- Japan

- /

- Professional Services

- /

- TSE:2492

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of a changing political landscape and economic indicators show mixed signals, investors are keeping a close eye on the high-growth tech sector. In such an environment, identifying stocks with strong innovation potential and resilience to policy shifts can be crucial for those interested in this dynamic market segment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1297 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally and has a market capitalization of SEK10.52 billion.

Operations: The company generates revenue primarily through its Pediatrics segment, contributing SEK1.04 billion, followed by the Adult Health segment with SEK306.08 million.

BioGaia's recent financial performance highlights both challenges and opportunities within the high-growth tech sector. Despite a downturn in net income from SEK 101.5 million to SEK 36.6 million in Q3 and a decrease in quarterly sales, the company's annual revenue growth forecast at 11.1% outpaces the Swedish market's nearly stagnant growth rate. Moreover, BioGaia is set to grow earnings by 16.6% annually, surpassing broader market expectations of 15.2%. This juxtaposition of short-term setbacks against robust growth forecasts suggests resilience and potential for recovery, underscored by significant R&D investments aimed at fostering innovation and maintaining competitive edge in biotechnology—a sector where continuous research is crucial for advancement.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Pictures Group Limited is an investment holding company involved in content, technology, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market capitalization of HK$14.11 billion.

Operations: Alibaba Pictures generates revenue through various segments, including Film Investment, Production, Promotion and Distribution (CN¥2.07 billion), IP Merchandising and Commercialization (CN¥1.05 billion), and Film Ticketing and Technology Platform (CN¥920.22 million). The company focuses on leveraging its content creation capabilities alongside technology-driven platforms to enhance its market presence in the entertainment industry across Hong Kong and the People's Republic of China.

Alibaba Pictures Group, navigating through a dynamic entertainment landscape, reported a revenue increase to CNY 3.05 billion for the half-year ended September 2024, up from CNY 2.62 billion in the previous year. This growth is coupled with an earnings forecast promising a substantial annual increase of 35.5%. Despite a dip in net income to CNY 336.6 million from CNY 463.79 million, the company's commitment to innovation is evident with significant R&D investments accounting for {rd_expense_string} of total expenses—crucial for sustaining its competitive edge and capitalizing on emerging market trends.

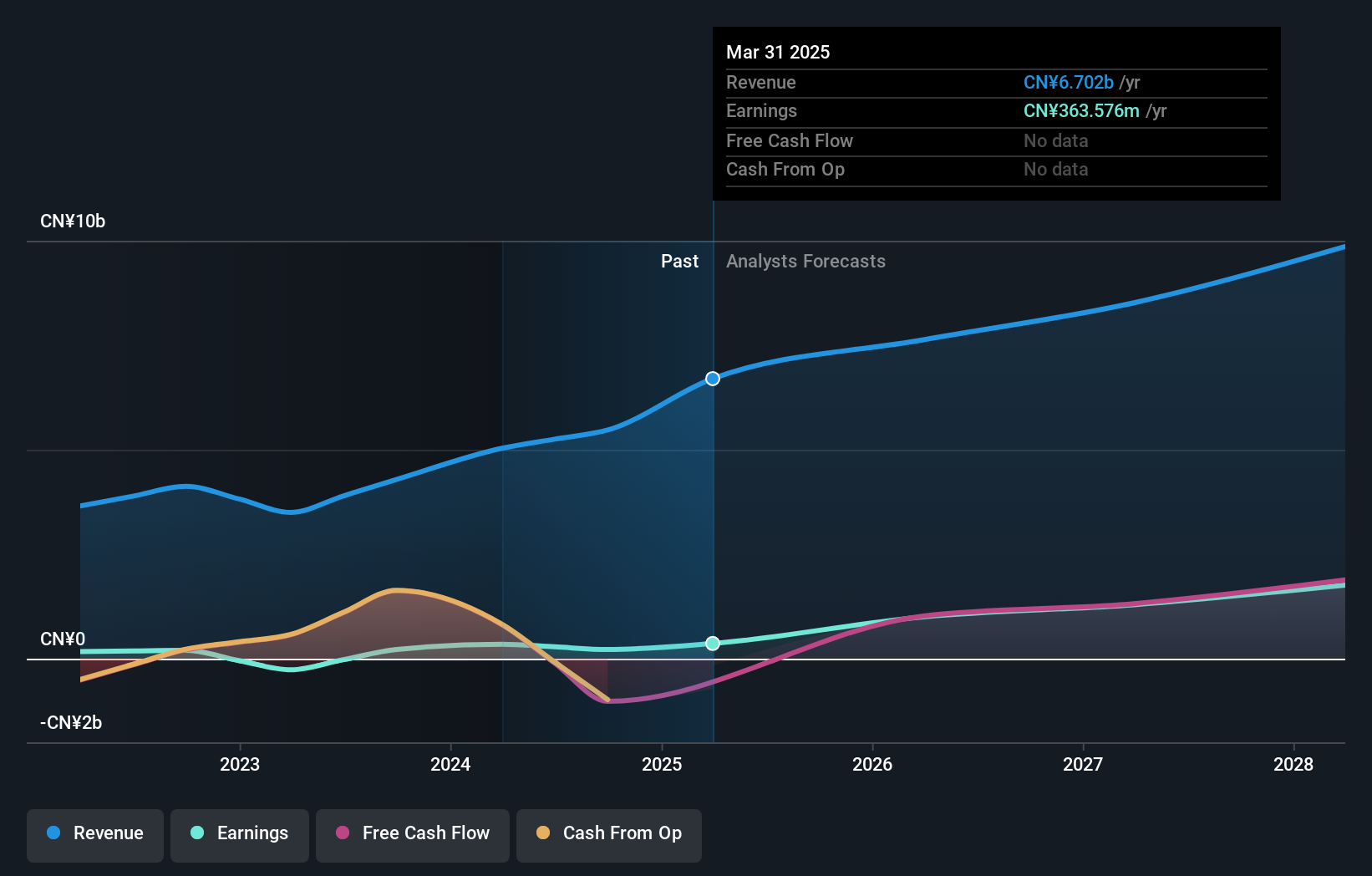

Infomart (TSE:2492)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomart Corporation operates an online BtoB e-commerce trading platform for the food industry in Japan, with a market capitalization of ¥64.04 billion.

Operations: The company's revenue streams are primarily derived from its B2B-PFES segment, generating ¥5.62 billion, and the B to B-PF FOOD segment, contributing ¥9.27 billion.

Infomart's strategic focus on R&D, accounting for 11.4% of its total expenses, underscores its commitment to innovation amidst a competitive tech landscape. This investment is pivotal as the company's earnings are projected to surge by 41.2% annually, outpacing the broader Japanese market's growth. Recent corporate guidance also reflects a positive trajectory with expected net sales reaching ¥16 billion and an operating profit of ¥1 billion for FY2024, alongside an increased dividend forecast, signaling robust financial health and shareholder confidence.

- Click to explore a detailed breakdown of our findings in Infomart's health report.

Gain insights into Infomart's historical performance by reviewing our past performance report.

Key Takeaways

- Dive into all 1297 of the High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2492

Infomart

Operates an online business-to-business (BtoB) electronic commerce platform in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives