- Hong Kong

- /

- Metals and Mining

- /

- SEHK:815

Would Shareholders Who Purchased China Silver Group's (HKG:815) Stock Three Years Be Happy With The Share price Today?

If you love investing in stocks you're bound to buy some losers. But long term China Silver Group Limited (HKG:815) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 58% in that time. The good news is that the stock is up 7.2% in the last week.

View our latest analysis for China Silver Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

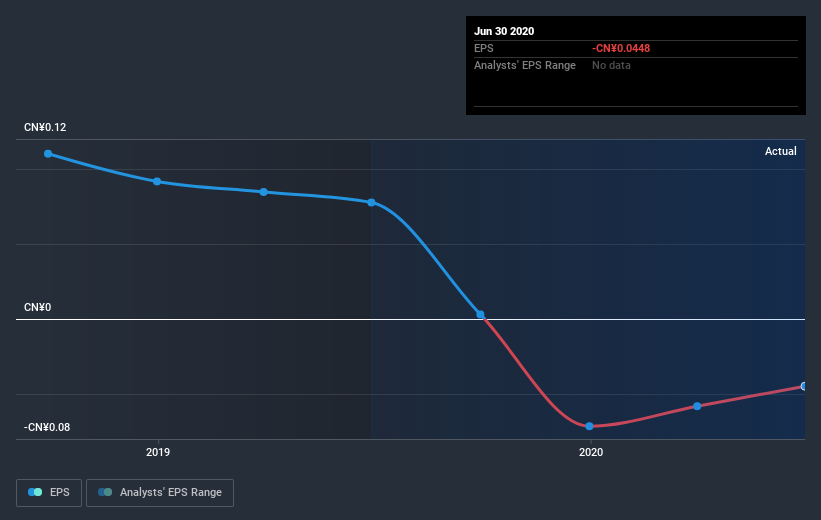

China Silver Group saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on China Silver Group's earnings, revenue and cash flow.

A Different Perspective

China Silver Group shareholders have received returns of 22% over twelve months, which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 8% over the last five years. While 'turnarounds seldom turn' there are green shoots for China Silver Group. It's always interesting to track share price performance over the longer term. But to understand China Silver Group better, we need to consider many other factors. Even so, be aware that China Silver Group is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Silver Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:815

China Silver Group

An investment holding company, manufactures, trades in, and sells silver ingots, palladium, and other non-ferrous metals in the People’s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.