Market Might Still Lack Some Conviction On Bright Future Technology Holdings Limited (HKG:1351) Even After 37% Share Price Boost

Despite an already strong run, Bright Future Technology Holdings Limited (HKG:1351) shares have been powering on, with a gain of 37% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

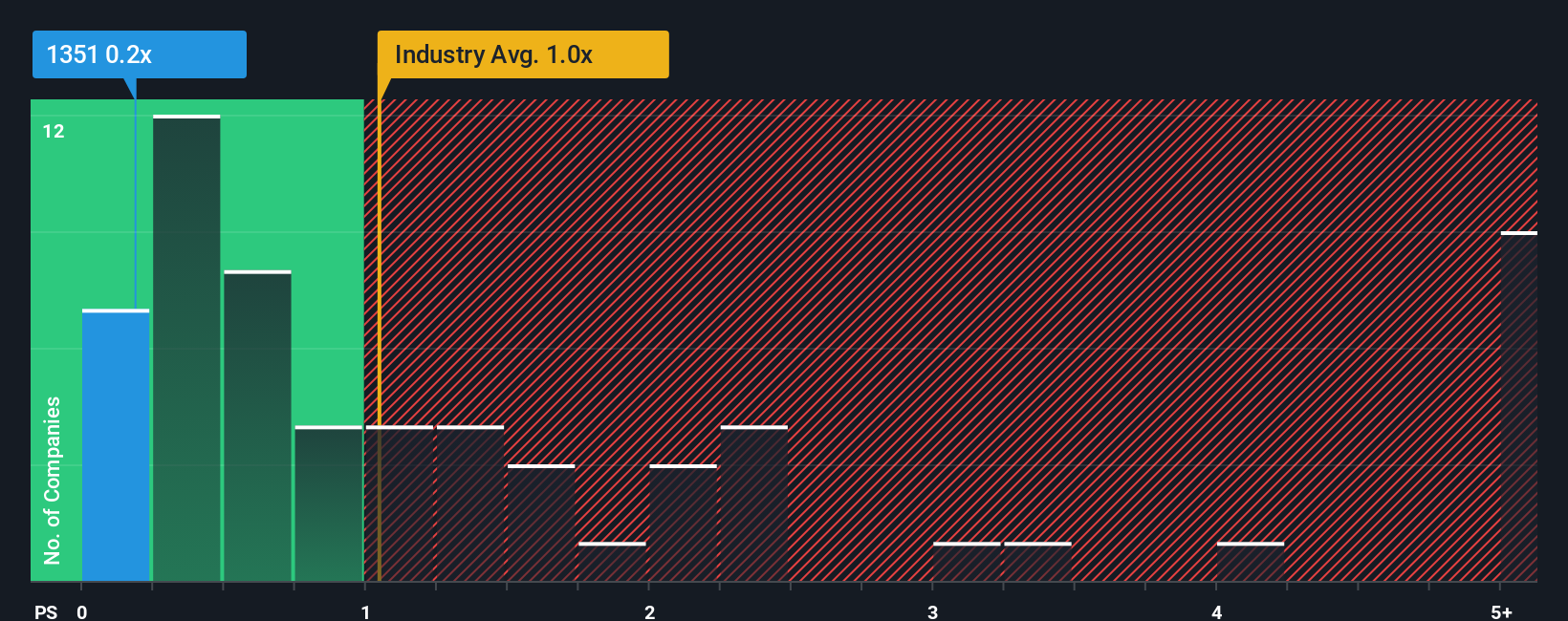

Even after such a large jump in price, given about half the companies operating in Hong Kong's Media industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Bright Future Technology Holdings as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Bright Future Technology Holdings

How Bright Future Technology Holdings Has Been Performing

Revenue has risen firmly for Bright Future Technology Holdings recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Bright Future Technology Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bright Future Technology Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Bright Future Technology Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow revenue by 113% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Bright Future Technology Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Despite Bright Future Technology Holdings' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Bright Future Technology Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Bright Future Technology Holdings you should be aware of, and 2 of them are a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bright Future Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1351

Bright Future Technology Holdings

An investment holding company, together with its subsidiaries, engages in the provision of intelligent marketing solutions in the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.