- Hong Kong

- /

- Metals and Mining

- /

- SEHK:9936

Shareholders May Find It Hard To Justify Increasing Ximei Resources Holding Limited's (HKG:9936) CEO Compensation For Now

Key Insights

- Ximei Resources Holding to hold its Annual General Meeting on 28th of May

- CEO Lijue Wu's total compensation includes salary of CN¥924.0k

- The total compensation is similar to the average for the industry

- Over the past three years, Ximei Resources Holding's EPS grew by 0.5% and over the past three years, the total loss to shareholders 23%

In the past three years, the share price of Ximei Resources Holding Limited (HKG:9936) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 28th of May. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Ximei Resources Holding

Comparing Ximei Resources Holding Limited's CEO Compensation With The Industry

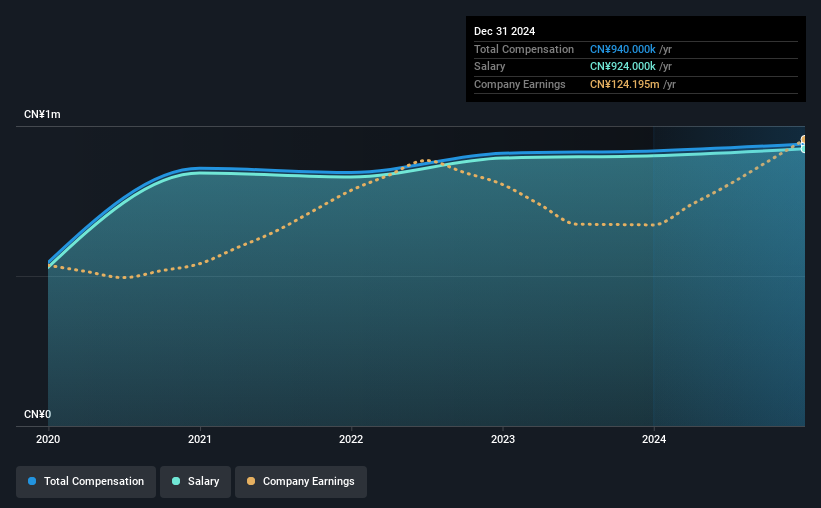

At the time of writing, our data shows that Ximei Resources Holding Limited has a market capitalization of HK$1.3b, and reported total annual CEO compensation of CN¥940k for the year to December 2024. That is, the compensation was roughly the same as last year. In particular, the salary of CN¥924.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Hong Kong Metals and Mining industry with market capitalizations between HK$783m and HK$3.1b, we discovered that the median CEO total compensation of that group was CN¥938k. So it looks like Ximei Resources Holding compensates Lijue Wu in line with the median for the industry. Moreover, Lijue Wu also holds HK$744m worth of Ximei Resources Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥924k | CN¥901k | 98% |

| Other | CN¥16k | CN¥16k | 2% |

| Total Compensation | CN¥940k | CN¥917k | 100% |

On an industry level, roughly 83% of total compensation represents salary and 17% is other remuneration. Investors will find it interesting that Ximei Resources Holding pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ximei Resources Holding Limited's Growth Numbers

Over the last three years, Ximei Resources Holding Limited has not seen its earnings per share change much, though there is a slight positive movement. Its revenue is up 30% over the last year.

It's great to see that revenue growth is strong. And in that context, the modest EPS improvement certainly isn't shabby. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Ximei Resources Holding Limited Been A Good Investment?

Since shareholders would have lost about 23% over three years, some Ximei Resources Holding Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Lijue receives almost all of their compensation through a salary. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

Shareholders may want to check for free if Ximei Resources Holding insiders are buying or selling shares.

Important note: Ximei Resources Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9936

Ximei Resources Holding

Produces and sells tantalum and niobium based metallurgical products in the People's Republic of China, the United States, Canada, United Kingdom, European Union, Asia, and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.