Further Upside For Zhejiang Chang'an Renheng Technology Co., Ltd. (HKG:8139) Shares Could Introduce Price Risks After 35% Bounce

Those holding Zhejiang Chang'an Renheng Technology Co., Ltd. (HKG:8139) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

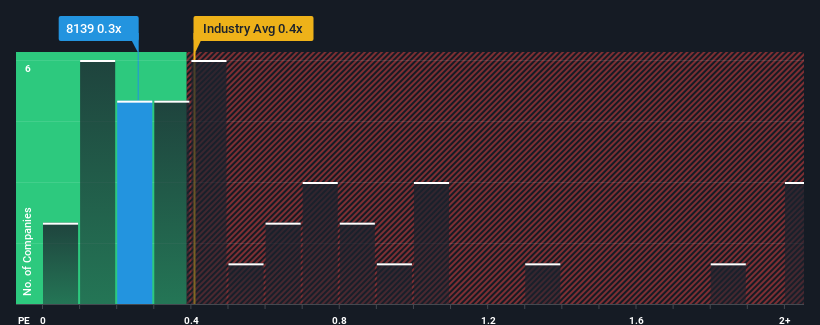

Although its price has surged higher, there still wouldn't be many who think Zhejiang Chang'an Renheng Technology's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Chemicals industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Zhejiang Chang'an Renheng Technology

What Does Zhejiang Chang'an Renheng Technology's P/S Mean For Shareholders?

Revenue has risen firmly for Zhejiang Chang'an Renheng Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Zhejiang Chang'an Renheng Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhejiang Chang'an Renheng Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Zhejiang Chang'an Renheng Technology would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has also seen an excellent 33% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 6.2%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Zhejiang Chang'an Renheng Technology's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Zhejiang Chang'an Renheng Technology's P/S

Its shares have lifted substantially and now Zhejiang Chang'an Renheng Technology's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhejiang Chang'an Renheng Technology currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Zhejiang Chang'an Renheng Technology (2 are a bit unpleasant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Chang'an Renheng Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8139

Zhejiang Chang'an Renheng Technology

Researches, develops, produces, and sells bentonite fine chemicals in the People’s Republic of China.

Slight risk and slightly overvalued.

Market Insights

Community Narratives