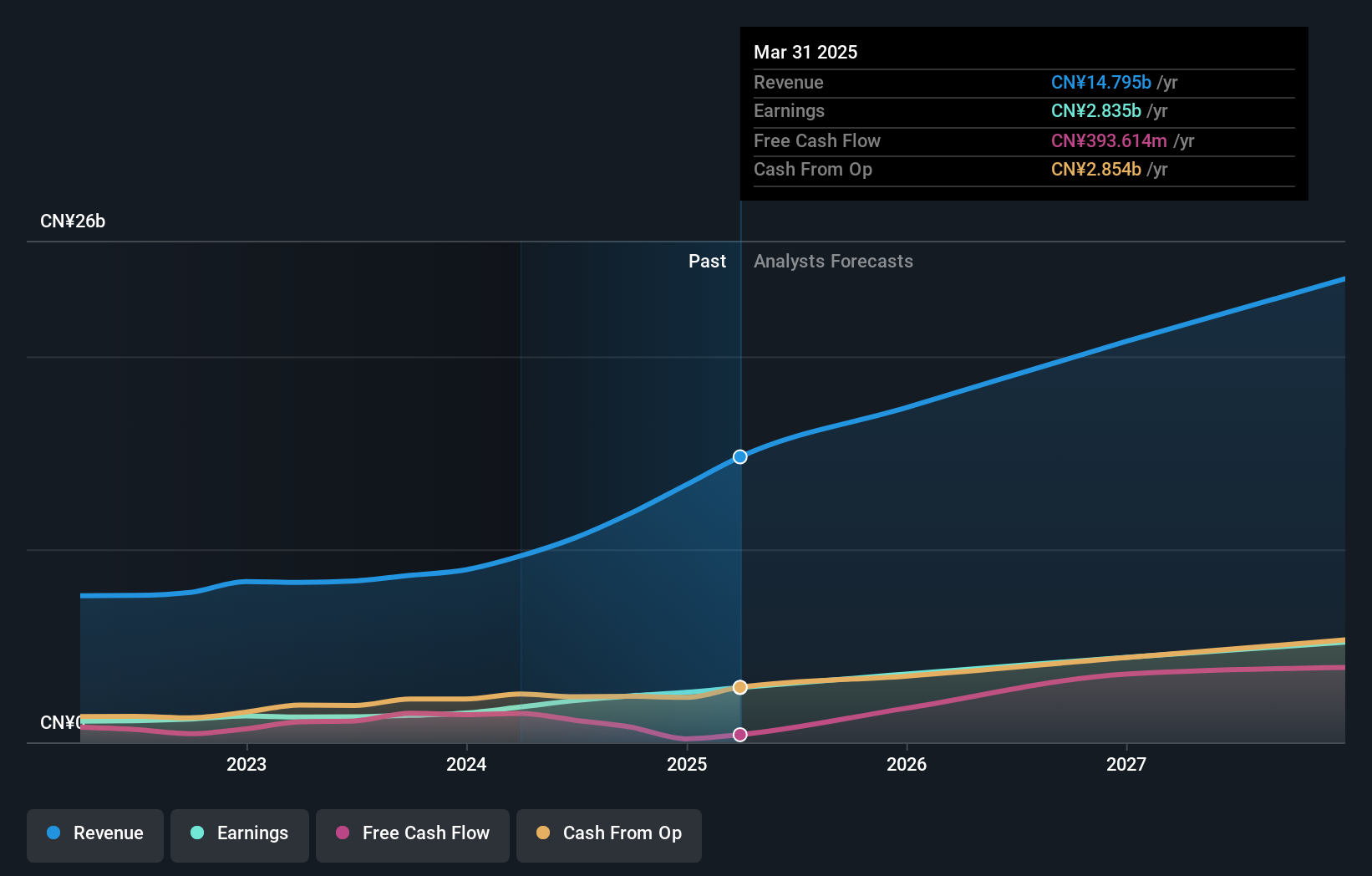

Wus Printed Circuit (Kunshan) (SZSE:002463)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. specializes in the research, development, design, manufacture, and sale of printed circuit boards in China with a market capitalization of CN¥70.41 billion.

Operations: Wus Printed Circuit (Kunshan) focuses on the production and sale of printed circuit boards in China. The company operates within a market capitalization of CN¥70.41 billion, reflecting its significant presence in the industry.

Wus Printed Circuit (Kunshan) has shown a remarkable financial trajectory, with its sales escalating to CNY 13.34 billion in 2024 from CNY 8.94 billion the previous year, marking a significant growth of over 49%. This surge is complemented by a robust increase in net income, which more than doubled to CNY 2.59 billion. The company's commitment to innovation is evident from its aggressive R&D investments, positioning it well within the rapidly evolving tech landscape of Asia. With earnings per share also seeing substantial growth from CNY 0.7944 to CNY 1.3516, Wus Printed Circuit stands out for its ability to scale operations and maintain profitability amidst competitive market dynamics.

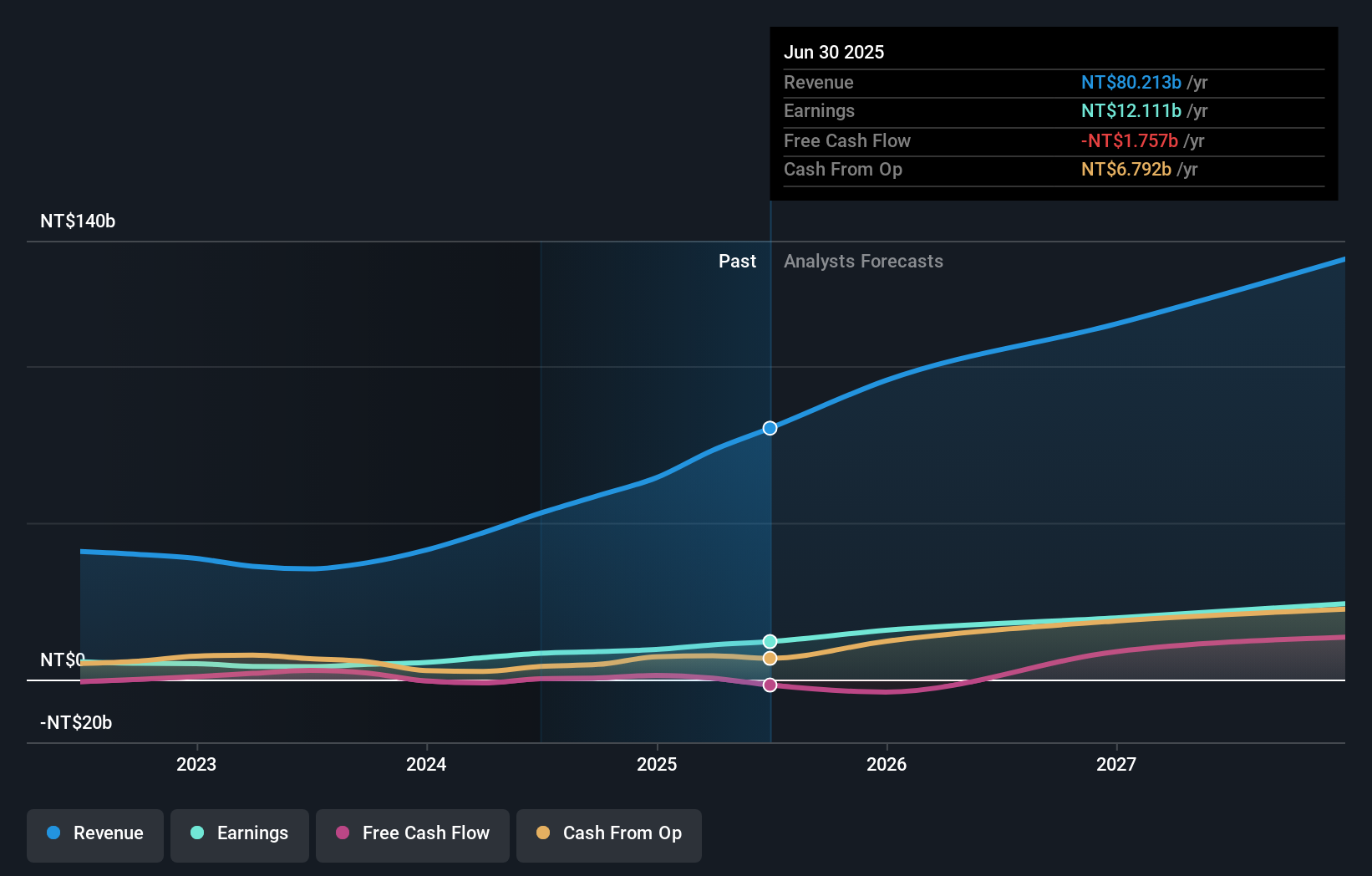

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elite Material Co., Ltd. specializes in manufacturing and selling copper clad laminates, electronic-industrial specialty chemicals, raw materials, and electronic components across Taiwan, China, and global markets with a market cap of NT$210.06 billion.

Operations: The company generates revenue primarily from its foreign departments, contributing NT$60.57 billion, while domestic operations add NT$15.47 billion.

Elite Material Co., Ltd. has demonstrated robust financial growth, with its revenues soaring to TWD 64.38 billion in 2024 from TWD 41.30 billion the previous year, reflecting a significant increase of approximately 56%. This surge is supported by an impressive rise in net income, which nearly doubled to TWD 9.58 billion. The company's aggressive approach to R&D is evident as it continues to invest heavily in innovation, positioning itself strongly within Asia's competitive tech landscape. Moreover, Elite Material's recent earnings announcement was complemented by a generous dividend increase to TWD 17 per share, underscoring its commitment to shareholder returns amidst its expansion strategies.

- Get an in-depth perspective on Elite Material's performance by reading our health report here.

Gain insights into Elite Material's historical performance by reviewing our past performance report.

Taking Advantage

- Embark on your investment journey to our 516 Asian High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Very undervalued with high growth potential.