- Hong Kong

- /

- Metals and Mining

- /

- SEHK:893

China Vanadium Titano-Magnetite Mining Company Limited (HKG:893) Doing What It Can To Lift Shares

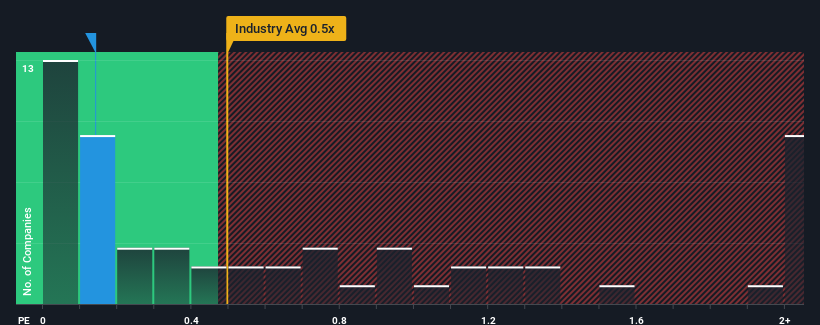

It's not a stretch to say that China Vanadium Titano-Magnetite Mining Company Limited's (HKG:893) price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in Hong Kong, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for China Vanadium Titano-Magnetite Mining

What Does China Vanadium Titano-Magnetite Mining's P/S Mean For Shareholders?

The revenue growth achieved at China Vanadium Titano-Magnetite Mining over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on China Vanadium Titano-Magnetite Mining will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Vanadium Titano-Magnetite Mining's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, China Vanadium Titano-Magnetite Mining would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.1%. Pleasingly, revenue has also lifted 61% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that China Vanadium Titano-Magnetite Mining is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Vanadium Titano-Magnetite Mining currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - China Vanadium Titano-Magnetite Mining has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on China Vanadium Titano-Magnetite Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:893

China Vanadium Titano-Magnetite Mining

An investment holding company, engages in mining and ore processing activities in the People’s Republic of China.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives