This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Clear Media Limited's (HKG:100), to help you decide if the stock is worth further research. Looking at earnings over the last twelve months, Clear Media has a P/E ratio of 32.53. That is equivalent to an earnings yield of about 3.1%.

See our latest analysis for Clear Media

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share (in the reporting currency) ÷ Earnings per Share (EPS)

Or for Clear Media:

P/E of 32.53 = CN¥5.202 ÷ CN¥0.160 (Based on the trailing twelve months to June 2019.)

(Note: the above calculation uses the share price in the reporting currency, namely CNY and the calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

Does Clear Media Have A Relatively High Or Low P/E For Its Industry?

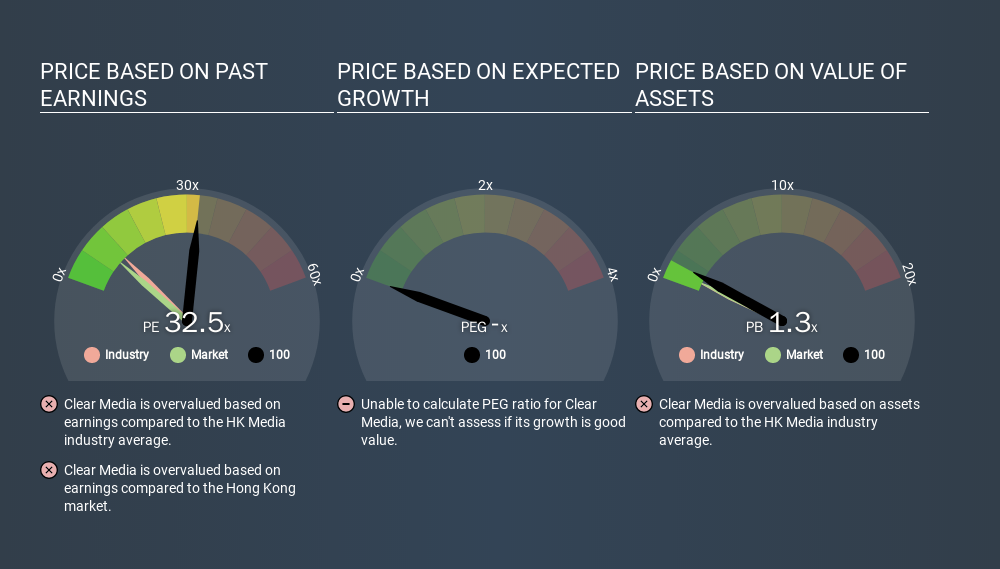

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. You can see in the image below that the average P/E (10.9) for companies in the media industry is lower than Clear Media's P/E.

Clear Media's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Clearly the market expects growth, but it isn't guaranteed. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Clear Media shrunk earnings per share by 65% over the last year. And EPS is down 12% a year, over the last 5 years. This could justify a pessimistic P/E.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Clear Media's P/E?

With net cash of CN¥536m, Clear Media has a very strong balance sheet, which may be important for its business. Having said that, at 19% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On Clear Media's P/E Ratio

Clear Media trades on a P/E ratio of 32.5, which is multiples above its market average of 9.1. The recent drop in earnings per share might keep value investors away, but the net cash position means the company has time to improve: and the high P/E suggests the market thinks it will.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives