- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

3 High Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets continue to reach new heights, with indices like the Dow Jones Industrial Average and S&P 500 Index hitting record intraday highs, investors are keenly observing the impact of geopolitical factors such as proposed tariffs and domestic policy changes. In this environment of heightened market activity and economic shifts, identifying growth companies with significant insider ownership can be a strategic move for investors looking to align with management teams that have a vested interest in their company's success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

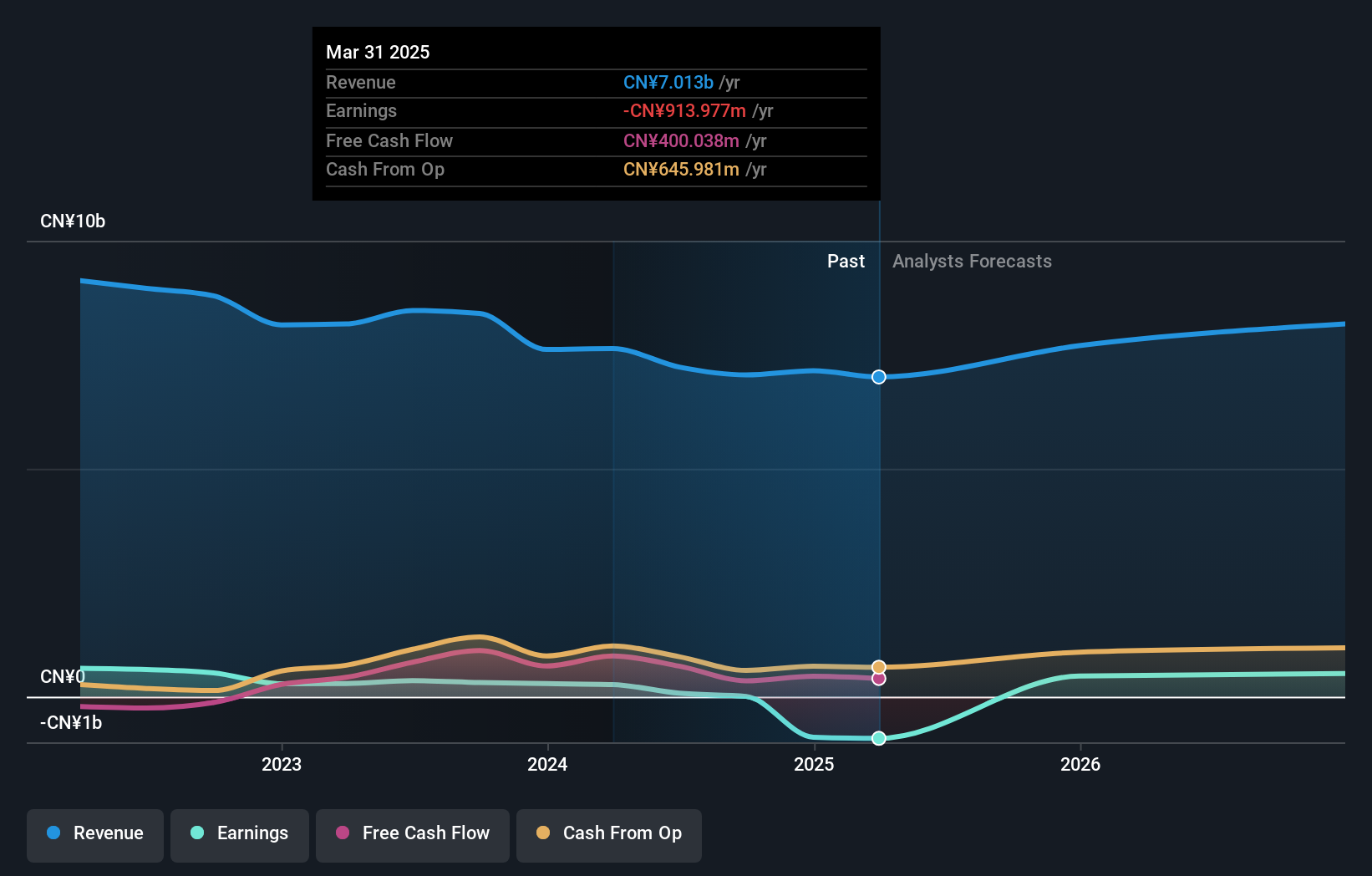

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of approximately HK$209.20 billion.

Operations: The company's revenue segments include Domestic at CN¥119.83 billion and Overseas at CN¥4.25 billion.

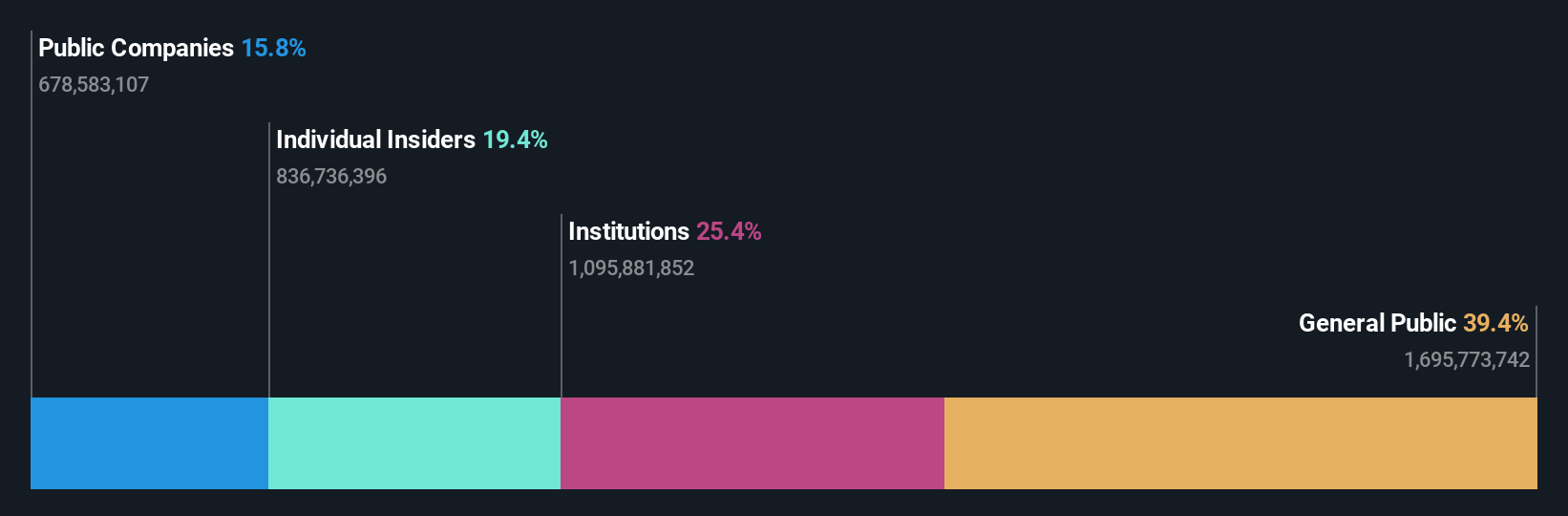

Insider Ownership: 19.5%

Earnings Growth Forecast: 17.3% p.a.

Kuaishou Technology demonstrates strong growth potential with earnings forecasted to grow at 17.3% annually, outpacing the Hong Kong market's average. Recent financial results show robust performance, with third-quarter sales reaching CNY 31.13 billion and net income climbing to CNY 3.27 billion. Despite substantial past profit growth, current insider trading activity is minimal over the last three months. The stock trades at a significant discount relative to its estimated fair value and peers in the industry.

- Click to explore a detailed breakdown of our findings in Kuaishou Technology's earnings growth report.

- In light of our recent valuation report, it seems possible that Kuaishou Technology is trading behind its estimated value.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. operates in the healthcare technology sector and has a market cap of approximately CN¥17.28 billion.

Operations: Revenue segments for the group include healthcare software solutions at CN¥1.45 billion, medical device sales totaling CN¥2.30 billion, and consulting services generating CN¥0.75 billion.

Insider Ownership: 22.7%

Earnings Growth Forecast: 34.9% p.a.

Winning Health Technology Group exhibits promising growth prospects, with earnings forecasted to grow significantly at 34.9% annually, surpassing the China market average. The company recently completed a share buyback program worth CNY 79.99 million, which may indicate confidence in its future performance. Despite large one-off items affecting earnings quality and a relatively low return on equity forecast of 10.2%, its price-to-earnings ratio remains attractive compared to industry peers.

- Click here and access our complete growth analysis report to understand the dynamics of Winning Health Technology Group.

- Insights from our recent valuation report point to the potential overvaluation of Winning Health Technology Group shares in the market.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥14.64 billion.

Operations: Revenue segments for the company include display products generating CN¥7.82 billion, landscape lighting contributing CN¥2.34 billion, and virtual reality technology bringing in CN¥1.56 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 90.5% p.a.

Leyard Optoelectronic is poised for significant earnings growth, forecasted at 90.5% annually, well above the China market average. Despite a decline in net income to CNY 181.38 million and lower profit margins this year, the company trades at a good value relative to peers. Recent share buybacks totaling CNY 22.4 million suggest management's confidence in future prospects, although large one-off items have impacted financial results and return on equity remains modest at 10.5%.

- Click here to discover the nuances of Leyard Optoelectronic with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Leyard Optoelectronic is priced lower than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 1514 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.