There's Reason For Concern Over GHW International's (HKG:9933) Massive 29% Price Jump

Despite an already strong run, GHW International (HKG:9933) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days were the cherry on top of the stock's 313% gain in the last year, which is nothing short of spectacular.

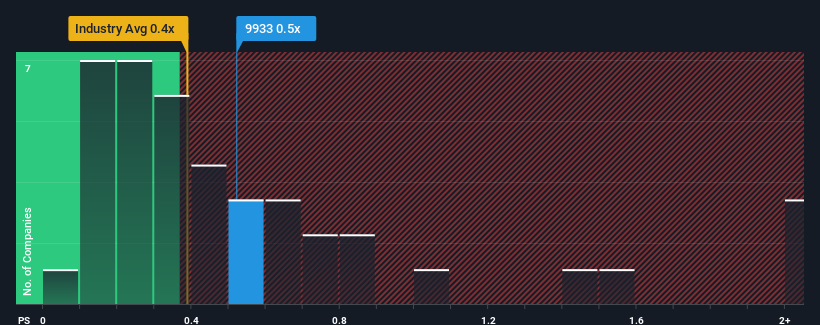

Although its price has surged higher, there still wouldn't be many who think GHW International's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Hong Kong's Chemicals industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for GHW International

How Has GHW International Performed Recently?

For instance, GHW International's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for GHW International, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is GHW International's Revenue Growth Trending?

In order to justify its P/S ratio, GHW International would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 33% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that GHW International is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From GHW International's P/S?

GHW International's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of GHW International revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Plus, you should also learn about these 4 warning signs we've spotted with GHW International (including 2 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9933

GHW International

An investment holding company, manufactures and sells chemical and pharmaceutical products in the People’s Republic of China, Europe, Vietnam, rest of Asia, and internationally.

Slight with imperfect balance sheet.