- Singapore

- /

- Metals and Mining

- /

- Catalist:5TP

Exploring 3 Undiscovered Gems in Asia for Potential Portfolio Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and geopolitical events, Asia's dynamic economies continue to present intriguing opportunities for investors. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, as they may offer the chance to capitalize on regional economic trends and sector-specific developments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 104 | NA | 10.13% | 11.50% | ★★★★★★ |

| MSC | 29.29% | 6.15% | 15.10% | ★★★★★★ |

| Champion Building MaterialsLtd | 29.77% | -2.25% | 8.58% | ★★★★★★ |

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| Grade Upon Technology | 3.39% | 16.93% | 65.43% | ★★★★★★ |

| Savior Lifetec | NA | -11.44% | 15.18% | ★★★★★★ |

| Kinpo Electronics | 106.22% | 5.77% | 45.80% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| Johnson Chemical Pharmaceutical Works | 9.07% | 9.87% | 8.78% | ★★★★★☆ |

| AblePrint Technology | 7.90% | 35.99% | 14.47% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Value Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market capitalization of SGD539.03 million.

Operations: CNMC Goldmine Holdings generates revenue primarily from its mining segment, amounting to $88.33 million. The company's market capitalization stands at SGD539.03 million.

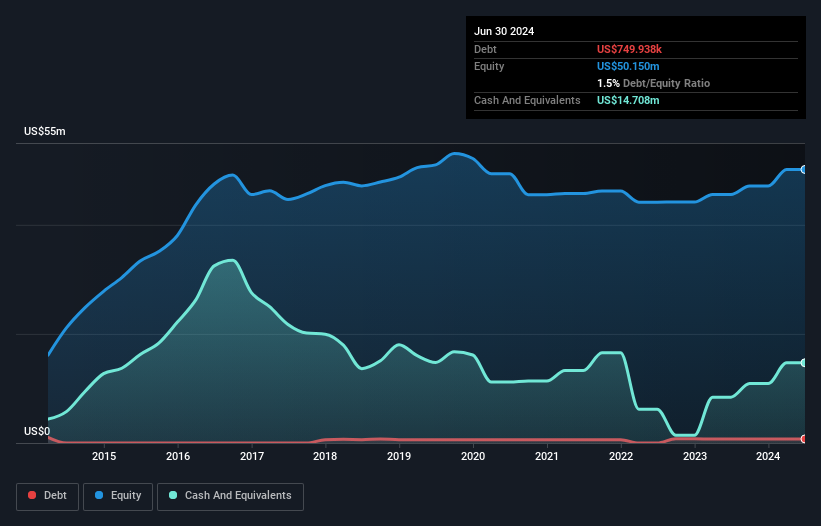

CNMC Goldmine Holdings, a smaller player in the mining sector, has shown remarkable earnings growth of 210% over the past year, outpacing the industry average of 0.7%. The company reported significant revenue for H1 2025 at US$52.8 million compared to US$29.67 million last year, with net income rising to US$15.76 million from US$4.43 million previously. Despite some insider selling recently, CNMC's financial health appears solid with more cash than debt and its stock trading at nearly 88% below estimated fair value suggests potential upside for investors seeking value opportunities in Asia's mining landscape.

- Get an in-depth perspective on CNMC Goldmine Holdings' performance by reading our health report here.

Assess CNMC Goldmine Holdings' past performance with our detailed historical performance reports.

Boyaa Interactive International (SEHK:434)

Simply Wall St Value Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in the People's Republic of China and Hong Kong, with a market cap of approximately HK$5.70 billion.

Operations: The company's revenue primarily stems from its mobile game-related business, generating HK$435.26 million, while the web3 related business contributes HK$51.66 million.

Boyaa Interactive International, a nimble player in the gaming sector, has shown robust financial health with no debt over the past five years and a price-to-earnings ratio of 6.5x, undercutting Hong Kong's market average of 12.9x. The company reported an impressive earnings growth of 132.5% last year, outpacing the entertainment industry's 23%. Recent strategic moves include forming a partnership with Sinohope Technology to explore Web3 opportunities and securing a spot in the S&P Global BMI Index. Despite these positives, net income for six months ended June 2025 dipped to HK$226 million from HK$312 million in 2024 due to reduced digital asset values impacting profits.

- Delve into the full analysis health report here for a deeper understanding of Boyaa Interactive International.

Understand Boyaa Interactive International's track record by examining our Past report.

China Silver Group (SEHK:815)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Silver Group Limited is an investment holding company that engages in the manufacturing, trading, and sale of silver ingots, palladium, and other non-ferrous metals in the People’s Republic of China with a market capitalization of approximately HK$1.98 billion.

Operations: The primary revenue streams for China Silver Group come from its Manufacturing Segment, generating CN¥4.04 billion, and the New Jewellery Retail Segment, contributing CN¥295.39 million. The company's financial focus is significantly on the manufacturing of silver ingots and other non-ferrous metals.

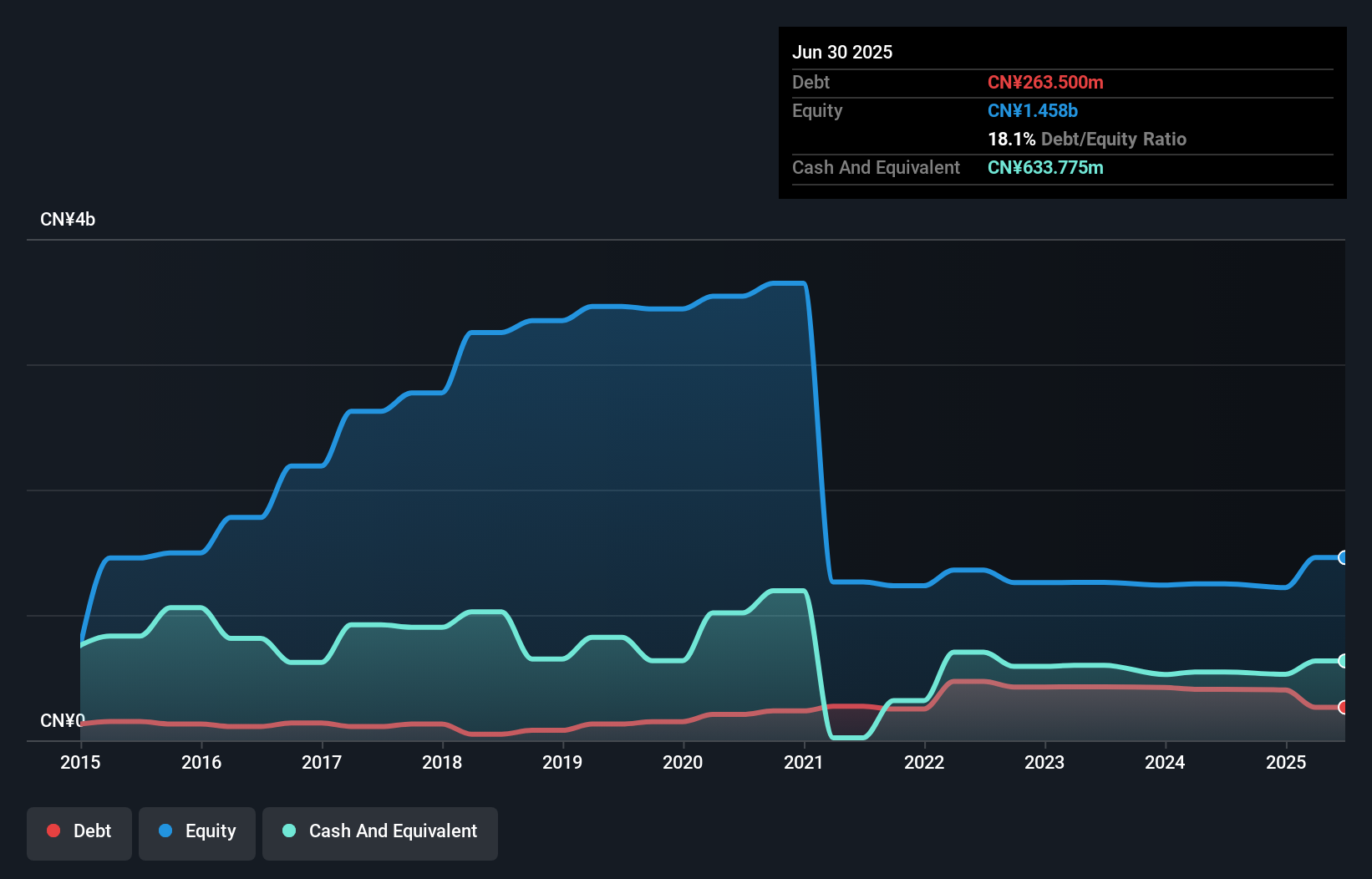

China Silver Group, a small player in the metals and mining sector, has seen its earnings grow at an impressive 44% annually over the past five years. Despite this growth, its recent performance did not outpace the industry's 30% rise. The company reported net income of CNY 54.91 million for H1 2025, a significant jump from CNY 20.56 million in H1 2024, driven by increased sales in gold products with low procurement costs and rising gold prices which boosted gross profit margins. However, shareholders experienced dilution last year as debt to equity rose from 5.8% to 18%.

Key Takeaways

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2376 more companies for you to explore.Click here to unveil our expertly curated list of 2379 Asian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About Catalist:5TP

CNMC Goldmine Holdings

An investment holding company, engages in the exploration and mining of gold deposits in Malaysia.

Outstanding track record and undervalued.

Market Insights

Community Narratives