- Hong Kong

- /

- Entertainment

- /

- SEHK:1119

The Co-founder of iDreamSky Technology Holdings Limited (HKG:1119), Xiangyu Chen, Just Bought A Few More Shares

Investors who take an interest in iDreamSky Technology Holdings Limited (HKG:1119) should definitely note that the Co-founder, Xiangyu Chen, recently paid HK$4.40 per share to buy HK$1.3m worth of the stock. However, it only increased shareholding by a small percentage, and it wasn't a huge purchase by absolute value, either.

See our latest analysis for iDreamSky Technology Holdings

iDreamSky Technology Holdings Insider Transactions Over The Last Year

In fact, the recent purchase by Co-founder Xiangyu Chen was not their only acquisition of iDreamSky Technology Holdings shares this year. They previously made an even bigger purchase of HK$78m worth of shares at a price of HK$5.92 per share. That means that an insider was happy to buy shares at above the current price of HK$4.48. It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. Xiangyu Chen was the only individual insider to buy shares in the last twelve months.

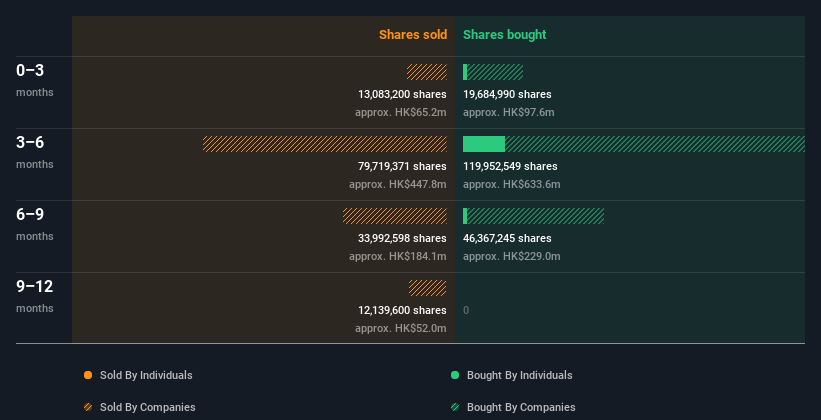

Xiangyu Chen purchased 16.73m shares over the year. The average price per share was HK$5.71. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

iDreamSky Technology Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. iDreamSky Technology Holdings insiders own 23% of the company, currently worth about HK$1.4b based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The iDreamSky Technology Holdings Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about iDreamSky Technology Holdings. That's what I like to see! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To assist with this, we've discovered 2 warning signs that you should run your eye over to get a better picture of iDreamSky Technology Holdings.

Of course iDreamSky Technology Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if iDreamSky Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1119

iDreamSky Technology Holdings

An investment holding company, operates a digital entertainment platform that publishes games through mobile apps and websites in the People’s Republic of China.

Mediocre balance sheet very low.

Similar Companies

Market Insights

Community Narratives