- Hong Kong

- /

- Metals and Mining

- /

- SEHK:98

We Take A Look At Why Xingfa Aluminium Holdings Limited's (HKG:98) CEO Has Earned Their Pay Packet

The performance at Xingfa Aluminium Holdings Limited (HKG:98) has been quite strong recently and CEO Yuqing Liao has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 27 May 2021. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Xingfa Aluminium Holdings

Comparing Xingfa Aluminium Holdings Limited's CEO Compensation With the industry

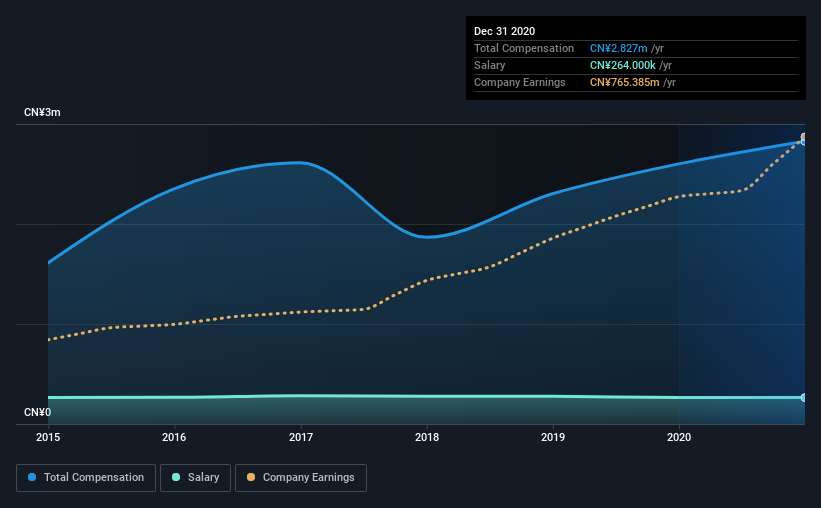

According to our data, Xingfa Aluminium Holdings Limited has a market capitalization of HK$4.7b, and paid its CEO total annual compensation worth CN¥2.8m over the year to December 2020. That's a notable increase of 8.7% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥264k.

On examining similar-sized companies in the industry with market capitalizations between HK$3.1b and HK$12b, we discovered that the median CEO total compensation of that group was CN¥2.3m. This suggests that Xingfa Aluminium Holdings remunerates its CEO largely in line with the industry average. Furthermore, Yuqing Liao directly owns HK$535m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥264k | CN¥265k | 9% |

| Other | CN¥2.6m | CN¥2.3m | 91% |

| Total Compensation | CN¥2.8m | CN¥2.6m | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. It's interesting to note that Xingfa Aluminium Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Xingfa Aluminium Holdings Limited's Growth Numbers

Xingfa Aluminium Holdings Limited's earnings per share (EPS) grew 26% per year over the last three years. Its revenue is up 5.4% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Xingfa Aluminium Holdings Limited Been A Good Investment?

Boasting a total shareholder return of 73% over three years, Xingfa Aluminium Holdings Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Xingfa Aluminium Holdings that investors should look into moving forward.

Switching gears from Xingfa Aluminium Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:98

Xingfa Aluminium Holdings

An investment holding company, manufactures and sells aluminium profiles in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.