- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

Asian Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, the Asian market remains a focal point for investors seeking growth opportunities. In this environment, companies in Asia with high insider ownership often stand out as they may indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.1% |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We'll examine a selection from our screener results.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that develops and provides photo, video, and design products along with AI-powered solutions in Mainland China and internationally, with a market cap of HK$38.72 billion.

Operations: The company's revenue primarily comes from its Internet Business segment, which generated CN¥3.54 billion.

Insider Ownership: 22.7%

Meitu's inclusion in the FTSE All-World Index highlights its growing prominence. Despite recent insider selling, the stock remains undervalued, trading 41.6% below estimated fair value. Analysts forecast robust revenue growth of 20.3% per year, outpacing the Hong Kong market's average. Earnings are expected to grow significantly at 21.6% annually over three years, although return on equity is projected to be relatively low. Recent dividend affirmations further bolster investor confidence in Meitu's financial health and growth prospects.

- Get an in-depth perspective on Meitu's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Meitu implies its share price may be lower than expected.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of HK$76.74 billion.

Operations: Smoore International Holdings Limited generates revenue from its vaping technology solutions.

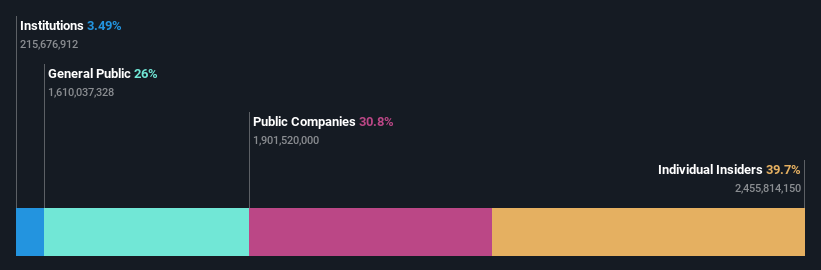

Insider Ownership: 39.7%

Smoore International Holdings' earnings are forecast to grow significantly at 37.6% annually, surpassing the Hong Kong market's average. Despite a decline in net income, recent sales growth to CNY 4.20 billion for Q3 signals potential recovery. The stock trades at a substantial discount of 41.1% below its estimated fair value, though return on equity is projected to remain low at 9.2%. Revenue is expected to grow moderately faster than the market average but below high-growth thresholds.

- Delve into the full analysis future growth report here for a deeper understanding of Smoore International Holdings.

- Our expertly prepared valuation report Smoore International Holdings implies its share price may be too high.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a company that manufactures, processes, and sells laptop computers and telecommunication products globally, with a market cap of NT$1.06 trillion.

Operations: The company's revenue primarily comes from The Electronics Sector, which generated NT$3.90 billion.

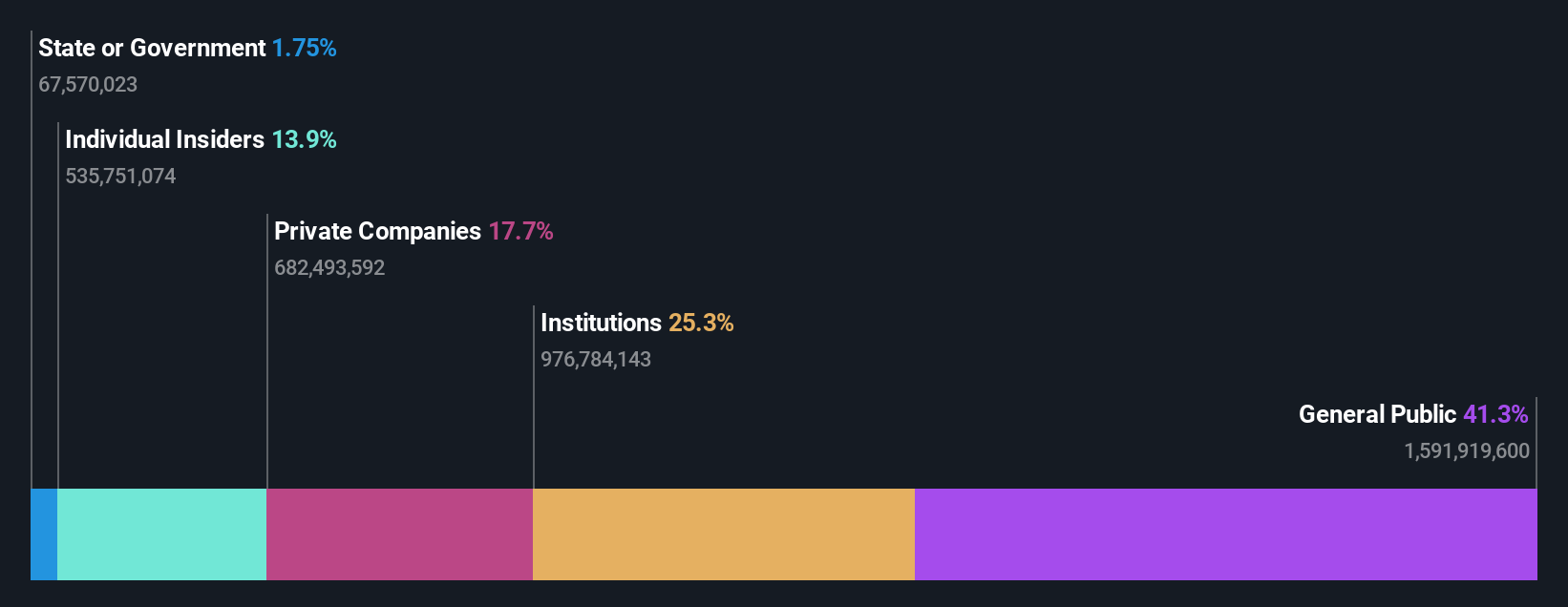

Insider Ownership: 13.9%

Quanta Computer's revenue is projected to grow at 27.1% annually, outpacing the Taiwan market average of 13.1%. Recent Q3 sales reached TWD 495.26 billion, showing robust growth from last year, though net income slightly declined to TWD 16.43 billion. Despite slower earnings growth forecasts compared to the market, Quanta's price-to-earnings ratio of 15.4x offers good value relative to peers and industry averages, with analysts expecting a potential stock price increase of 27.3%.

- Click here and access our complete growth analysis report to understand the dynamics of Quanta Computer.

- The analysis detailed in our Quanta Computer valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click through to start exploring the rest of the 631 Fast Growing Asian Companies With High Insider Ownership now.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1357

Meitu

An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.