- Hong Kong

- /

- Entertainment

- /

- SEHK:1022

Spotlight On 3 Penny Stocks With Market Caps Over US$40M

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while others such as the Russell 2000 experience declines, investors are paying close attention to growth opportunities in various sectors. Penny stocks, though often overlooked due to their historical association with volatility, remain an intriguing area for those seeking potential value in smaller or newer companies. When backed by strong financials, these stocks can offer a blend of growth and stability that larger firms might not provide.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £808.16M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £159.32M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Feiyu Technology International (SEHK:1022)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Feiyu Technology International Company Ltd. is an investment holding company focused on developing and operating various games in Mainland China, with a market cap of HK$365.63 million.

Operations: The company generates revenue from the provision of online game services, amounting to CN¥220.04 million.

Market Cap: HK$365.63M

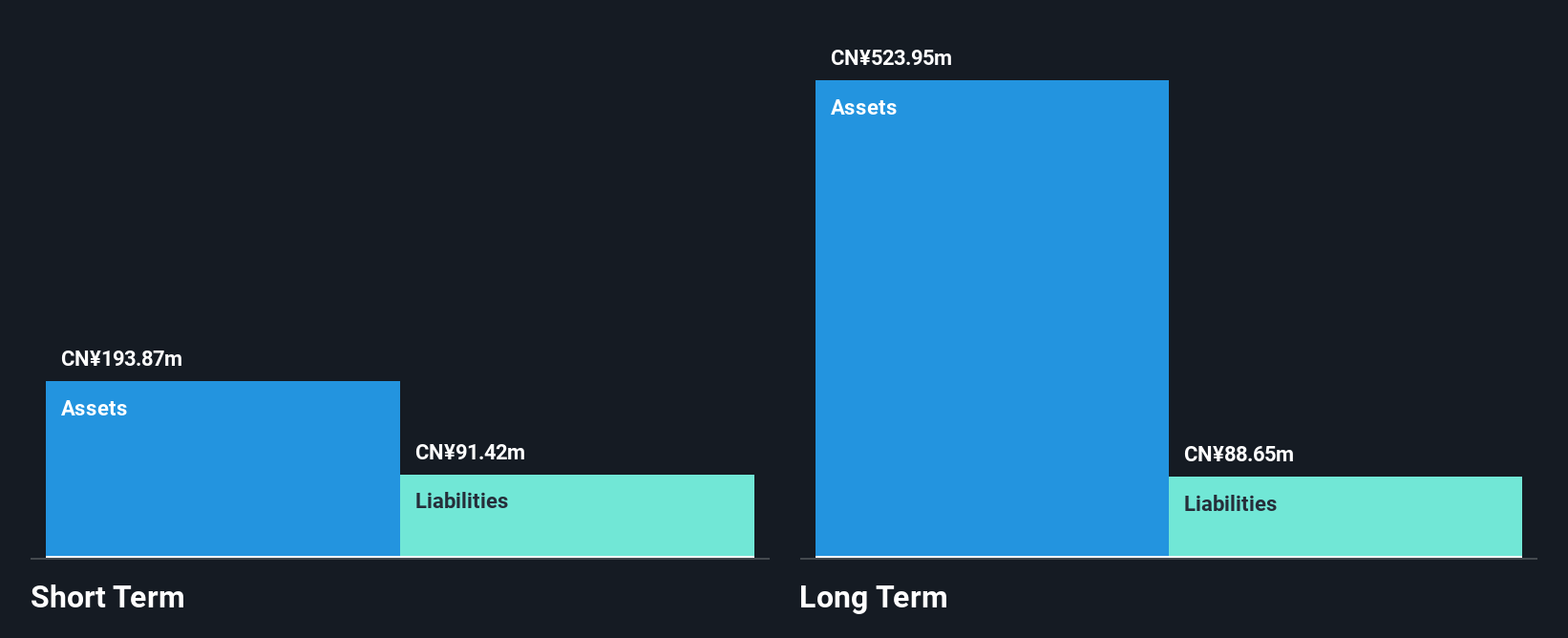

Feiyu Technology International, with a market cap of HK$365.63 million, generates CN¥220.04 million in revenue from online game services in Mainland China. The seasoned management and board bring stability, though the company faces challenges with negative earnings growth of -49.5% over the past year and declining profit margins from 9% to 4.6%. While short-term assets cover both short and long-term liabilities, debt is not well-covered by operating cash flow at 17%. Despite a volatile share price recently, Feiyu maintains more cash than total debt and has avoided shareholder dilution over the past year.

- Click here to discover the nuances of Feiyu Technology International with our detailed analytical financial health report.

- Evaluate Feiyu Technology International's historical performance by accessing our past performance report.

Cosmo Lady (China) Holdings (SEHK:2298)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cosmo Lady (China) Holdings Company Limited is an investment holding company involved in the design, research, development, and sale of branded intimate wear products in China, with a market capitalization of HK$577.53 million.

Operations: The company generates its revenue primarily from the People's Republic of China, amounting to CN¥2.90 billion.

Market Cap: HK$577.53M

Cosmo Lady (China) Holdings, with a market cap of HK$577.53 million, primarily generates revenue of CN¥2.90 billion from China. The company has seen impressive earnings growth of 101.4% over the past year, outpacing the luxury industry significantly. Despite low return on equity at 4.7%, its price-to-earnings ratio is favorable at 5.5x compared to the Hong Kong market average of 10.1x, suggesting potential undervaluation for investors seeking value opportunities in penny stocks. Additionally, Cosmo Lady's financial position is strong with more cash than total debt and operating cash flow well covering its debt obligations by 51.7%.

- Dive into the specifics of Cosmo Lady (China) Holdings here with our thorough balance sheet health report.

- Learn about Cosmo Lady (China) Holdings' future growth trajectory here.

Ajisen (China) Holdings (SEHK:538)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ajisen (China) Holdings Limited operates a chain of fast casual restaurants in the People’s Republic of China and Hong Kong, with a market cap of HK$905.98 million.

Operations: The company's revenue is primarily derived from its restaurant operations in Mainland China (CN¥1.49 billion), followed by the manufacture and sales of noodles and related products (CN¥681.62 million), and its restaurant operations in Hong Kong (CN¥192.77 million).

Market Cap: HK$905.98M

Ajisen (China) Holdings, with a market cap of HK$905.98 million, primarily derives revenue from its restaurant operations in Mainland China and noodle sales. The company faces challenges with declining earnings, down 27.8% annually over five years and negative growth last year. Despite this, it maintains a solid financial position with short-term assets exceeding liabilities and more cash than debt. However, its return on equity is low at 1.6%, and profit margins have decreased to 2.3% from 5.8%. The dividend yield of 10.31% isn't well supported by earnings, indicating potential sustainability concerns for income-focused investors.

- Get an in-depth perspective on Ajisen (China) Holdings' performance by reading our balance sheet health report here.

- Gain insights into Ajisen (China) Holdings' past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock more gems! Our Penny Stocks screener has unearthed 5,704 more companies for you to explore.Click here to unveil our expertly curated list of 5,707 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1022

Feiyu Technology International

An investment holding company, engages in the development and operation of various games in Mainland China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives