- Hong Kong

- /

- Metals and Mining

- /

- SEHK:826

Do Tiangong International's (HKG:826) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Tiangong International (HKG:826). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Tiangong International

How Quickly Is Tiangong International Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Who among us would not applaud Tiangong International's stratospheric annual EPS growth of 40%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

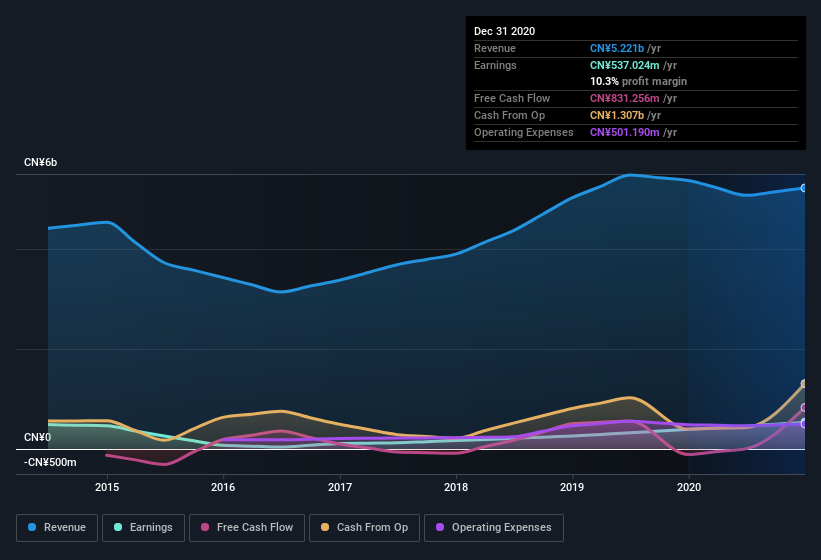

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Tiangong International's revenue dropped 2.7% last year, but the silver lining is that EBIT margins improved from 11% to 14%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Tiangong International's forecast profits?

Are Tiangong International Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -CN¥5.4m worth of shares. But that's far less than the CN¥22m insiders spend purchasing stock. This makes me even more interested in Tiangong International because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Executive Chairman Xiaokun Zhu for HK$6.8m worth of shares, at about HK$3.41 per share.

Along with the insider buying, another encouraging sign for Tiangong International is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth CN¥2.8b. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Does Tiangong International Deserve A Spot On Your Watchlist?

Tiangong International's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Tiangong International deserves timely attention. It is worth noting though that we have found 3 warning signs for Tiangong International that you need to take into consideration.

As a growth investor I do like to see insider buying. But Tiangong International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tiangong International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:826

Tiangong International

Manufactures and sells alloy steel, cutting tools, titanium alloys, and related products in the People’s Republic of China, North America, Europe, other Asian countries, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives