- Hong Kong

- /

- Metals and Mining

- /

- SEHK:826

Tiangong International (HKG:826) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

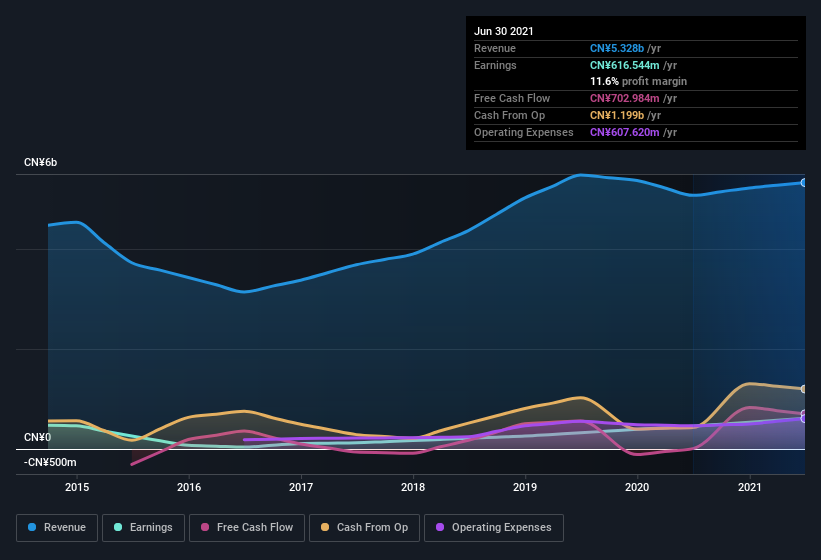

Tiangong International Company Limited (HKG:826) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

Check out our latest analysis for Tiangong International

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Tiangong International expanded the number of shares on issue by 9.0% over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Tiangong International's historical EPS growth by clicking on this link.

A Look At The Impact Of Tiangong International's Dilution on Its Earnings Per Share (EPS).

As you can see above, Tiangong International has been growing its net income over the last few years, with an annualized gain of 187% over three years. In comparison, earnings per share only gained 151% over the same period. And the 35% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 32% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Tiangong International shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Tiangong International's Profit Performance

Each Tiangong International share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Tiangong International's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Tiangong International as a business, it's important to be aware of any risks it's facing. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Tiangong International.

Today we've zoomed in on a single data point to better understand the nature of Tiangong International's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Tiangong International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:826

Tiangong International

Manufactures and sells alloy steel, cutting tools, titanium alloys, and related products in the People’s Republic of China, North America, Europe, other Asian countries, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives